Central Banks Fuel Market Rebound

The weekend has not been too punishing for global stock markets, it seems, even as coronavirus cases jumped and we got some woeful PMI surveys from China.

Source – Thomson Reuters Eikon

Whatever the headline expectations were for the Chinese PMIs, traders will have always been willing to give them a relatively large degree of leeway, under the circumstances. Prior to last week’s open, you could have argued that markets were not positioned for such dreadful numbers but you can’t really say that now.

I guess this once again also highlights what happens when investors feel the central banks will always have their backs. And they’re certainly banking on that, with the markets now fully pricing in a 50 basis point cut from the Fed with a strong likelihood of 75 basis points.

Source – Thomson Reuters Eikon

I can’t help but feel that a strong relief rally at the start of the week when, the reality is, there’s nothing really to be relieved about, is just putting us unnecessarily back into dangerous territory. It’s early to say for sure what’s happening at this stage though, this could simply be short relief but investors do have a history of jumping back in early.

Investors may be willing to accept the PMIs for what they are, aided by the expectation of a strong rebound in the second half of the year, but what about the virus itself? I’m sure everyone’s phone, like my own, has been vibrating all weekend with updates of new cases and fatalities around the world. We’re not in de-acceleration mode yet and maybe not close.

Environment bullish for gold

Gold has not been very well behaved this past week. If a safe haven can’t be relied upon in times of panic then what’s the point? That said, we have seen before that markets can act very strangely during periods of severe declines and I’m sure the worst week since the financial crisis falls into this category.

We can only speculate on the cause of this dislocation but selling to cover losses elsewhere certainly makes sense. And while gold is a traditional safe haven, Treasuries at a time when investors are betting the house on aggressive easing also makes sense. Still, I expect gold will find its feet in time and this is certainly a bullish environment for it.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil rebounds after more huge losses

Oil got the week off to a rough start but it has rebounded strongly as sentiment across the markets has improved. The impact of the Chinese PMIs was short-lived and Brent was in need of a lift after a more than 30% plunge from its early January peak.

Whether it has any legs or not is another thing. This rebound doesn’t exactly feel like it’s built on very strong foundations. In the meantime, Brent is back above $50 which may make producers feel a little better as they prepare to meet this week. It may not help Saudi Arabia’s case that another aggressive cut is needed, coming up against Russian resistance.

Brent Daily Chart

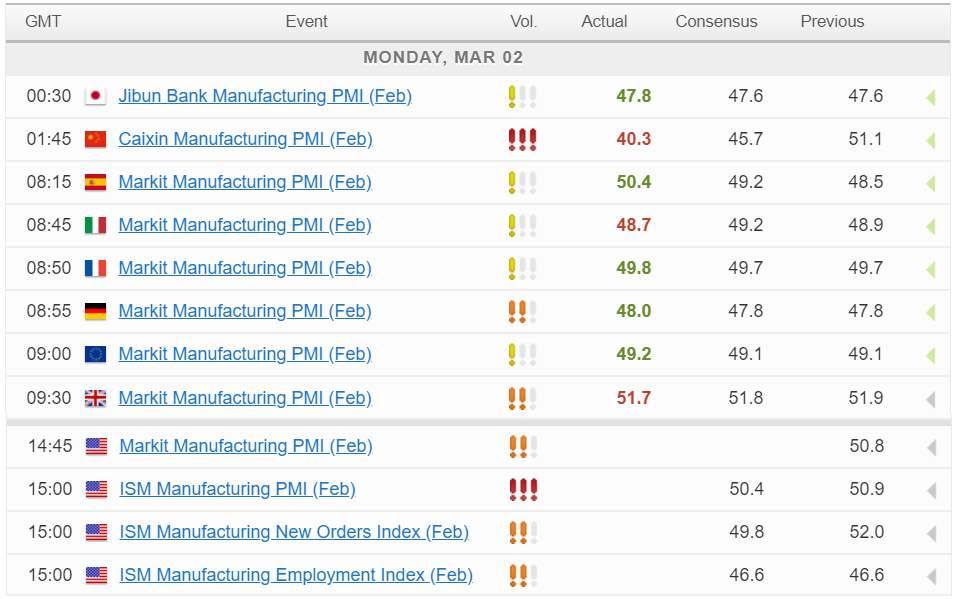

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.