Nervous wreck investors rattled by tech earnings

Risk aversion is alive and kicking on Friday, as weaker than expected tech earnings trigger the latest stampede and those still buying the dips once again get burned.

For once, the decline in Asia actually looks quite mild compared to what we’re seeing in Europe and expecting on Wall Street. Tech companies have raised the bar so high in recent years that the numbers reported by Amazon and Alphabet just weren’t quite spectacular enough, not at a time when investors are a nervous wreck and fleeing for safety at the first sign of danger.

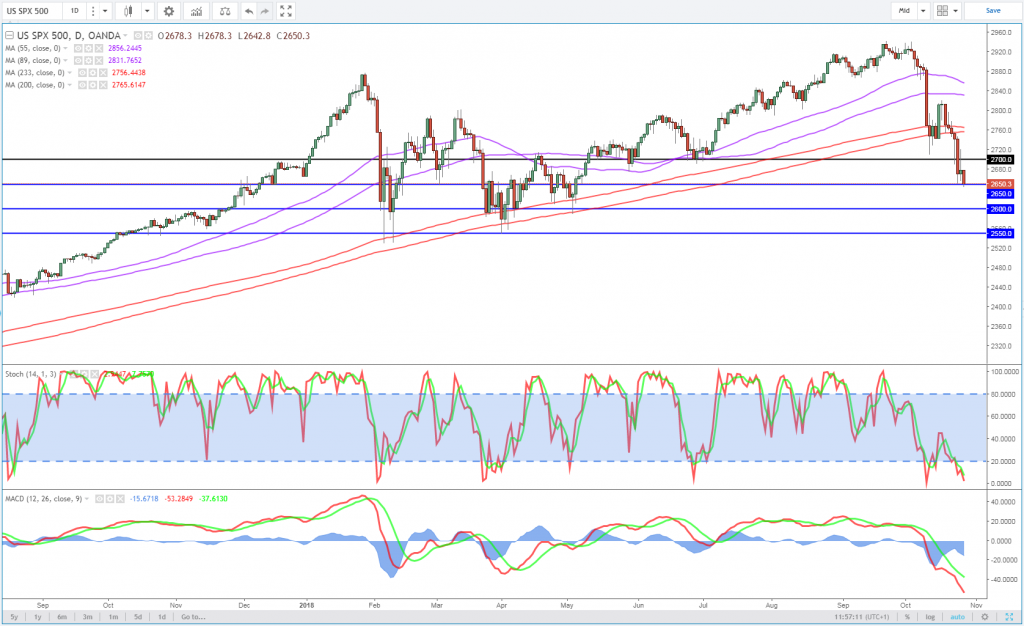

S&P 500 (SPX500) Daily Chart

OANDA fxTrade Advanced Charting Platform

Earnings season has more to run so there’s plenty of time for companies to turn this funk around but as yet, they haven’t given investors the boost they well and truly need. More than a quarter of the S&P 500 will report on the third quarter next week so there’s plenty of opportunity to turn things round but sentiment has been well and truly dampened recently.

New vice Chair Clarida echos Powell comments on interest rates

Investors will also be paying close attention to what Fed policy makers will be saying in the coming weeks, ahead of the November meeting. Given the recent market turbulence and evidence of a slowing global economy, with the US even showing some points of weakness, there is potential for policy makers to scale back the number of rate hikes they’re planning over the next couple of years.

Given that this current sell-off started with Fed Chairman Jay Powell claiming the neutral rate to be a long way away, before claiming they could go a little beyond it, it’s safe to assume that a slight softening here could really help stabilise markets. US 10-year Treasuries have already come well off their highs but confidence in the markets has not recovered.

DAX plunges as Asian markets crumble

Data in focus as Fed goes into blackout period

New vice Chair Richard Clarida passed up the opportunity to do so on Thursday, insisting that more rate hikes are the right course of action. This will likely frustrate the very man that chose him to succeed Stanley Fischer, given that Trump has been a very harsh critic of the central bank’s tightening. It will all go quiet now on that front as we enter into the blackout period ahead of the 8 November meeting but there is plenty of economic data that will likely drive people’s opinions on what we can expect.

US GDP

Today we have the advanced third quarter GDP number which people will be paying very close attention to. Trump has regularly lauded the work of his administration after the economy grew at more than 4% in the previous quarter. We’re not expecting a repeat of this but a very respectable 3.3% is on the cards. There has been much talk of the softening in the housing data recently, while retail sales have also come off a little and the latest durable goods orders were also a little weaker. This could be a temporary slowdown or the result of higher interest rates and the fading benefit of tax reforms on consumers, perhaps the GDP data will shed further light.

US Retail Sales and Housing Data

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.