European equity markets are expected to open a little higher on Tuesday following a mixed session in Asia overnight, as traders await data from the euro area this morning while maintaining a little caution ahead of Janet Yellen’s Jackson Hole speech at the end of the week.

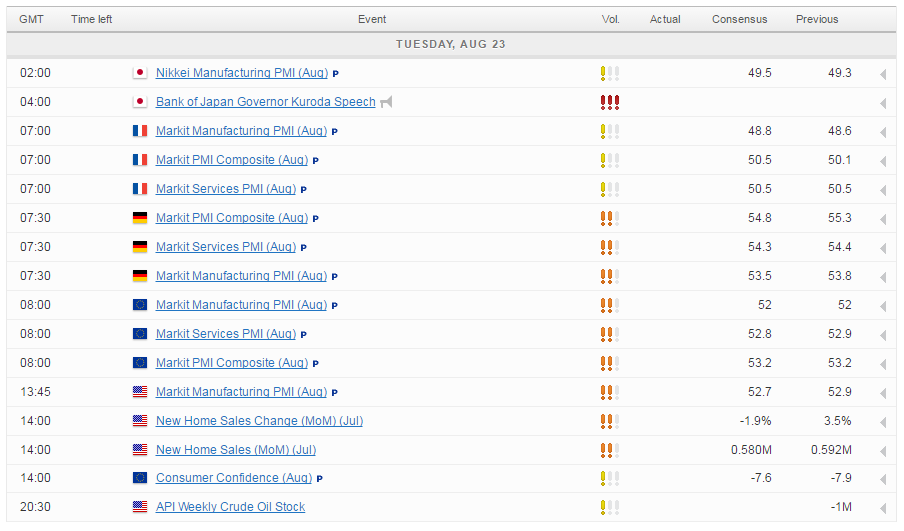

After a very slow start to the week on the data side, we’ve got PMI data from the eurozone, Germany and France throughout the morning followed by manufacturing and housing data from the US this afternoon. The eurozone figures will be of particular interest as we continue to seek evidence of the Brexit impact on the UK’s largest trading partner. While it’s too early to get this from the hard data, releases like the PMIs are a good source of early insight into how the region will respond.

USD/CAD Canadian Dollar Falls as Oil Price Tumbles with Persistent Glut

The initial response was quite worrying, with PMI readings taking a hit in the immediate aftermath, particularly in the services sector. Confidence quickly rebounded though in August and we’re expecting it to have built marginally on this again in the September flash reading. Some of the bright spots from the last report, such as the improving employment trend in the euro area could again be a positive point of today’s report but with Brexit risks remaining, we may not be able to get too carried away with the data as confidence could quickly turn sour again.

With all this in mind, we have to wonder whether the ECB is going to be in any rush to ease monetary policy further to cushion the blow of the Brexit vote. There’s no hard data to suggest the economy has suffered, the euro is trading around the same levels it was prior to the vote and even the survey’s don’t indicate an immediate threat lies ahead. Under the circumstances, it’s tough to see the ECB taking the leap at the next meeting having announced a large stimulus package only in March. Instead it’s more likely to continue to monitor the situation and warn it’s ready and willing to act if necessary.

XAU/USD – Gold Quiet at Start of Week, Housing Report Next

Yellen’s speech on Friday remains the headline event this week and I think we could continue to see an element of caution in the markets in the lead up to this. Investors are still not buying a 2016 rate hike, even following Stanley Fischer’s comments over the weekend regarding the economy – markets now marginally pricing in February – so the probability that Yellen says something that goes against what’s priced in seems quite high. The only question is whether she’ll strongly hint at a hike this year or indicate that holding off to early next year may be warranted, at which point markets would push the hike right back once again.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.