Economic Projections and Yellen Speech Eyed for Rate Hike Clues

Markets have been relatively steady ahead of the US open on Wednesday, as traders await the latest monetary policy decision from the Federal Reserve.

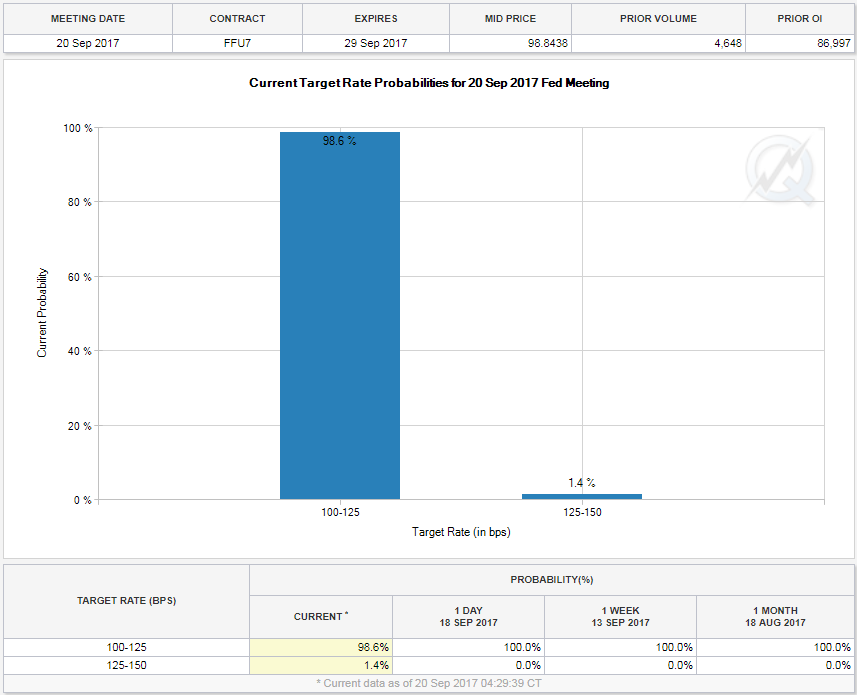

With the probability of a rate hike today only 1% priced in, according to Fed funds futures, we can be quite confident that there won’t be any surprises here from the central bank, with policy makers having previously been very careful to adequately prepare markets for such moves. That said, policy makers have become less hawkish over recent months as inflation has failed to graduate towards target as anticipated, leaving market watchers seeking further clarity on the path that interest rates are now on.

Source – CME Group FedWatch Tool

The economic projections that accompany the statement should provide further clarity on this, as will Chair Janet Yellen’s views in the press conference shortly after. With there now being an element of doubt around the path of inflation, not to mention Yellen’s position once her current term ends early next year, it’s possible that the Fed Chair may be very vague on the subject of interest rates beyond the end of the year and instead focus on the job of balance sheet reduction.

Sterling and Kiwi dollar forge ahead of Dot Plot release

Will Balance Sheet Reduction Plans Finally Impact Yields?

The Fed is expected to announce plans to start reducing its $4.5 trillion balance sheet today, having alluded to such an move repeatedly in recent months. As of yet, markets have been relatively unresponsive to such talk which would suggest it won’t have much impact following the announcement but there is a chance that either the scale exceeds expectations, triggering a rise in market rates or that traders were just waiting for details before reacting. With information on both this and interest rates expected, I imagine there’ll be plenty of movement, regardless.

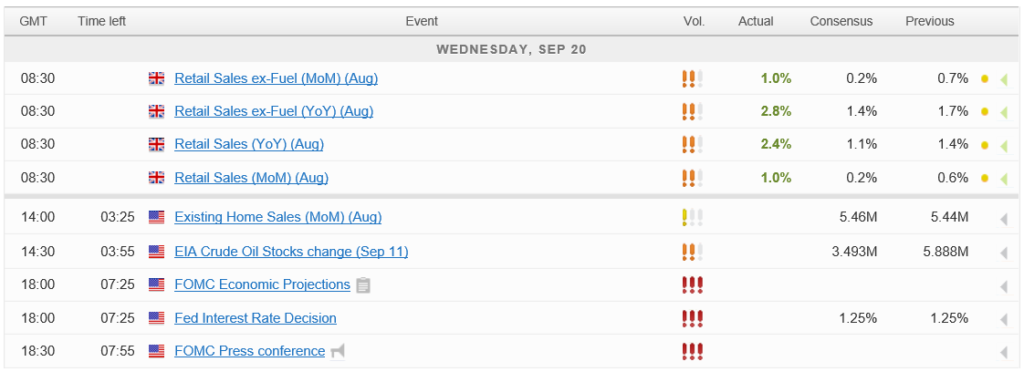

We’ll get existing home sales data prior to the release, which could trigger some movement in the dollar prior to the Fed announcement. The dollar has softened a little in the lead up to the decision which suggests traders are expecting the Fed to err on the dovish side today rather than stubbornly stick to the tightening message. With the dollar having weakened significantly already this year, it is showing signs of bottoming and today could signal whether this is the case or whether further pain lies ahead in the final months.

USD/JPY – Yen Steady Ahead of Federal Reserve, BoJ Rate Statements

UK Retail Sales Exceed Expectations But GBP Rally Short-Lived

The pound tested 1.36 against the dollar earlier after retail sales data from the UK in August easily exceeded expectations, triggering a pop higher in sterling. The pair fell slightly short of its previous high though before falling back close to the levels it traded at prior to the release. Perhaps this is a sign that after a very strong rally over the last month, the pair is a little stretched, or maybe the BoE agents report that followed that mentioned future impacts of sterling weakness on consumer goods inflation having peaked, among other things, was perceived as a little dovish.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.