Markets Steady After Strong Start to Earnings Season

Financial markets appear to have lost some of their spark in recent days, with a flat session on Wednesday being followed by similar trading in Europe on Thursday and US futures pointing to a similar open.

Stocks have been gradually rising this month which has been aided by easing trade war tensions – albeit far from resolved – and the geopolitical environment, while remaining heated, becoming less of a concern. Earnings season has also got off to a very good start with the banks reporting strong earnings growth and comfortably beating already inflated market expectations.

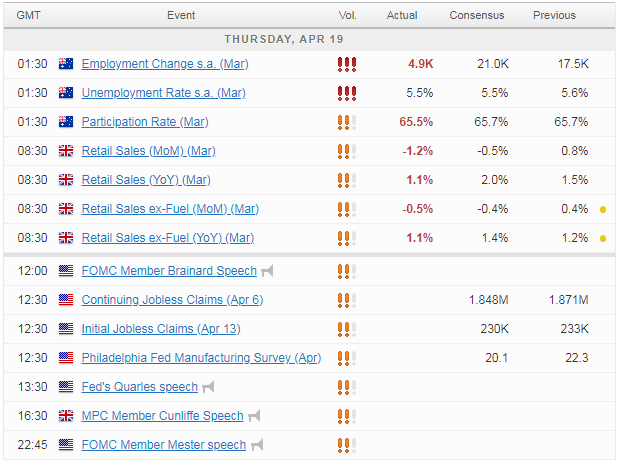

The number of companies reporting on the first quarter will pick up considerably over the coming weeks and, in the absence of tensions mentioned above significantly escalating, could help the recovery in market which have struggled since late January. Other events of note today will be the release of jobless claims data and speeches from three Federal Reserve officials including Lael Brainard, Randal Quarles and Loretta Mester, all of whom are voters on the FOMC.

Dollar Supported by Higher Yields

Retail Sales Data Provides Further Headache For BoE

UK retail sales slumped on a month by month comparison in March, with bad weather having an adverse impact, particularly on petrol sales, although online performance provided a positive takeaway. A weak showing in March meant annual growth slipped to only 1.1% and while temporary factors may have strongly contributed to it, it is part of a longer term trend of softer consumer spending driven primarily by the squeeze on incomes.

UK Retail Sales

That squeeze is likely to ease over the course of this year thanks to a combination of lower inflation and slightly higher wages, with the numbers earlier in the week confirming real wages grew by 0.1% in February for the first time in a year. The figures, combined with the inflation and labour market data earlier in the week won’t make for easy reading for the Bank of England which has been prepping investors for a rate hike, widely seen prior to this week as coming in May.

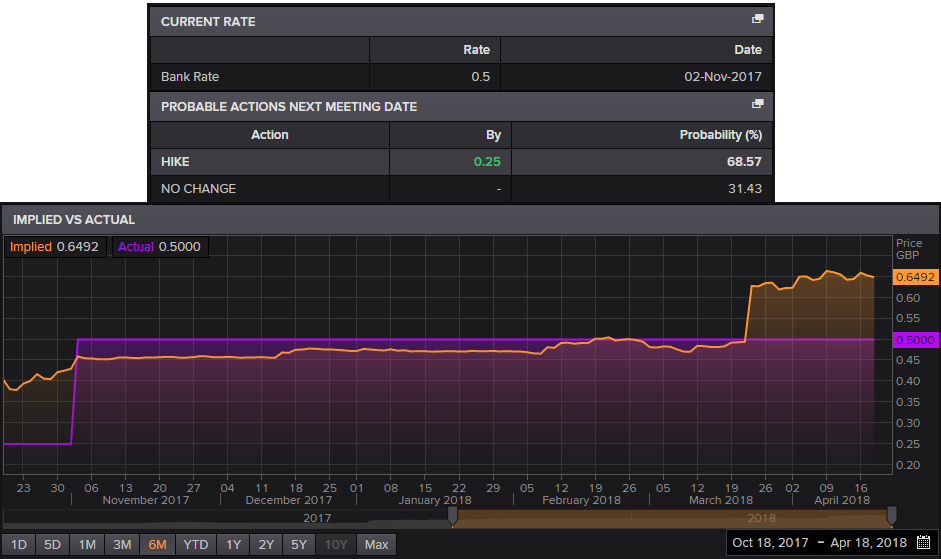

Softer inflation and weak consumer spending at a time when the economy is growing at a slow pace and facing the uncertainty of Brexit makes the case for a rate hike less compelling. Still, while market expectations of a hike have fallen to around 68%, I still expect policy makers to push through with one in May and possibly accompany it with dovish language intended to talk down the possibility of another this year.

BoE Interest Rate Probabilities

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.