It seems the Federal Reserve’s hawkish message on interest rates is finally starting to sink in which is weighing on U.S. futures ahead of the open on Thursday.

For months, Fed officials have been suggesting that more rate hikes are likely this year but the warnings have fallen on deaf ears with markets instead repeatedly pushing back the date at which it believes the next rise will come. The situation was made worse for the Fed when it pared back its outlook for four rate hikes this year to two, bringing it more in line with the markets and creating a situation in which the markets appeared to be leading the Fed, rather than the other way around.

Since then the job of preparing investors for future hikes has been very difficult, with the markets simply brushing off any warnings and assuming the Fed will follow again. Well that all appears to be changing, with the Fed firming up its communication considerably in recent weeks and the FOMC minutes from the April meeting were very much in line with this new strategy, to the apparent disappointment of investors.

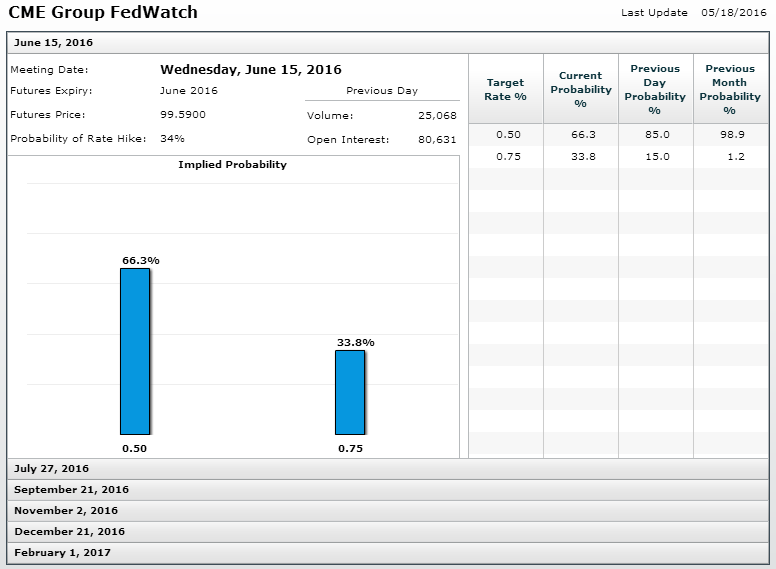

The Fed’s recent tactics are finally baring fruit with markets pricing in a much higher chance of a hike in June, up from 4% at the start of the week to 34% now. While this still means no hike is expected and it’s well below the threshold that the Fed will want to see come the meeting, if in fact it intends to hike, it represents significant progress for the Fed and puts June back on the table.

Source – CME Group FedWatch Tool

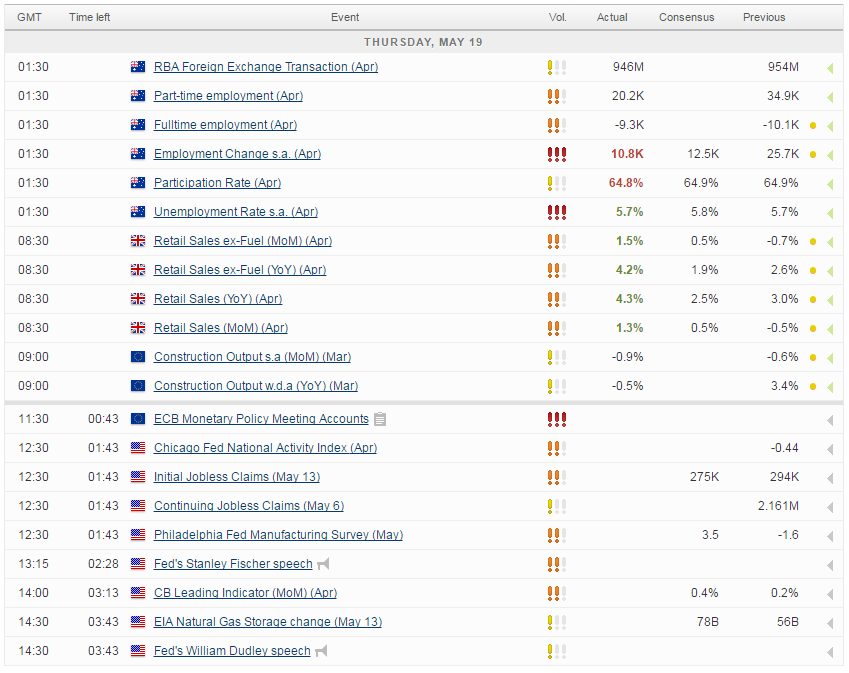

Given what we’ve seen over the last couple of days, today’s comments from Vice Chair Stanley Fischer and New York Fed President William Dudley will be very significant. Markets are likely to be very sensitive to references to the June meeting now, particularly when it comes to senior influential officials such as Fischer and Dudley. What would make support for a hike in June even more significant is the fact that Fischer is typically one of the more neutral policy makers and Dudley is firmly in the dovish camp. Hawkish tones from either of these would suggest there is consensus support for a hike and I think the markets would respond accordingly, with the implied odds of a hike surging once again. Moreover, we could even see the odds of a second hike before the end of the year being priced in, something investors were absolutely convinced would not happen even a week ago.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.