It’s been a relatively calm start to trading on Wednesday as investors await the release of the September FOMC minutes and look for rate hike clues ahead of the final two meetings of the year.

Of those two meetings, November appears all but off the table coming a week before the US Presidential election and not being accompanied by a press conference, giving Janet Yellen an opportunity to explain the decision and what it means for monetary policy going forward. December on the other hand is now heavily priced in by the markets – currently 69% based on Fed Funds futures – with investors coming around to the idea that the Fed is determined to raise rates this year.

Source – CME Group FedWatch Tool

Obviously, that could all change and investors have previously jumped at the opportunity to abandon the rate hike ship but I doubt that will happen today. Three of the 10 voting FOMC members dissented at the last meeting, all of whom are permanent voters, which would strongly suggest that a majority is not far away, not with a number of other policy makers appearing to lean that way, including Chair Yellen herself.

Baht Falls as Thai Stocks Crash

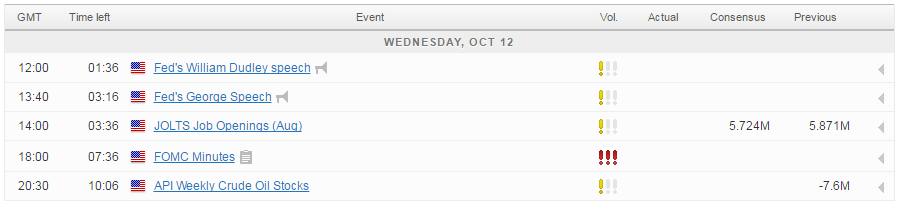

The minutes today could offer good insight into just how close others are to voting for a hike, what it is they want to see before doing so and just how many voters are currently on the fence. We tend to have quite a good idea of all this from the large number of appearances we now get from Fed officials, but more information is always welcome and could spark some volatility in the markets. The latest officials to make an appearance will be William Dudley and Esther George, both of which are permanent voters on the FOMC, the latter of which was one of the three dissenters in September. Dudley is a close ally of Chair Yellen and previously suggested that the US is edging closer to the point at which a rate hike will be appropriate. It will be interesting to see if he believes sufficient progress has been made and whether he’s any closer to supporting a hike.

One of the few big moves in the markets this morning has been in the pound, which has experienced some reprieve having taken a hammering since the early hours of Friday morning. While the pound was arguably due a correction of some kind, we’re probably just seeing a little profit taking at the moment, triggered by Theresa May’s acceptance that Parliament should be allowed to vote on Brexit deal, something that’s seen as reducing the chance of a hard Brexit being imposed on the UK. That said, the concession was accompanied by a warning that it shouldn’t attempt to block or undermine the negotiating position of the government, with May determined to remain in full control of the talks. The gains are small in comparison to the losses incurred by the pound recently so I don’t think these comments have greatly altered people’s outlook for sterling.

APAC Corner: GBP Jumps While ZAR Crashes

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.