European equity markets are expected to open on a positive note, with focus on Thursday remaining on the UK election, as well as the latest oil inventory data from EIA and a raft of other data from around the globe.

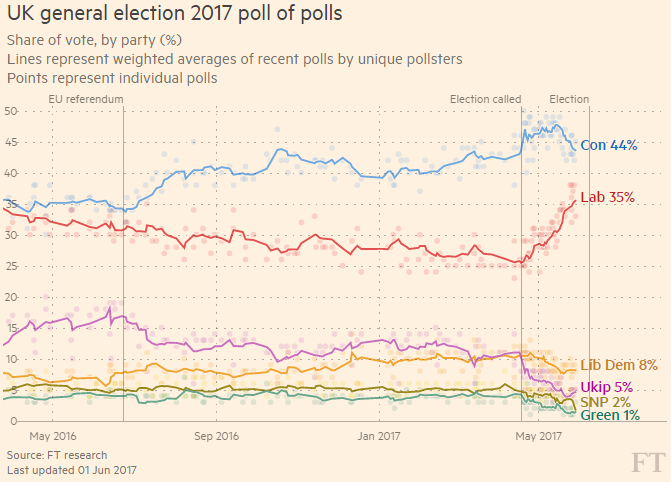

GBP Remains Vulnerable to Polls That Show May’s Lead Deteriorating

Sterling is likely to remain volatile over the next week as we approach the election on 8 June. Recent polls have shown that Theresa May’s lead has narrowed, in some cases quite considerably, which has sent the pound into a bit of a tailspin at times.

Commodities Diverge Ahead Of Trump’s Climate Accord Decision

The polls can be inconsistent at times though, as seen yesterday with the YouGov and Panelbase polls predicting very different outcomes, but the trend does appear to be one of May’s lead shortening. It may be worth remembering though that these same polls also underestimated the Conservative lead only two years ago.

Source – FT Poll of Polls

Could EIA Give Oil a Reason to Reverse Course This Afternoon?

Oil will be back in focus again on Wednesday as we await the release of last week’s inventory report from EIA. The release comes as oil continues to trade under pressure, despite last week’s agreement to extend the cuts by another nine months, and after API reported a substantial drawdown on Wednesday.

While the market reaction to the report wasn’t muted, per say, I’m not convinced it fully sunk in either. Should EIA report a reduction in inventories in the region of the 8.67 million that API reported, it may offer some reprieve for oil as it would suggest the cuts are working. It would be the eighth consecutive drawdown and the largest since September.

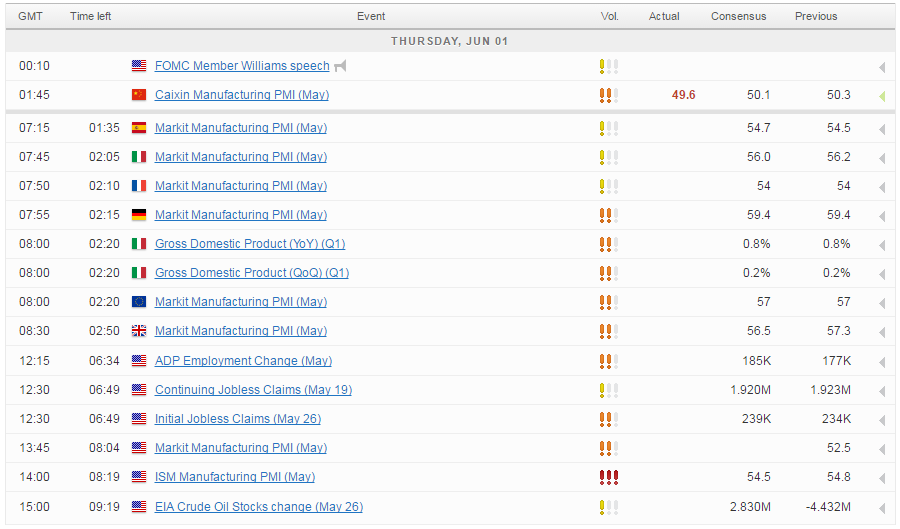

Manufacturing PMIs, ADP Employment and More to Come Throughout the Day

There’ll be plenty of economic data being released throughout the day today, including manufacturing PMI reports from across Europe and the US, as well as jobless claims, productivity, labour costs and of course, ADP non-farm employment numbers, also from the US. The ADP number comes ahead of tomorrow’s jobs report and is expected to show 181,000 jobs being created in May.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.