MPC Signals Interest Rate Hike “Over the Coming Months”

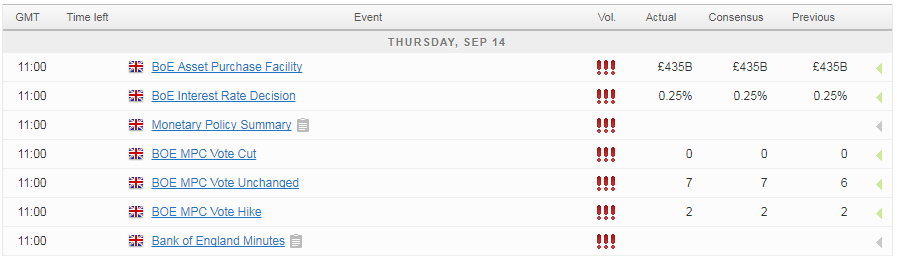

The Bank of England threw its name into the hat of central banks that could still raise interest rates this year when released the minutes from its monetary policy meeting today.

While traders were initially looking for a change in the voting – which remained at 7-2 in favour of no change – the clues were actually in the minutes, resulting in a sharp u-turn from the initial moves. Traders were anticipating at least one more vote in favour of a rate hike which would have represented a potential shift of power within the MPC but instead it was the minutes that were used to signal a possible hike in the coming months, the result being that sterling’s drop was immediately reversed and the currency is now up around 1% on the day against the dollar and the euro.

Turkey’s Central Bank Holds Rates Steady

The admission that some withdrawal of stimulus is likely over the coming months, inflation will now likely rise above 3% and spare capacity has been absorbed faster than expected thereby reducing policy makers tolerance of above-target inflation is very hawkish and strongly suggests a rate hike is coming. It seems policy makers are not willing to wait and see whether the above-target inflation is in fact transitory or if it has become more ingrained but I guess the actions taken last year allow them the opportunity to act while remaining as accommodative as they were prior to the Brexit vote.

The question now is how far can the pound go. The next test against the dollar is 1.35, a break of which would be very surprising as it would signal a move back towards the kind of levels we were seeing prior to the Brexit vote.

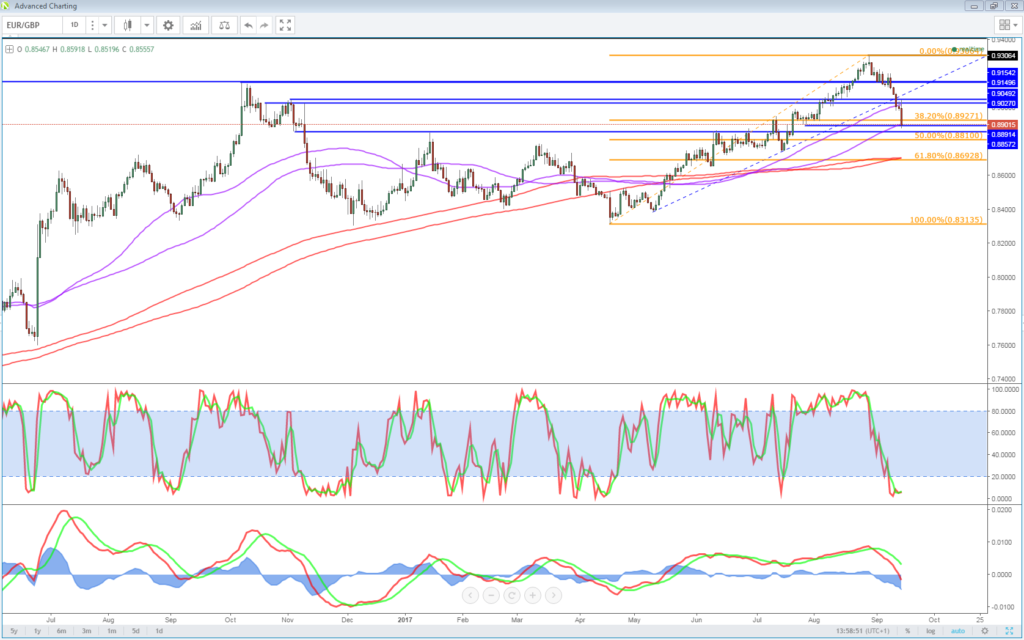

Against the euro, we’ve broken back below 0.90 and currently trade below 0.89 and so the next test below could come around 0.8850 and 0.88 below that.

With the BoE now joining the Bank of Canada and the Federal Reserve is contemplating rate hikes and the ECB looking to withdraw more stimulus, it’s going to be a very interesting end to the year.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.