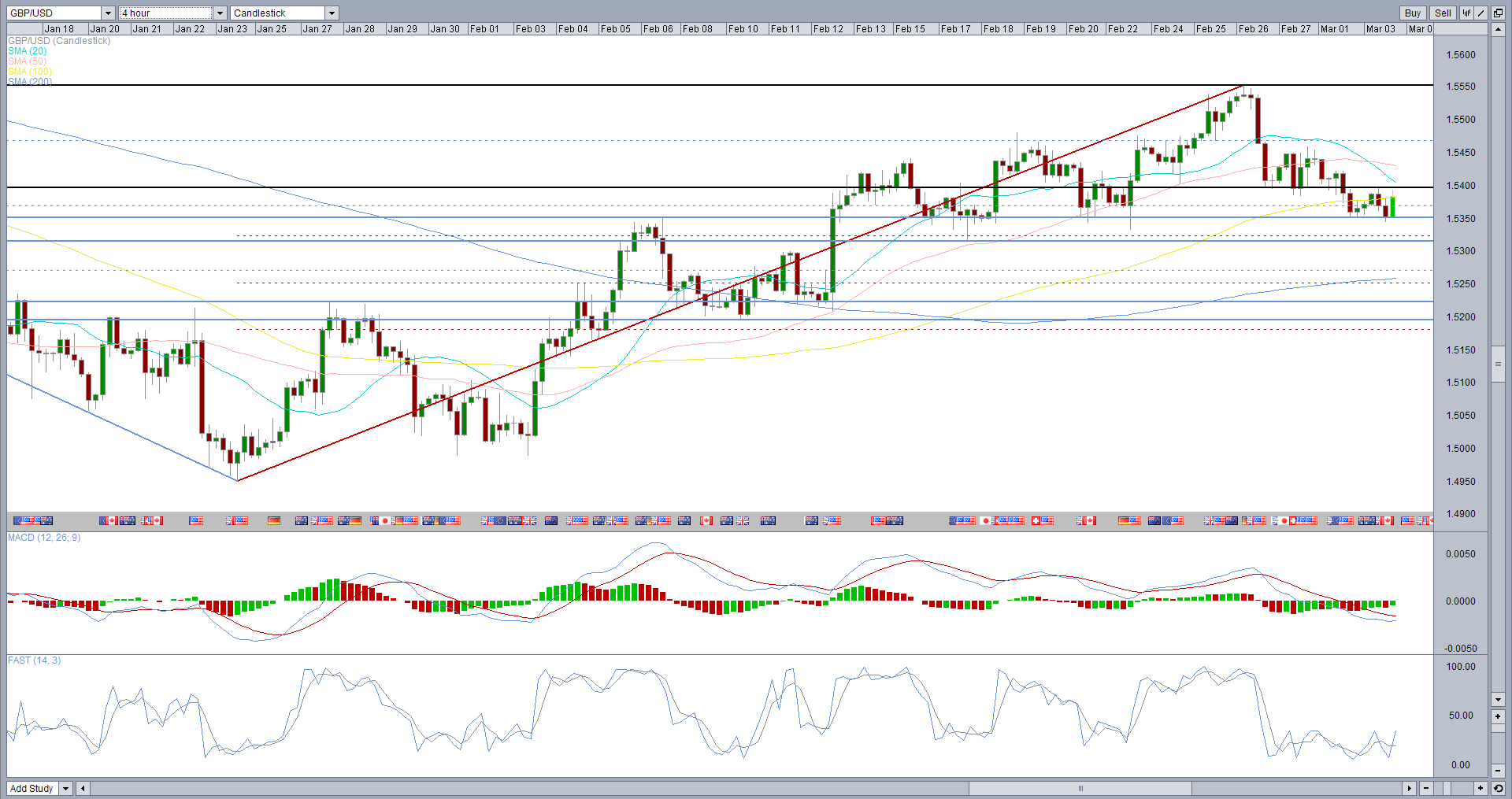

Cable has continued to decline over the last few trading sessions which isn’t entirely surprising. As mentioned in last Thursday’s post, the formation of the bearish engulfing pattern after the pair ran into the 1.5550 barrier suggested that we may see a few sessions of dollar dominance and that is pretty much what we’ve seen.

Now we’ve approached the first cluster of support levels, it’s important to determine whether the correction in the pair, which I am so far assuming this is, has run its course or just come up against a temporary support.

So far, 1.5350 has provided a solid floor for the pair on two occasions. Should we see a double bottom occur as a result, it may suggest that this particular correction is only a small one. Of course, the neckline of the double bottom would have to be broken in order to give this impression. This currently lies just below 1.54, which is also a psychological level as see by the response to it on previous occasions.

That makes 1.5350 and 1.54 the two most important levels in my opinion right now. A significant break of 1.5350 would bring 1.5315 – 1.5320 into focus, with previous support and 38.2 fib level – 23 January lows to 26 February highs – potentially offering renewed support.

A break above 1.54 would not mean the correction is over but it would mean the first hurdle has been cleared. Based on the size of the double bottom, this would then bring 1.5450 into focus. With previous resistance coming around 1.5460, this would provide the next significant barrier in my view. A break of this would suggest to me that the correction has played out and the rally may be back on.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.