Can gold break $1,280 again?

Earlier this week, gold broke below long-term support around $1,280 and, importantly, held below in what was viewed as a very bearish development in the yellow metal. Since then though, it hasn’t exactly triggered a wave of selling that may be expected when such a significant breakout happens which begs the question, is this a false breakout or are we just seeing a delayed reaction?

What’s interesting is that the stronger dollar is not really holding gold back this morning, which has been the opposite trend to what we’ve been seeing recently that led to it breaking below $1,280. Gold is holding onto gains early in the session, although it’s still trading below $1,280. It already tested this from below on Wednesday and held but another run may be on the cards.

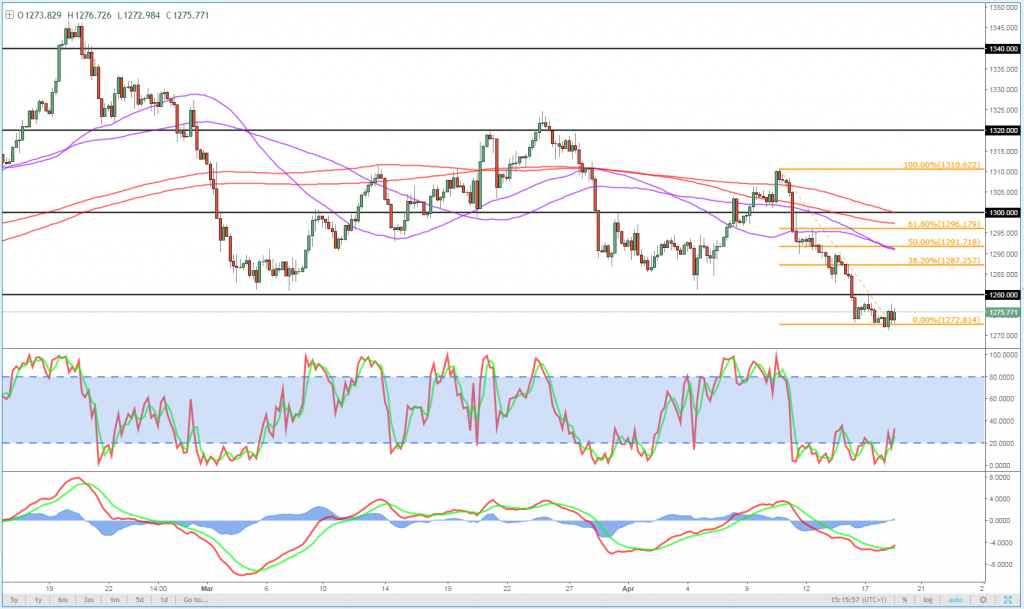

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

The bears won’t have been filled with confidence earlier this morning as we barely made a new low – and with flagging momentum – before prices started to rise again. Coming even as the dollar rallied doesn’t provide any additional comfort either. A break back above $1,280 doesn’t necessarily signal the end of the decline in gold prices but it will make the bears nervous coming so soon.

In this scenario, attention will initially be drawn to the major fib levels, most notably the 50% and 61.8% retracements between roughly $1,290 and $1,295, with $1,300 also being notable above. A move above these levels will add to the nerves of sellers but won’t necessarily signal a failed breakout.

Gold 4-Hour Chart

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.