US futures have edged into the green ahead of the open on Tuesday, a continuing sign of investor approval at the progress made in trade negotiations between the US and Mexico.

While I’m sure investors would rather the deal include Canada and preserve NAFTA, this is at least a step in the right direction and could be an important first step towards it. US President Donald Trump may have rebranded the agreement as the United States – Mexico Trade Agreement due to the apparent negative connotations associated with NAFTA but I think this may be yet another attempt to drag Canada to the negotiating table and align themselves with his idea of how it should look.

Trump has made renegotiating trade deals a key feature of his presidency and is willing to do whatever it takes in order to get what he wants. So far, he has had limited success with China, the EU and his NAFTA partners but coming ahead of the midterm elections, this could be viewed as an important success. While the US consumer may be the primary loser in his approach and the outcome of it due to the impact it has on prices, he is receiving credit for fighting to preserve skilled US jobs.

Canada should expect tough trade negotiations with U.S

Whether such perception will be enough to secure him a second term will be determined in a couple of years but it does appear to be working in his favour so far. From an investor perspective, the economy is still booming and in coming to an agreement with Mexico, one trade risk has been effectively removed and for now, that is good news.

While there are some notable data pieces out later in the week, politics is likely to continue to be a driving force in the markets. The threat of a US-initiated trade war has dragged on markets for most of the year, with tax reform helping to offset this and prevent too significant a drop in the US. With progress being made, the S&P 500 hitting new record highs and stocks now in their longest ever bull run, the environment seems perfect for Trump to continue to pressure the countries trade partners and force concessions so I don’t expect any change in strategy any time soon.

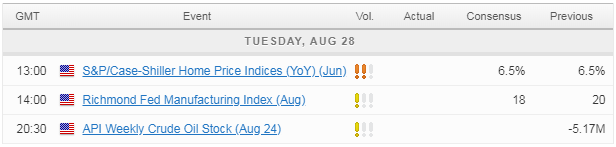

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.