We remain in wait and see mode in the markets on Tuesday, with US futures closely tracking moves in Europe where indices are marginally lower as investors perch themselves on the fence ahead of tomorrow’s Fed decision.

With markets having almost entirely priced in a rate hike tomorrow, there appears to be little appetite to pre-empt the decision, especially as how investors respond will likely largely be driven by future rate hike expectations as opposed to the hike itself. Should the Fed renege on a rate hike that policy makers have strongly hinted at then the potential downside could be quite substantial. It’s always a little concerning when markets are so certain that an event is going to happen and we’ve seen plenty of examples of this backfiring in 2016 alone.

DAX Hugging 12,000 as Germany Posts Solid Data

That said, given the effort that the Fed went to just to get to this point, it would come as quite a shock if it didn’t deliver. With the markets now so onside, the most important thing should be the projections and Janet Yellen’s expectations going forward. Should the Fed signal a possible fourth hike this year then further upside could be in store for the dollar and Treasury yields, while an indication that expectations are unchanged could trigger some profit taking given investors current positioning.

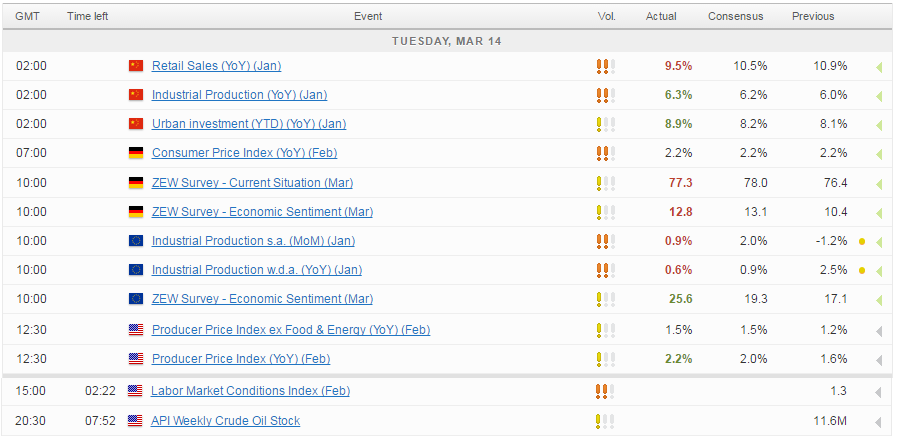

With so many major events in store this week including the Fed, BoE, BoJ and Dutch elections, today is likely to be another relatively calm session. US PPI and API weekly crude oil stocks are the only notable data releases, with the latter being of particular interest as oil continues to pare its losses today having fallen off a cliff over the last week.

Sterling to Suffer with Two Divorces

The UK is doing its best to fill the void at the start of the week with the House of Lords late last night passing the Brexit bill in its original form after parliament rejected its two previous amendments. Theresa May is now free to legally trigger article 50 as and when she chooses, which will likely out of respect be later in the month after the Dutch election this week and the sixtieth anniversary celebration of the signing of the Treaty of Rome on 25 March. The pound has taken another hit today after the events of Monday evening, with the loss of the vote on the final deal in parliament possibly being seen as increasing the possibility of a hard Brexit. In reality, the pound had been on the way down prior to its slight bounce on Monday and the vote last night has possibly just been the capitalised on by those looking for an excuse to short. 1.20 remains a key level for EURUSD.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.