Oil finishes the year positively and receives a boost in Asia as protests in Iran escalate and spread across the country.

Oil ended 2017 on a positive note, as falling inventories globally and strong economic growth offset the restart of the Forties pipeline and the resumption of production following a pipeline outage in Libya. Crude Inventories fell again last week in the United States, supporting WTI in particular, although it should be noted that holiday period volumes were much below the usual we would expect.

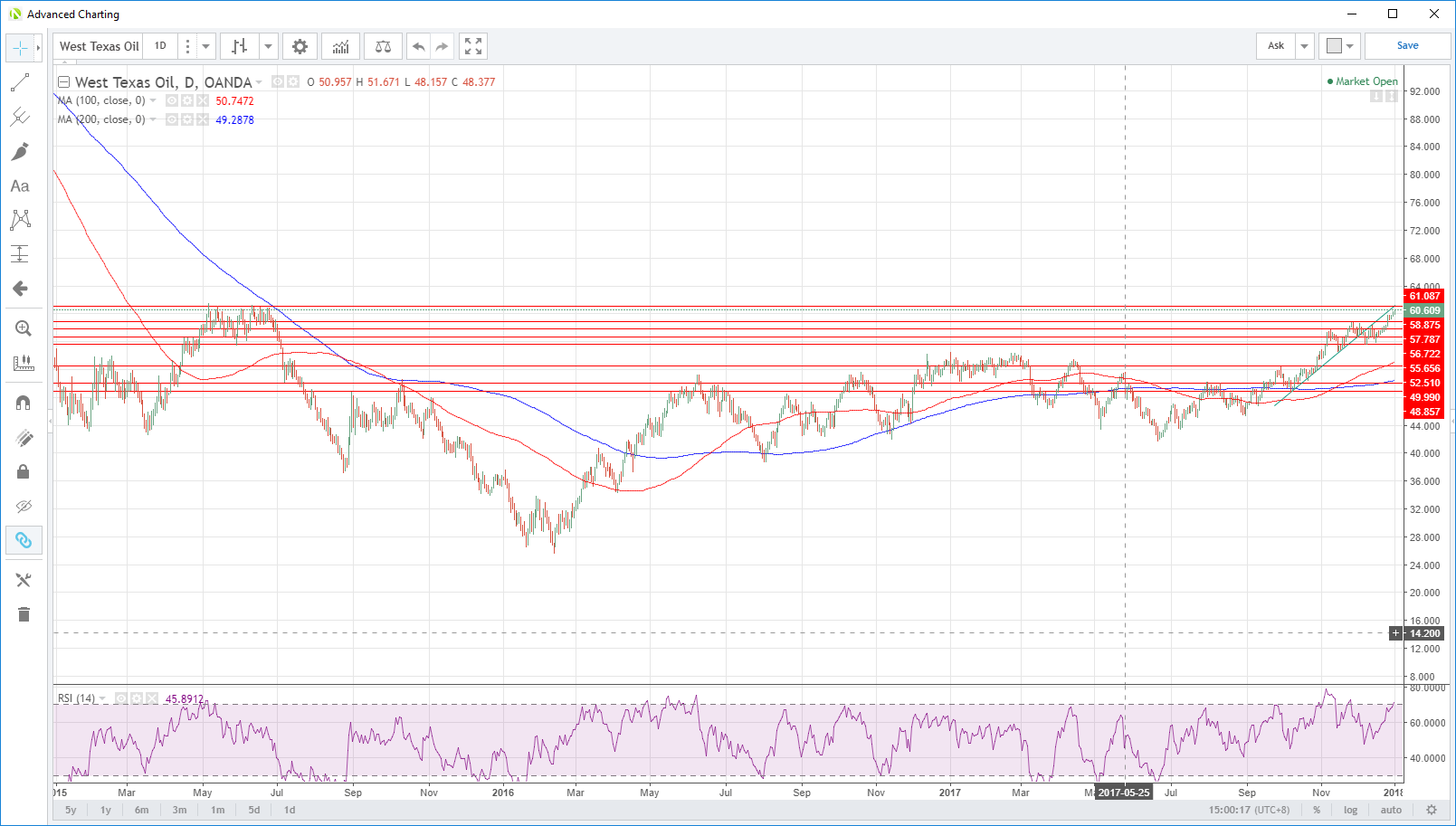

One cautionary note to sound after last week’s sprightly price action is that the Relative Strength Index’s (RSI) on both Brent and WTI crudes are now a breath away from very overbought levels. The RSI has been an excellent indicator of short-term corrections in 2017 so some caution at these levels on both contracts should be exercised.

Technicals aside though, Oil has enjoyed an impressive Asian session with bothy contracts marching higher by 80 cents. The driver has been unrest in Iran where political protests have erupted in a number of major cities across the country. Although having no effect on oil production and exports, for now, potential turmoil in a top five global oil producer will always be positive for prices. Crude should remain bid until things settle down. An upswing in the situation will have the effect of throwing fuel on the fire and bears monitoring by traders.

Brent rose 80 cents on Friday, touching 67.35 before falling to close at 67.00. It has raced higher by 0.80% in Asia, trading through the overnight high to 67.60. Resistance will be at 68.00 followed by 69.25. Support is found in the 65.75/66.00 region followed by 64.85.

WTI spot has risen an impressive 0.95% in Asia to trade at 60.65. The critical resistance zone around the 2015 highs looms near at the 61.10 area. A break of this opens the road for a rally to 74.00. Its overnight high at 60.50 is now intra-day support followed by 59.70, 59.25 and then 58.85.

All that said, please reread my cautionary note on the RSI above.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.