Hurricane Irma gives WTI a standing eight count as gold starts a welcome technical correction.

OIL

WTI collapsed by 3.30% on Friday as Hurricane Irma induced jitters weighed on the contract and also dragged Brent lower by 1.40 %. With Hurricane Irma’s landfall in Florida, traders fretted that extensive evacuations and damage across Florida and its neighboring states could see downstream products demand sink causing an inventory bottleneck much as we saw with Hurricane Harvey. The fact that WTI fell so much more than Brent speaks volumes, with Brent’s premium over WTI blowing out to over six dollars, two-year highs.

While WTI will most likely continue to suffer until the weather picture becomes clearer in Florida, Brent will probably gain support from comments over the weekend from Venezuela. Their oil minister is calling for a renegotiation of the OPEC/Non-OPEC production cut deal to bring Nigeria and Libya into the fold. That said will WTI taking an eight count Brent’s gains are likely to be limited.

WTI spot is trading slightly higher at 47.67 this morning with one positive note being that it held its 100-day moving average at Friday’s low of 47.20. This is the crucial short-term support today. 46.60 is the next support level with a break suggesting a return to the 45.50 regions. Resistance is now far distant at the 49.00/49.30 zone as WTI trades of Hurricane Irma headlines.

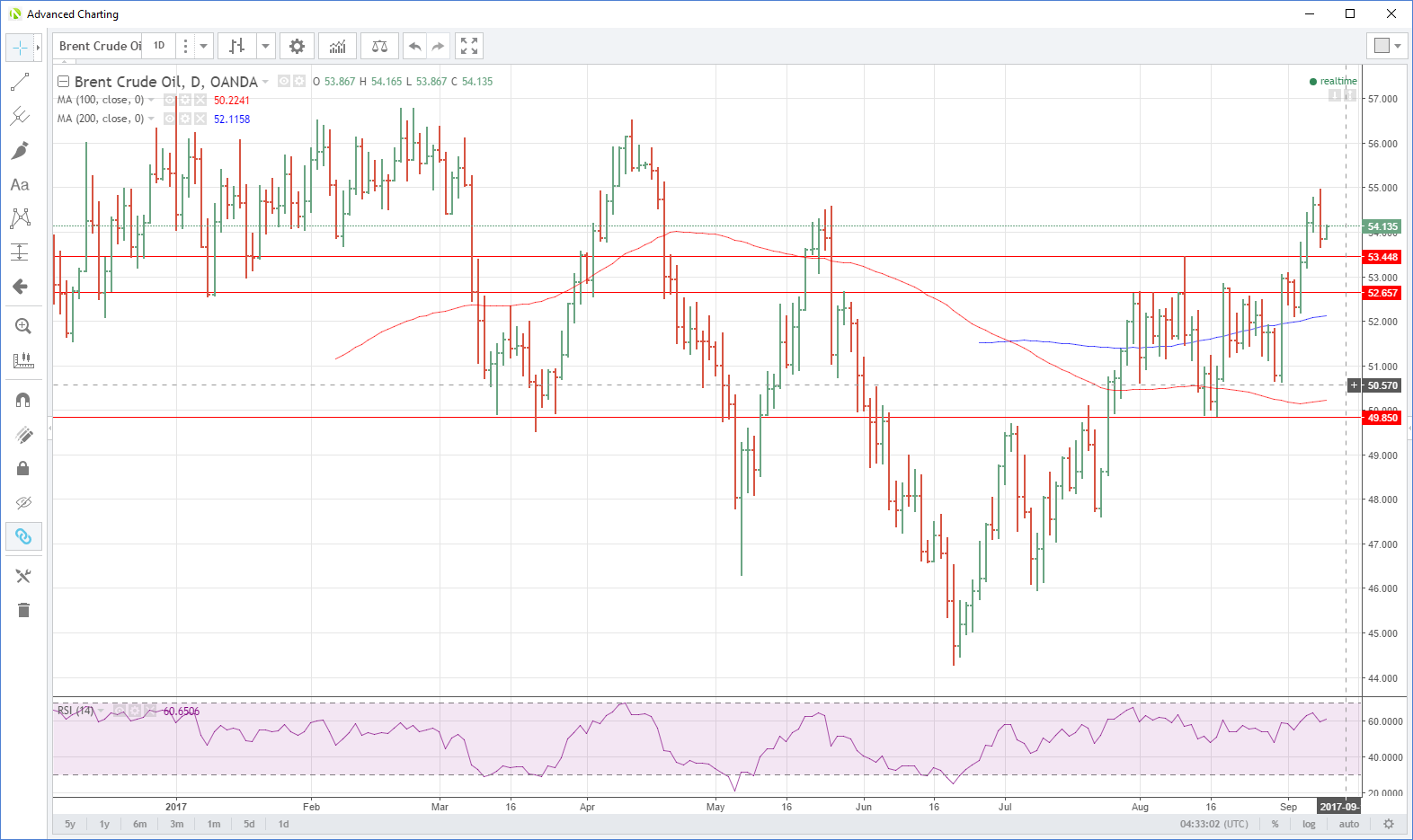

Brent spot trades at 54.10, just above it’s 53.85 close with support at last sessions low of 53.65 followed by the 53.00 area. Resistance is clearly defined at 55.00 with the overall technical picture for Brent remaining far more constructive.

GOLD

Gold has been very stretched on a technical basis for much of last week, driven higher by geopolitical woes. The pullback this morning will be a welcome development, taking the heat out of a very overbought relative strength index (RSI). As the week starts, the technical picture suggests that the pullback may have some legs to it in the absence of any headlines causing a rush to safe havens.

Gold is trading at 1337.70 in early Asia, flirting with each side of its nearby 1337.50 pivot level. A break below 1330.00 opens a drop to the 1320.00 regions and possibly as far as the longer-term support at 1296.00/1300.00. Although a move that far is possible looking at the technical picture, it is unlikely given global tensions and the state of the U.S. dollar.

Initial resistance is at Friday’s high of 1347.00 and then Thursday’s high of 1357.50. However, it would probably take more North Korea headlines or a large dollar sell-off to recapture these levels in the earlier part of the week. For now gold appears to be making a welcome technical correction within a larger longer term bullish picture.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.