Wednesday June 5: Five things the markets are talking about

Global stocks have surged overnight, rebounding sharply from their recent declines after Fed Chair Powell hinted that the central bank could lower interest rates if the economy slows in response to escalating tariffs and economic uncertainty. U.S Treasuries have again advanced, while the ‘big dollar is trading steady after four session of declines.

In commodities, oil is under renewed pressure along with MXN after Twitter Trump tweeted that the U.S is not bluffing on its tariff proposal that is due to take effect next week. However, Mexico’s president has indicated that he hopes to reach a deal before the deadline.

Elsewhere, the World Bank lowered its outlook for global growth, noting that “international trade and investment flows dropped faster than expected in the first six-months of the year, curtailing economic activity.”

Note: Global economic growth is on track to be the weakest since 2016, while trade growth is set to be the weakest since the financial crisis in 2008. The world economy is to expand at a +2.6% pace this year and below its 2.9% forecast made in January.

On tap: ECB monetary policy statement & press conference, CAD trade balance & CNY Bank Holiday (Jun 6), CAD & U.S employment data (Jun 7).

1. Stocks get the thumbs up

In Japan, the Nikkei rebounded sharply overnight, following yesterday’s rally in U.S equities after Fed Chair Powell signalled a possible rate cut. The Nikkei share average ended +1.8% higher, posting the biggest daily percentage gain since March 26. The broader Topix jumped +2.1%.

Down-under, Aussie shares finished higher overnight, in line with the rally in global stocks after ‘dovish’ Fed comments. Australia’s S&P/ASX 200 index rose +0.4%, in its second session of gains. Stocks also rose on Tuesday after the Reserve Bank of Australia (RBA) lowered its cash rate to a record low (+1.25%) to revive the country’s slowing economy. In S. Korea, the Kospi added +0.1%.

In China, the main indexes ended close to flat overnight as Beijing’s plans to conduct accounting checks pushed healthcare firms lower. At the close, the Shanghai Composite index was down -0.03%, while the blue-chip CSI300 index was down -0.04%.

In contrast, Hong Kong Shares ended higher overnight as comments from the U.S Fed raised investor hopes for an interest rate cut this year. At the close of trade, the Hang Seng index was up +0.5%, while the Hang Seng China Enterprises index rose +0.04%.

In Europe, regional bourses trade higher, tracking gains across Asia and in U.S futures after steep gains yesterday following a slightly more ‘dovish’ Fed.

U.S stocks are set to open higher (+0.28%).

Indices: Stoxx600 +0.17% at 373.54, FTSE +0.23% at 7,230.58, DAX +0.18% at 11,993.16, CAC-40 +0.23% at 7,230.58, IBEX-35 +0.22% at 9,137.44, FTSE MIB -0.33% at 20,163.50, SMI +0.44% at 9,639.80, S&P 500 Futures +0.28%

2. Oil prices fall on U.S stocks rise and Russia comments

Oil prices remain under pressure, dragged down by an unexpected gain in U.S inventories and comments from the head of Russian state oil producer Rosneft questioning the point of a deal with OPEC to withhold supplies.

Brent futures are down -42c, or -0.7%, at +$61.55 a barrel. They rose +1.1% yesterday after a near -13% fall in the previous four-sessions. U.S West Texas Intermediate (WTI) crude is down by -48c, or -0.9%, at +$53 a barrel. The U.S benchmark closed +0.4% higher yesterday.

Oil prices have been under pressure from investor fears about slowing global demand. However, yesterday’s rally was helped by a global stock market rally on hopes of a cut in U.S interest rates.

Nevertheless, providing new pressure is U.S crude stock numbers which rose unexpectedly last week. According to API data released yesterday, crude inventories rose by +3.5M barrels in the week to May 31 to +478M, compared with expectations for a decrease of -849K barrels.

Expect investors to take direction from today’s official numbers from the U.S Energy Information Administration (EIA) – the report is released at 10:30 am ET.

OPEC+ continues to give assurances that they would continue to manage global crude supplies to avoid a surplus.

Note: OPEC+ will decide later this month or in early July whether to continue the supply curbs.

However, underlining concerns about oversupply, the head of Russia oil giant Rosneft said Russia “should pump at will” and he would “seek compensation from the government if cuts were extended.”

Ahead of the U.S open, gold prices have rallied to a three-month high after the latest comments from Fed officials lifted expectations of a cut in interest rate, pushing the dollar to a multi-week low. Spot gold jumped +0.7% to +$1,333.90 per ounce, while U.S gold futures have climbed +0.8% to +$1,339.60 an ounce.

3. Sovereign yields ease again

Four weeks ago, market consensus believed the Fed would hold rates steady for the rest of this year. However, that was before President Trump decided to take a hard-line stance on his trade policies with both China and Mexico. Ten-days ago, U.S fixed income dealers were pricing in one-rate cut in 2019. But now, in the past seven-days, money market dealers pricing of rate cuts has got a tad more aggressive, futures prices are now implying two-to-three -25 bps rate cuts by the end of this year.

The yield on U.S 10-year Treasuries eased -1 bps to +2.12%. In Germany’s the 10-year Bund yield declined -1 bps to -0.21%, the lowest on record. In the U.K, the 10-year Gilt yield decreased -2 bps to +0.884%, while in Japan, the 10-year JGB yield declined -2 bps to -0.123%, the lowest in almost three-years on the largest decrease in almost 10-weeks.

4. Pound rises as UK services sector activity picks up

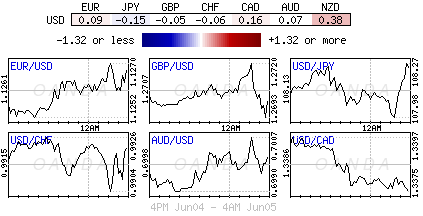

The ‘big’ dollar continues to struggle, trading atop of its two-month lows on rising expectations of a U.S Fed interest rate cut in response to trade conflict-related risks. With the Fed possibly rethinking their current strategy, has investors gravitating towards safe-haven assets like the EUR (€1.1284) and the Japanese yen (¥108.24).

The pound (£1.2729) has rallied to a nine-day high after the U.K services purchasing managers’ survey rose to 51.0 in May, up from 50.4 in April, and above market expectations of 50.5. There was a “greater intakes of new work and a slight improvement in underlying business conditions since the start of spring,” said IHS Markit. However, “there were again widespread reports that Brexit uncertainty had held back client demand and remained a headwind to growth.”

The EUR continues to hold its ground outright despite the focus for the ‘single’ unit continues to be the Italian government and their tensions with the EU. According to techies, the next levels to the upside will be in the €1.1320 area, a level set as the high in May. However, market focus remains on tomorrow’s ECB’s meeting, but many believe the event to be likely to be more an important driver for Italian government bonds (BTP’s) than the EUR.

5. Eurozone private sector growth remains subdued during May

Data this morning from Europe for the month of May saw the continued expansion of the euro area private sector.

After accounting for seasonal factors, the IHS Markit Eurozone PMI Composite Output Index rose to 51.8 in May, up from April’s 51.5 and slightly better than the earlier flash reading (51.6).

Note: The latest reading was the highest for three-months and extends the current period of continuous growth to just under six-years.

Digging deeper, it was the service sector that provided the impetus to overall growth during May, expanding at a solid pace. In contrast, manufacturing output fell for a fourth successive month.

Germany saw growth improve to a three-month high and, despite recording its weakest expansion for five-and-a-half years, Spain continued to expand solidly. In France, output increased modestly, but Italy remained just inside contraction territory for a second successive month.

Note: With activity increasing solidly, firms were subsequently able to reduce their overall backlogs of work for a third consecutive month.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.