It’s jobs day in the US and while this report may not be considered as important as some others, due to rate hike expectations being continually pushed back, it is still going to be extremely significant.

There is understandably a lot of pessimism among some about the health of the US economy – two quarters of weak growth, woeful May jobs report and a growing list of growth risks, to name a few good reasons – and it seems that no matter how much the Federal Reserve tries to convince people otherwise, the markets just aren’t buying it.

Dollar Bulls Rely On A Strong NFP

This is what makes today’s report so significant in my view. We’ve now had two jobs reports in which one has been woeful and the other very good. On average, jobs growth is quite solid, and not just across the last two, if you take the average back to the start of the year also. If you take the average going back to the start of 2015, it’s even better. From this perspective we should be wondering why anyone is really concerned.

However, should we get another bad report on the labour market today, those pessimists will point to two out of three poor months of job growth as evidence that the US economy is slowing and not near the point at which rate hikes should be being considered. We could see markets price out a hike even further beyond the summer of next year at which point markets still marginally expect interest rates to be the same.

Source – CME Group FedWatch Tool

A good jobs report on the other hand may not quite have the same effect but with rate hike expectations now so far out and the Fed still talking up the prospect of a hike this year, the markets would likely respond.

EUR/USD – Euro Steady, Eurozone Manufacturing Data Dips

The other aspect of the report worth considering is the hourly earnings number. Low income growth has been a thorn in the side of both the economy and the Fed, as in the absence of it, inflation and spending has remained subdued. The Fed’s assumption has been that as the slack is removed from the labour market, this should pick up but with unemployment at 4.9%, something is clearly amiss. Between this remaining low, growth falling short, inflation being constantly below target and risks growing, the Fed is running out of reasons to raise rates.

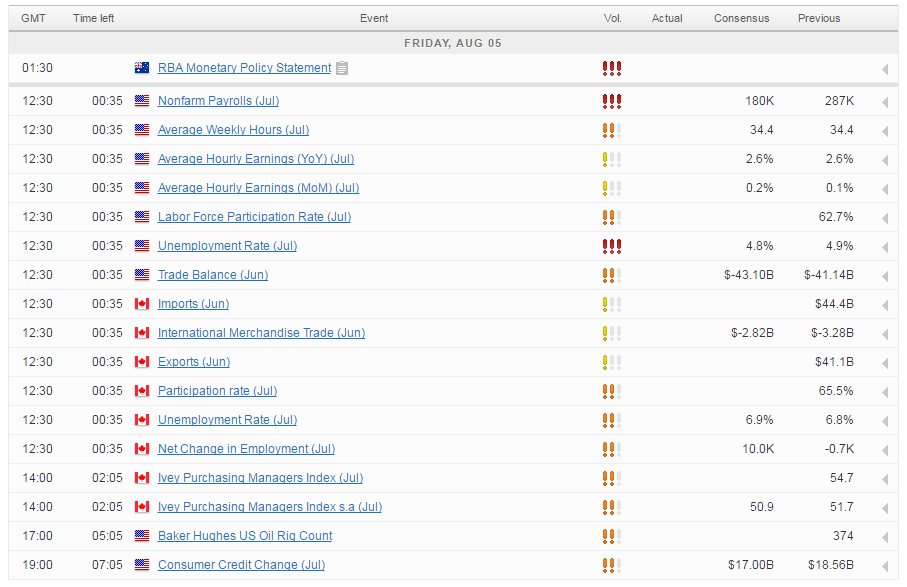

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.