Investors look for another boost from earnings

US futures are pointing slightly higher again on Wednesday as indices look to extend the winning streak to three sessions on the back of strong earnings reports.

Investors have been encouraged by the results we’ve seen so far, with lower taxes not the only thing providing a big lift to the bottom line, although they are obviously a considerable contributor. Another 52 companies are preparing to report on the second quarter today, including Facebook, the second of three FANG stocks reporting this week and investors will be hoping for more strong figures after Alphabet’s report was so well received, despite the $5 billion fine that was imposed on it last week.

Trump and Juncker to set the dollars tone

German IFO beats expectations but business worried about outlook

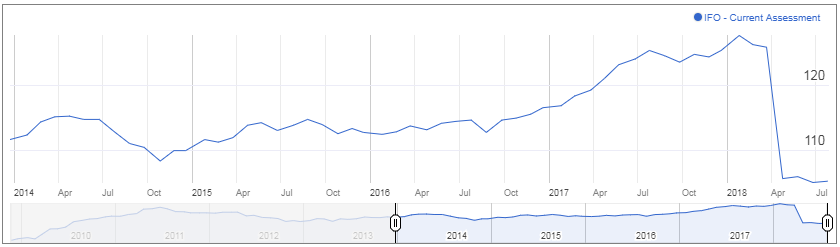

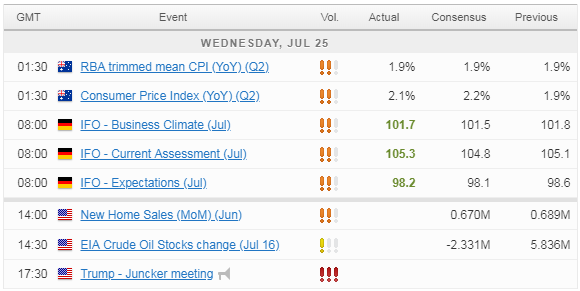

One of the few pieces of data that was scheduled for release today was the German Ifo business climate survey and the results were broadly as expected, with businesses feeling positive about the current climate and anxious about the outlook. Overall, the index fell marginally to 101.7 which was slightly higher than expectations and signals continued decent growth in the eurozone’s largest economy.

The continued decline in the expectations component of the survey is likely being driven by the ever-increasing threat of a trade war, with US President Donald Trump now taking aim at the eurozone as the conflict with China heats up. Germany has been a particular focal point of his attacks on the eurozone, with the country benefiting from a weaker euro which is more a reflection of the region as a whole rather than its own economy.

German IFO Business Climate

German IFO Current Assessment

German IFO Expectations

Juncker heads to Washington in attempt to cool trade conflict

Trump has repeatedly threatened tariffs on the European car industry which would disproportionately hit Germany and is likely factoring into businesses less optimistic outlook. It will be interesting to see if anything can be achieved during Jean-Claude Junckers visit to Washington today, with the European Commission President hoping to convince Trump to drop plans to impose tariffs on the EU, something I am not hopeful he will be able to achieve.

The IFO number did lift the euro in early European trade and it now finds itself around a tenth of one percent higher against the dollar on the day. This comes ahead of the ECB meeting tomorrow, which could be one of the less eventful gatherings after the central bank last month laid out plans for the end of quantitative easing this year and made clear that interest rates will not start to rise until at least the middle of next year. Nothing that has happened since is likely to have changed this view.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.