The New Zealand Dollar finishes the week on just above daily support.

It’s been a long week in the markets for sure, with some winners and losers. From a technical perspective, the NZD could be one of the latter. The NZD/USD is finishing the week perched just above daily support at 7010. US Yields pushing higher daily, flat to small up dairy prices, a slowing Auckland housing market and the RBNZ on hold for the foreseeable future, the Kiwi looks like it is finally losing its high yielder glow.

Politically the market also seems to be slowly pricing in the Prime Minister John Key’s resignation last week and the elevation of Bill English to the top job. This has been followed by what seems to be a minister a day standing down and intending to retire at next year’s election. Many would say, and I am one of them, that they wish more politicians would follow such a path instead of hanging around like bad smells. In this case though, one feels that the breaking up of the ten years Key/English dream team is the final straw on the camels back.

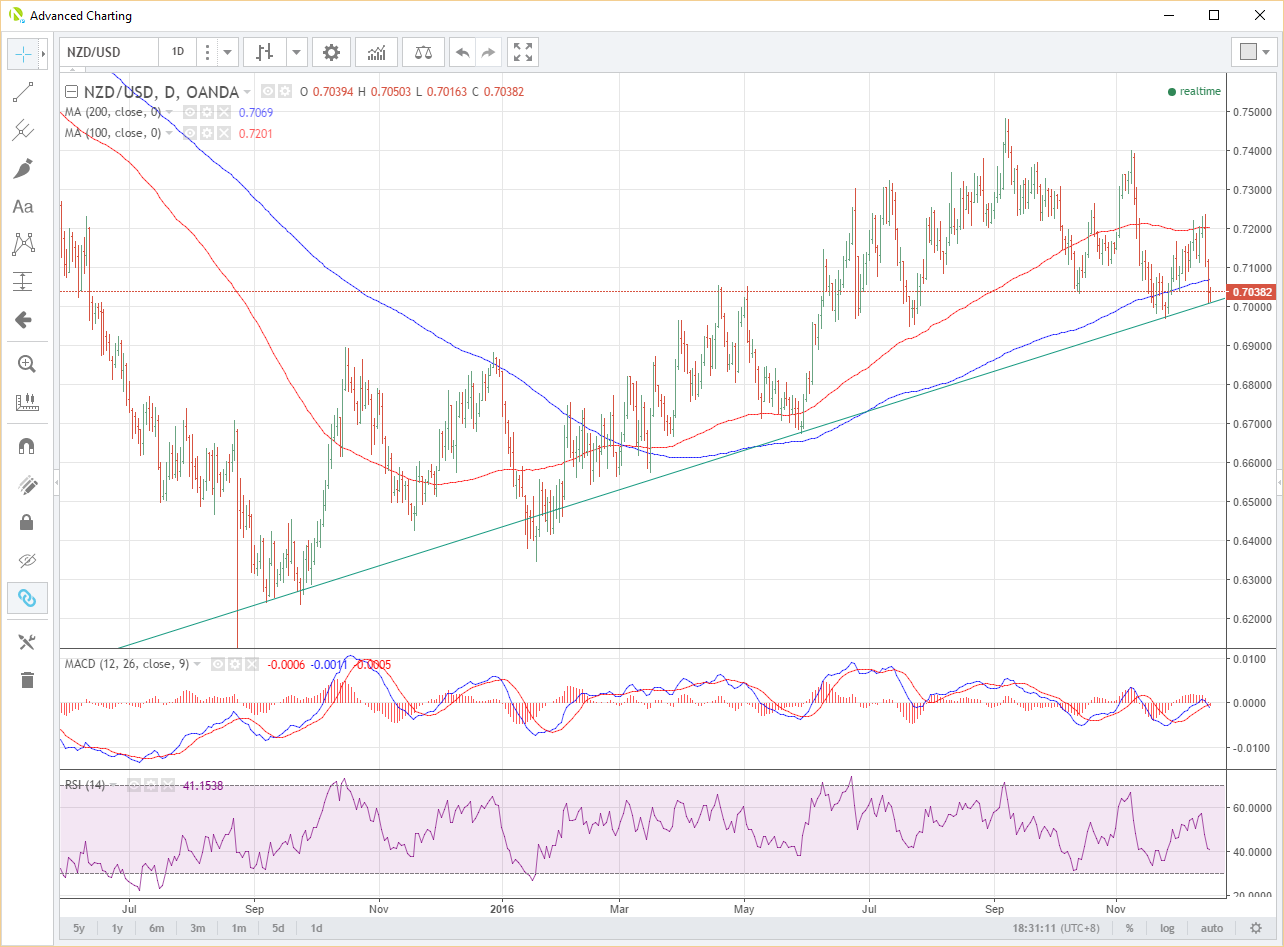

Coming back to the daily chart, I note that as Kiwi finishes the week on daily support, the RSI is still not oversold. More interestingly the fast line on the MACD (blue) has crossed the slow to the downside.

From a technical perspective, a close below 7010 could signal a move to next support at 6950. After that, the next support is a long way away at 6670. Resistance comes in at the 200-day moving average at 7070 and then 7100. Above there we have a congestion zone around 720010/30 including the 100-day moving average.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.