Just when you though it was safe to invest in an asset that made sense, be it forex, bonds or stocks, fear and contagion has suddenly appeared, and in under 48-hours has severely bullied emerging markets into near submission.

In six-weeks, the Turkish lira has fallen nearly +45% against the dollar, when President Erdogan won an election strengthening his absolute power. Today alone, TRY has fallen -11% to hit a record low of $7.2412 outright, as concerns grow about strained relations between Turkey and the U.S as well as about the worsening state of the Turkish economy.

Reports that the European Central Bank (ECB) is becoming increasingly concerned about the exposure of some banks in the region has sent the EUR to a new one-year low of €1.1367.

News that investors are losing confidence that Turkey will act in the interests of the economy has many flocking to own USD’s, a natural reaction. However, a stronger dollar will eventually hurt the U.S economy, from an export perspective in particular. Nor does it help President Trump’s agenda of growth through trade and stimulus through a weaker greenback.

Central Bank of the Republic of Turkey (CBRT) overnight said it had lowered reserve requirement ratios for banks to free up liquidity and assured markets that it would take all necessary measures to maintain financial stability. Turkish Finance Minister Berat Albayrak also said the banking watchdog had also limited swap transactions in the currency.

On tap: There are no central bank meetings this week. Q2 growth data for the Eurozone and Germany will be released (Aug 16). Stateside, the pace of new data in the U.S. picks up with industrial production (Aug 15) and housing starts (Aug 16). The U.K posts key data including employment (Aug 14), consumer and producer price indexes (Aug 15) and retail sales (Aug 16) and Brexit talks between the E.U and the U.K. resume in Brussels (Aug 16).

1. World stocks hit one-month low as Turkish rout spreads

Contagion worries continue to impact investor risk sentiment, especially in emerging markets.

In Japan, the Nikkei tumbled -2% to a five-week low overnight as a sell-off in emerging market currencies frightened investors, with the safe-haven yen’s (¥110.20) appreciation also hurting sentiment. The broader Topix dropped -2.1%.

Down-under, Aussie shares ended lower overnight, weighed down by materials and banks after the crisis in Turkey hit Asian assets, while global trade turmoil pushed commodity prices lower. The S&P/ASX 200 index fell -0.4%. In S. Korea, the Kospi ended down -1.5%, in line with other Asian countries.

In Hong Kong, the Hang Seng index ended -1.5% down, while the China Enterprises Index closed -1.6% lower. In China, stocks too ended lower overnight, but managed to recoup most of their earlier losses aided by gains in shares of tech firms. The blue-chip CSI300 index fell -0.4%, while the Shanghai Composite Index ended down -0.3%.

In Europe, regional bourses opened lower and continue the trend as the session progresses.

U.S equities are set to open in the ‘red’ (-0.3%).

Indices: Stoxx50 -0.4% at 3,410, FTSE -0.5% at 7,633, DAX -0.5% at 12,366, CAC-40 -0.2% at 5,403; IBEX-35 -0.9% at 9,517, FTSE MIB -0.5% at 20,983, SMI -0.5% at 8,982, S&P 500 Futures -0.3%

2. Oil dips on EM woes, gold lower

Oil prices have slipped overnight as trade tensions and troubled emerging markets have knocked the market outlook for fuel demand, despite U.S sanctions against Iran pointing towards tighter supply conditions.

Brent crude oil is down -10c at +$72.74 a barrel, while U.S light crude is -15c lower at +$67.48 a barrel.

Contagion fears in emerging markets is compounding worries that a deepening trade war between the U.S, China and the E.U will hurt business activity in the world’s biggest economies.

Also putting pressure on oil prices were U.S energy companies last week increasing their number of active oilrigs by the most since May, adding +10 rigs to bring the total count to 869, according to the Baker Hughes. That was the highest level of drilling activity in three-years.

Ahead of the U.S open, gold prices have extended their declines into a third-session overnight, as the U.S dollar climbed to a 13-month high against G20 currency pairs. Spot gold had dropped -0.2% to +$1,208.50 an ounce. U.S gold futures are down -0.3% at +$1,215.7 an ounce.

3. Turkish yields jump despite CBRT measures

Turkish government bond yields again have backed up aggressively overnight despite the CBRT announcement of a set of measures to support the TRY. Yields on the Turkish 10-year government bond hit a new record high +8.914% this morning. They fell briefly to +8.427% after the central bank announcement.

Elsewhere in Europe, Italian bonds and stocks have also been hit by the turmoil in Turkey. Italian banks in particular have a lot of exposure in Turkey. Consequently, investors continued to push Italy’s borrowing costs higher, with yields across the curve +3 to +11bps higher.

Elsewhere, the yield on 10-year U.S Treasuries has declined -2 bps to +2.86%, the lowest in more than three-weeks. In Germany, the 10-year Bund yield has decreased less than -1 bps to +0.31%, the lowest in five-weeks, while in the 10-year Gilt yield has dipped -1 bps to +1.242%, the lowest in more than three-weeks.

4. Dollar in demand on contagion fears

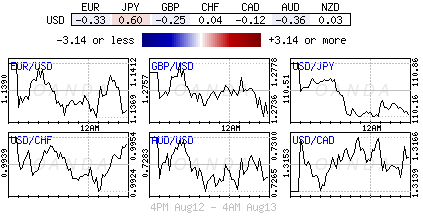

FX markets continue to find flows into safe haven currencies on risk aversion trading around the Turkish crisis.

TRY ($6.8794) has pared some of its losses outright after the CBRT said it had lowered the reserve requirement ratios for banks as well as pledged to “provide whatever liquidity banks needed and to take all necessary measures to maintain financial stability.” The currency is still down more than -6% on the day and within touching distance of a record low around $7.24 hit it early Asian trade. The lira has weakened nearly -45% since the start of the year.

Other EM currency pairs have not fared any better, South Africa’s rand ($14.4607) has skidded to levels not seen since mid-2016, while Russia’s rouble ($67.7) slumped to a near 2-1/2 year trough. The Indian rupee ($69.71) has plummeted to an all-time low, while the Indonesian rupiah ($14610) hit a near three-year low prompting the central bank to intervene. China’s yuan (¥6.8791) has weakened -0.5% – its steepest daily decline in nearly four weeks.

EUR/USD (€1.1384) remains below the key technical level of €1.15. The Italian budget issue continues to simmer in the background – Italy Deputy PM Di Maio believes that Italy is not at risk of financial market attack.

5. China July new loans up +¥623.7B y/y to +¥1.45T

Faced with sluggish domestic demand and potential pressure from a trade war with the U.S, Chinese policymakers have recently boosted policy support and softened their stance on deleveraging.

According to China’s banking and insurance regulator (CBIR) China extended +¥1.45T (+$210.84B) in new yuan loans in July – a form of pumping liquidity into a slowing economy.

However, the PBoC continues to faces difficulty in channelling credit to small firms – which are vital for economic growth and job creation – State banks remain reluctant to lend to these small firms, which are considered riskier than state-controlled ones.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.