Tuesday August 21: Five things the markets are talking about

The ‘big’ dollar has dropped for a fourth consecutive session, along with U.S Treasuries after President Trump criticized his own appointed Fed Chairman’s interest-rate hikes.

Trump said he is not “thrilled” with the Fed raising interest rates, suggesting that U.S policy makers take a break from policy normalization while he carries out his protectionist policies.

The unconventional President has taken a swipe at U.S dollar bulls that have built up ‘long’ rate differential and risk aversion summer positions. Would his administration even go down the route of outright currency intervention? Or is Trump just limited to verbal comments?

Market focus now shifts to tomorrow’s Fed meeting minutes and this week’s Jackson Hole symposium for clues on U.S monetary policy, and for any response from Powell to Trump’s comments.

1. Global stocks find support

Most stocks in Asia gained after U.S equities flirted with record highs yesterday, though European shares are little changed ahead of the U.S open.

In Japan, the Nikkei edged a tad higher overnight (+0.1%) after a weakening of the yen (¥110.24) prompted futures purchases, but mobile phone stocks plummeted on reports that a Japanese official said that the industry needs reform. However, the broader Topix lost -0.4%.

Down-under, Aussie shares slid overnight, as investors took note of failed attempts to topple PM Turnbull and top miner BHP missing annual earnings expectations. The benchmark S&P/ASX 200 index lost -1% after rallying +0.1% on Monday. In S. Korea, the Kospi (+0.99%) stock index closed higher on hopes that Sino/U.S talks would thaw a potential trade war.

In Hong Kong, stocks found support as the yuan stabilized and as investors expect Beijing to further relax its policies to counter the impact of trade frictions. The Hang Seng index rallied +0.6%, while the China Enterprises Index gained +1.0%.

In China, equities have extended their gains, led by technology, consumer and financial stocks, as risk appetite improved on signs the government will relax monetary and fiscal policies. The blue-chip CSI300 index ended +1.8% higher, while the Shanghai Composite Index closed up +1.3%.

In Europe, regional bourses are trading higher, following their Asian counterparts.

U.S stocks are set to open in the ”black’ (+0.1%).

Indices: Stoxx600 +0.2% at 383.9, FTSE 0.0% at 7590, DAX +0.6% at 12388, CAC-40 +0.5% at 5406, IBEX-35 +0.6% at 9526, FTSE MIB +1.0% at 20687, SMI +0.2% at 9074 S&P 500 Futures +0.1%

2. Oil firm on tighter U.S outlook, gold higher

Oil prices trade firm stateside, with U.S fuel markets seen to be tightening, although the release of crude from the American strategic reserves is offsetting an expected supply cut due to upcoming sanctions against Iran.

Brent crude oil futures are down -9c, at +$72.12 a barrel, while U.S West Texas Intermediate (WTI) crude futures are up +30c, or +0.45%, at +$66.73 per barrel.

Note: Inventories in U.S for refined products – diesel and heating oil – are at their lowest in four-years.

Washington yesterday offered +11M barrels of crude from its Strategic Petroleum Reserve (SPR) for delivery from Oct. 1 to Nov. 30. The market expects the released oil may offset expected supply shortfalls from U.S sanctions against Iran.

However, on the flip side, the overall market sentiment remains cautious because of concerns over the demand outlook amid the Sino-U.S trade dispute.

Ahead of the U.S open, gold prices have climbed to a one-week high on the back of a weaker dollar. Spot gold has rallied +0.4% to +$1,194.81 an ounce, the highest level since Aug. 14. U.S gold futures have climbed +0.5% to +$1,200.60 an ounce.

3. Yields – impact of Trump’s comments remain unclear

Given that the Fed is an independent institution, explicit comments about interest rates from a sitting President could just as easily have the opposite effect.

Trump wants lower rates and a weaker U.S dollar, however, Fed Chair Powell maybe more inclined to ‘normalize’ rate policy to defend their credibility – the Fed has raised interest rates twice this year and has penciled in two-more +25 bps increases in 2018 and three-more in 2019.

Note: The market will be watching for tomorrow’s FOMC minutes and as well as the annual Jackson Hole symposium of global central banks for ‘yield’ guidance.

The yield on 10-year Treasuries have rallied +1 bps to +2.83%, the biggest advance in a week, while the yield on two-year notes has gained +2 bps to +2.60%, also the largest advance in a week. In Germany, the 10-year Bund yield has backed up +1 bps to +0.31%, while in the U.K the 10-year Gilt yield has increased +1 bps to +1.223%.

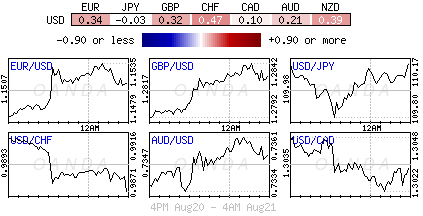

4. Dollar under pressure from Trump remarks

The ‘mighty’ U.S dollar remains on soft ground after President Trump again complained about the job Fed Chair Powell was doing and believed that the Fed should be more accommodating to his policies. In an interview yesterday, Trump also reiterated his view that both China and Europe were manipulating their ‘respective’ currencies.

EUR/USD (€1.1519) is holding above the key €1.15 level – the techies will monitor today’s daily close level to gauge whether a reversal is possible for the ‘bearish’ EUR trend since the break occurred last week.

GBP/USD (£1.2820) is higher by +0.2% as Brexit negotiations resumed. U.K officials continue to remain optimistic that an agreement with the E.U can be achieved. An opinium poll for the Observer newspaper has found that +40% now believe it is most likely that the U.K will leave in next March without a deal – up sharply from +31% last month. One in five (+22%) think Britain will leave with a deal, while +16% thinks Britain will not leave the E.U in March.

USD/JPY (¥110.26) traded below ¥110 for the first time since late June amid broad USD weakness, but has since moved off its worst levels as the European session progressed.

The Chinese yuan has rallied +0.25% to ¥6.839, pulling further away from ¥6.934, its weakest since January 2017 marked last week.

5. RBA has greater confidence in Aussie consumers

The Reserve Bank of Australia (RBA) agreed the next move in the cash rate would more likely be an increase in yesterday’s minutes from the Aug. 7 policy meeting.

Aussie policy makers stressed that keeping rates at +1.50% would “help reduce the jobless rate and lift wage growth over time.”

Members assessed it would be appropriate to hold the cash rate steady and for the Bank to be a source of “stability and confidence” while this progress unfolds.

Note: Political instability remains an issue, despite Aussie PM Turnbull winning a leadership vote for the ruling Liberal Party by a vote of 48 to 35.

The RBA generally sounded more upbeat about the economy, citing recent strength in the labor market and strong business confidence.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.