Shutdown averted, trade talks with China more important

The US equity market rally has stalled over the last couple of weeks, with increased uncertainty around trade talks with China, a government shutdown and a potential earnings recession weighing on investor confidence.

Reports overnight suggest that one of these may have been averted, with Democrats and Republicans apparently reaching an agreement that will prevent another government shutdown. All of the details are still not know but the reported number agreed for physical barriers – around $1.375 billion – is well short of what Trump was demanding which may be a blocker to the deal getting over the line, unless other means of funding have also been found.

A deal to avoid another shutdown may resolve another unwanted distraction for the US but I’m not sure it was ever viewed as a major risk factor for the markets. They may be trading in the green ahead of the open but I don’t think this is a game changer, unlike the negotiations with China. The escalation of the trade war between the two countries has undoubtedly been disruptive and remains a significant risk, with fears of recessions – both economic and earnings – very real and a major threat for markets.

Success in these negotiations will provide a welcome distraction for Trump and his team and draw any attention away from the failure to secure the full funding for the wall. Officials are in Beijing this week and appear optimistic that a deal can be agreed by the end of this month, despite recent suggestions that the two sides remain far apart. From a markets perspective, we just need to avoid more tariffs so an extension to the 90-day truce will be encouraging and could keep investors on board.

OANDA Business Breakfast on Jazz FM

May to push for more time

The Brexit saga continues today, with Theresa May addressing Parliament a day earlier than planned to urge MPs to give her more time to negotiate the changes to the backstop arrangement that can get the support of the House. This request is unlikely to come without its criticism but MPs are likely to allow her the extra time to do so.

But time is fast running out so amendments will still likely be tabled on Thursday in an attempt to prevent May running down the clock any more. Another “meaningful” vote is then likely at the end of February, one month before Brexit day. Traders remain relatively laid back about this though, with the pound remaining under some pressure but well off the recent lows. I still think there is a belief that a deal – probably May’s – gets over the line.

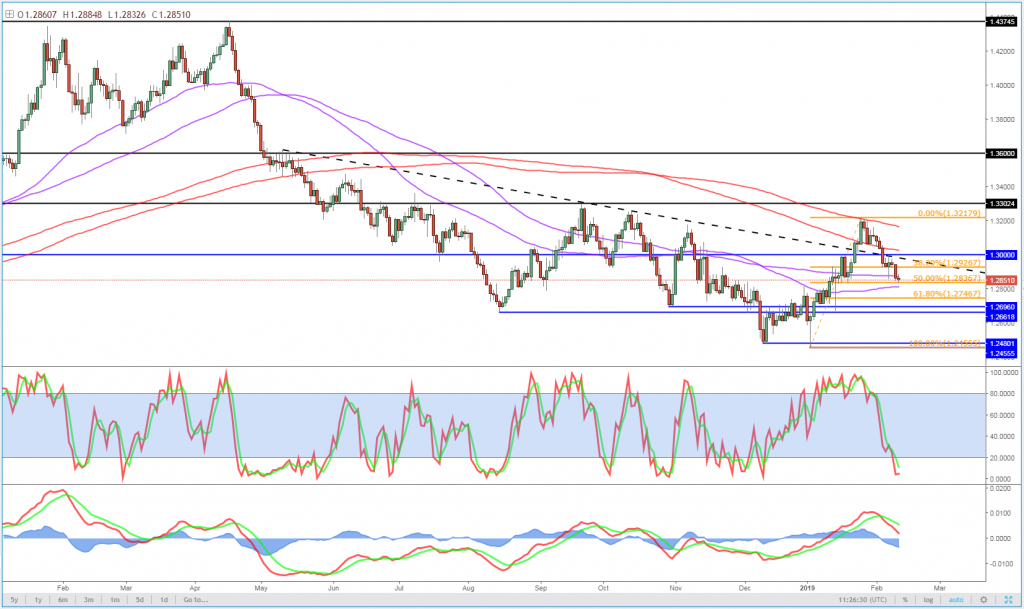

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Gold continues to show resilience

Gold continues to show strong resilience in the face of a stronger dollar. The greenback is relatively flat today but this comes on the back of another strong session on Monday. This has taken the edge off the gold rally but there continues to be strong support, to the point that $1,300 is yet to be properly tested. At some point, something will have to give if the dollar continues this winning streak – eight days of gains already and on course for a ninth – but so far, gold bulls are holding firm.

Commodities Weekly: Investors most-bearish on copper since 2016

OPEC monthly report eyed as oil trades near range lows

A stronger dollar, among other things, has also taken the edge off the rally in oil, with Brent and WTI both trading around recent range lows. We seem to be going through a holding phase, whereby traders are optimistic about price but lacking evidence to support the next breakout. Oil inventories have been rising and US output is at record highs, while at the same time the global economic outlook is uncertain.

The OPEC monthly report today may be a bullish catalyst for oil if it shows strong compliance with previously agreed cuts but this has been called into question recently, particularly with Russia which has reportedly been slow to cut to agreed levels. Oil bulls may well have to be more patient before OPEC+ efforts start to pay off.

Oil (WTI and Brent) Daily Chart

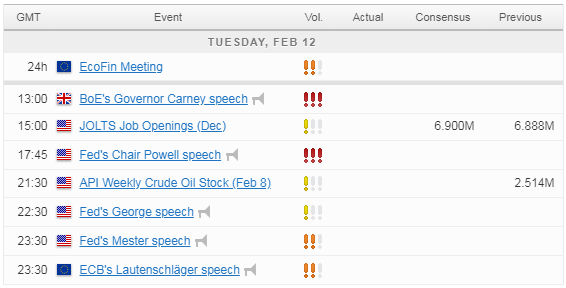

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.