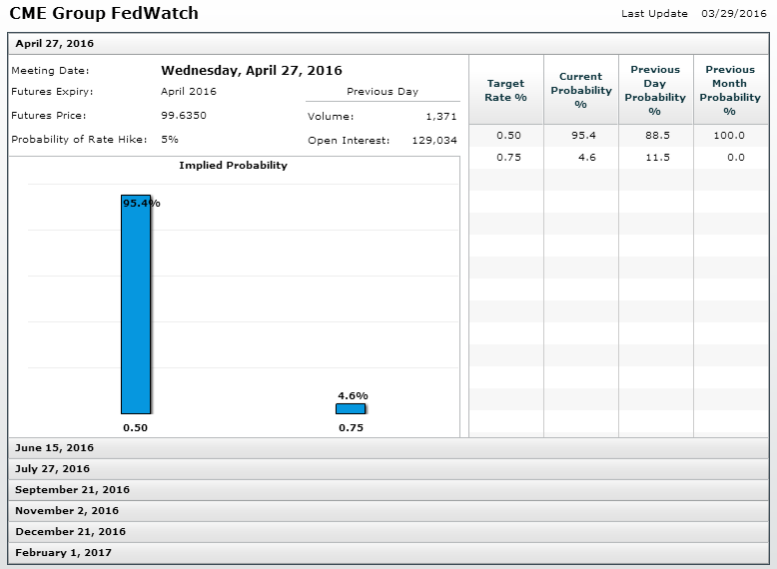

Janet Yellen gave equity markets a nice boost overnight, delivering a surprisingly dovish message during her speech to the Economic Club of New York and all but killing the possibility of a rate hike at next month’s meeting. European indices are now expected to follow in the footsteps of their U.S. and Asian counterparts, with futures currently indicating an open more than half a percentage point higher.

It seems once again the Fed is on a mission to confuse investors, sending very mixed messages over the last week which clearly highlight the divisions among policy makers that makes any rate hike at the April meeting suddenly extremely unlikely.

Source – CME Group FedWatch Tool

The Fed appeared to have fallen more in line with market expectations a couple of weeks ago and it would appear Yellen is determined to remain that way.

Yellen’s downplaying of the rise in inflation, which in January reached 1.7%, just shy of the Fed’s 2% target and the highest since July 2014, perhaps came as the biggest shock. Yellen has previously been keen to avoid overshooting the central bank’s target and warned of inflation rising faster than markets expect and now she appears intent on doing the opposite, instead warning of the negative impact of the global economy on the U.S.. She even indicated that further stimulus is possible if necessary which is odd for someone who insisted on three months ago that it is suitable for the tightening cycle to begin.

Whatever the reason for her remarks, I’m sure there will be few that will disagree with the need for rate increases to be gradual, certainly more so than the four hikes the Fed indicated in December. That said, I wonder how much the global economy and financial markets are now influencing the Fed compared to what it has previously, given that both appear to be creeping increasingly into its messaging.

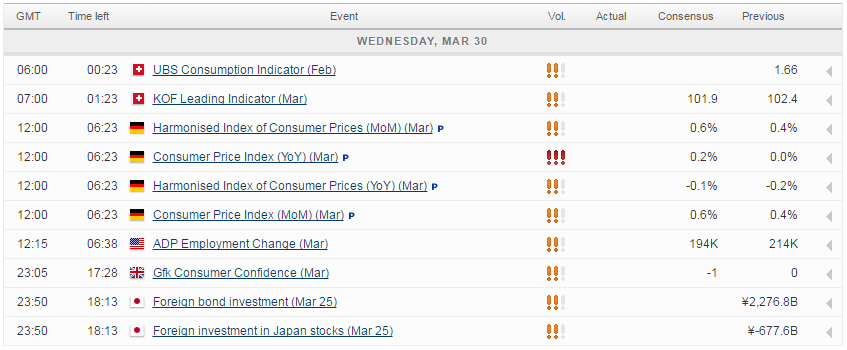

Today is looking a little light on the data front again as we head into a data-packed week-end. Germany preliminary CPI data is seen edging higher in March, while remaining well below target. We’ll also get a number of sentiment surveys for the euro area this morning which will be of interest, although coming after the PMI data the market impact tends to be a little muted. The ADP non-farm employment data from the U.S. later will get the most attention from investors, although following Yellen’s comments on Tuesday, it will be interesting to see what kind of impact it will have on the markets.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.