Will Earnings Support or Stall Equity Market Rally?

US equity markets are poised to start on a positive note once again, looking to build on the numerous record highs recorded in recent weeks on the prospect of a brighter global economic outlook.

With corporate earnings season now underway and the number of companies reporting on the third quarter picking up quickly – 56 S&P 500 companies to release numbers this week – investors will be looking to the figures to add further support to the rally. This is particularly the case given the quieter week we have on economic data side, with predominantly tier two figures scheduled for release.

EUR/USD – Euro Dips Lower Despite Positive Eurozone Data

UK Data Key as BoE Lines Up Rate Hike

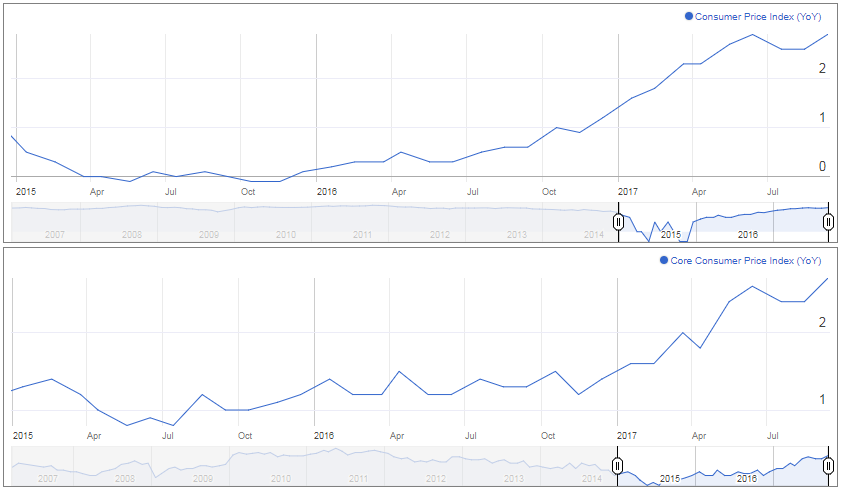

On the data side, it’s the UK that will be in focus this week, as we get numbers on the labour market, inflation and consumer spending. This comes as the Bank of England continues to weigh up raising interest rates before the year is out, a controversial move considering the gloomy economic outlook at mostly temporary nature of above target inflation. Should inflation ease off tomorrow as it did a few months ago, it will be interesting to see whether traders adjust rate hike expectations accordingly or stick with the line coming from the central bank.

IBEX Underperforms as Puigdemont Side-Steps Independence Request

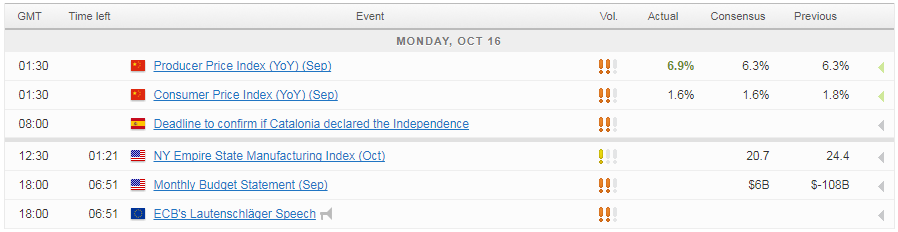

Spanish shares are once again underperforming their European counterparts after Catalan leader Carles Puigdemont opted not to clarify whether or not independence had been declared, having been given a deadline of 10am local time to do so. Instead Puigdemont once again called for dialogue with Madrid over the next two months, which once again suggests independence is possibly not the aim of the government, at least not against the will of the Spanish authorities.

We’ll have to wait and see whether Prime Minister Mariano Rajoy is open to talks or if the current stand-off will be maintained. Rajoy may see the latest response as a sign of weakness and instead look to test Puigdemont’s resolve, creating further market uncertainty. The preferred outcome would be to find a diplomatic solution which would probably include more autonomy being granted to the region, something Rajoy is against.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.