Kiwi Dollar has rallied a huge way. Prices were below 0.806 yesterday at one point, but today we’ve almost reached 0.826 at the highest – a move of 200 pips in less than 24 hours. Amazingly, there hasn’t been any significant pullback along the way, with a ratio of 5 : 2 bull/bear candle from peak to trough where the average length of the bearish candle body is much smaller compared to the bullish ones.

From a fundamental perspective, this rally was fuelled by a temporary change in risk appetite which saw US stocks rallied (S&P 500 +0.76%, DJI +0.47%) and also slightly more encouraging economic data from both Europe and US (stronger UK Construction PMI, ISM New York and better than expected US Factory Orders and IBD/TIPP Economic Optimism numbers). Also, yesterday’s less dovish Reserve Bank of Australia rate announcement fuelled speculation that RBNZ will raise rate in March.

However, all these mentioned above only managed to send prices up to a high of 0.8225. The reason price managed to climb another 35 pips higher (or 50 pips if we consider peak to trough) was due to latest New Zealand employment data that was much better than expected. Q4 unemployment stayed flat at 6.0%, but all other gauges of measurement were positive – The main metric Employment Change grew 1.1% Q/Q vs 0.6%, while the Y/Y figure grew 3.0% vs 2.4%. Participation rate is also higher at 68.9% vs 68.6% expected/previous. Even the peripheral metrics were all good: Average hourly earnings grew 0.3% vs 0.1% expected, Private Wages grew 0.6% vs 0.5% while Labor Cost is also up by 0.6% vs 0.5%. This is as bullish as employment report can get, suggesting that NZ economy is performing well and growth will be expected to continue.

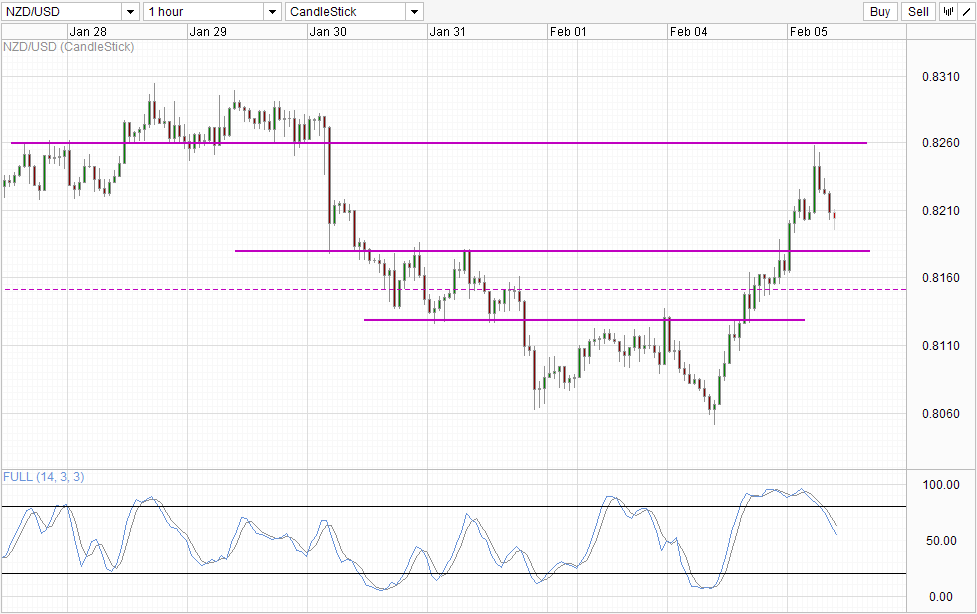

Hourly Chart

Unfortunately, it seems that bullishness in NZD/USD is only confined to the initial rally. Prices have come off rather significantly with 4 consecutive bearish candles – a stark difference from the run up to 0.826 from under 0.806. This is rather surprising as one would have thought that there was firm bullish footing for price to launch off higher, and the extremely bullish employment numbers should have been the perfect fuel for the already flying bullish rocket to enter in the stratosphere (read: above 0.826 breakout). The fact that prices actually managed to rebuff this is a huge warning sign to the sustainability of this bullish recovery, as there is a possibility that yesterday’s recovery in risk sentiment could simply be a technical pullback, or a dead cat bounce if you will. If this is true, then the underlying sentiment for NZD/USD right now should still remain bearish, and we could see prices heading towards 0.818 resistance turned support and potentially all the way towards 0.813 and back to 0.806 should broad risk sentiment reverts back to the previously bearish stance.

On the technical side, a new bearish cycle is in play now according to Stochastic. Looking at current Stoch level, it is possible that a move towards 0.815 in the short term is possible before Stoch readings turn back and give us a bullish cycle signal.

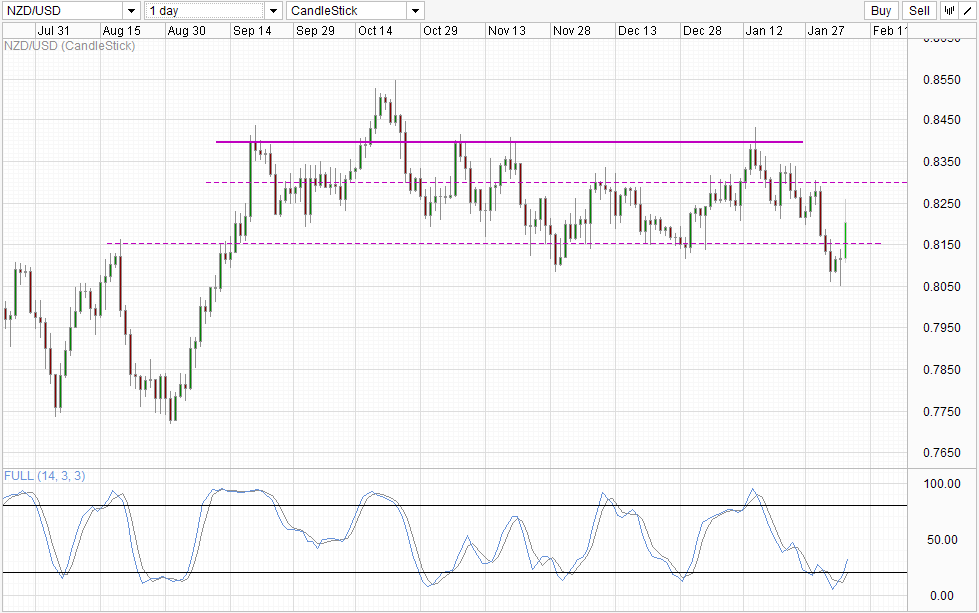

Daily Chart

Daily Chart shows price breaking back into the 0.815 – 0.84 consolidation, a move that we’ve mentioned yesterday will fit the rate hike narrative and also the Stoch bullish signal better. However, we will definitely need further confirmation that this move is legit and not a “fake” move as weakness is already seen in the Short-Term chart.

More Links:

GBP/USD – Bounces Off Support at 1.6250

AUD/USD – Breaks Through 0.88 to Three Week High above 0.89

EUR/USD – Consolidates around 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.