U.S. futures are pointing to a relatively flat open on Wednesday following a lacklustre start in Europe where indices are paring recent gains, weighed down by gloomy global growth forecasts.

While slowing global growth is not a new story for investors, the decision by the World Bank to cut its growth forecast from 2.9% to 2.4%, citing sluggish growth in advanced economies and weak global trade, among other things, has put a dampener on things. Perhaps if it wasn’t such a quiet start to the European session, this could have been brushed off but with not much happening so far today, what little there is, is negative.

We are seeing further gains in oil today, building on Tuesday’s advances which came as data from API showed that crude inventories fell last week by 3.56 million barrels, the third decline we’ve seen in four weeks. It would appear that the rebalancing of the oil markets is very much underway, the only questions now are how temporary these supply disruptions are and how high prices can go.

While I do think WTI could continue to grind higher for now, I do think it’s going to find significant resistance around $53.50-54. A move above this level would be quite bullish. It will be interesting to see if the EIA crude inventory figures confirm yesterday’s API release, which could be the catalyst for further gains in oil later on today.

Dollar And Yields Define Market Direction

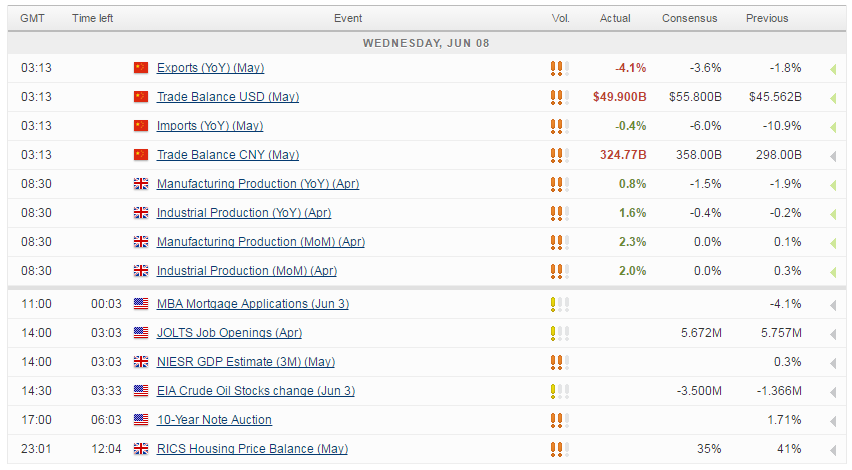

We’ll also get JOLTS jobs opening data from the U.S. for April, which is expected to decline for the first time in five months, potentially raising further questions about the strength of the labour market. I still believe the labour market is very strong, regardless of the recent jobs data but I imagine the Fed will want to see it bounce back quickly if it’s going to consider raising rates in July. It will also be interesting to see whether the NIESR U.K. GDP data for the three months to May indicates an ongoing slowdown in the economy in the lead up to the referendum.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.