Oil’s extended speculative long positioning feels the heat as crude runs out of momentum.

The unwind in long crude positioning continued overnight, with WTI falling 1.90 % and Brent 1.00% respectively. Separate Bloomberg and Reuters surveys pointing to higher than expected OPEC production in September was enough to see the rot set in. This, however, was more an excuse then the underlying reason, with extended speculative long positioning in both contracts the real culprit. The surveys gave nervous traders the excuse to run for the exit door with WTI faring the worse as it broke its September trendline support at 51.15 spurring more stop-loss selling.

As the dust settles, we could face a deeper correction in the near term as the street seems to have run out of reasons to keep buying crude at elevated levels. This means that we may need to see speculative long positioning further degraded before the street can turn back to oils increasing positive fundamentals. Most particularly the backwardation in the prompt Brent futures contracts.

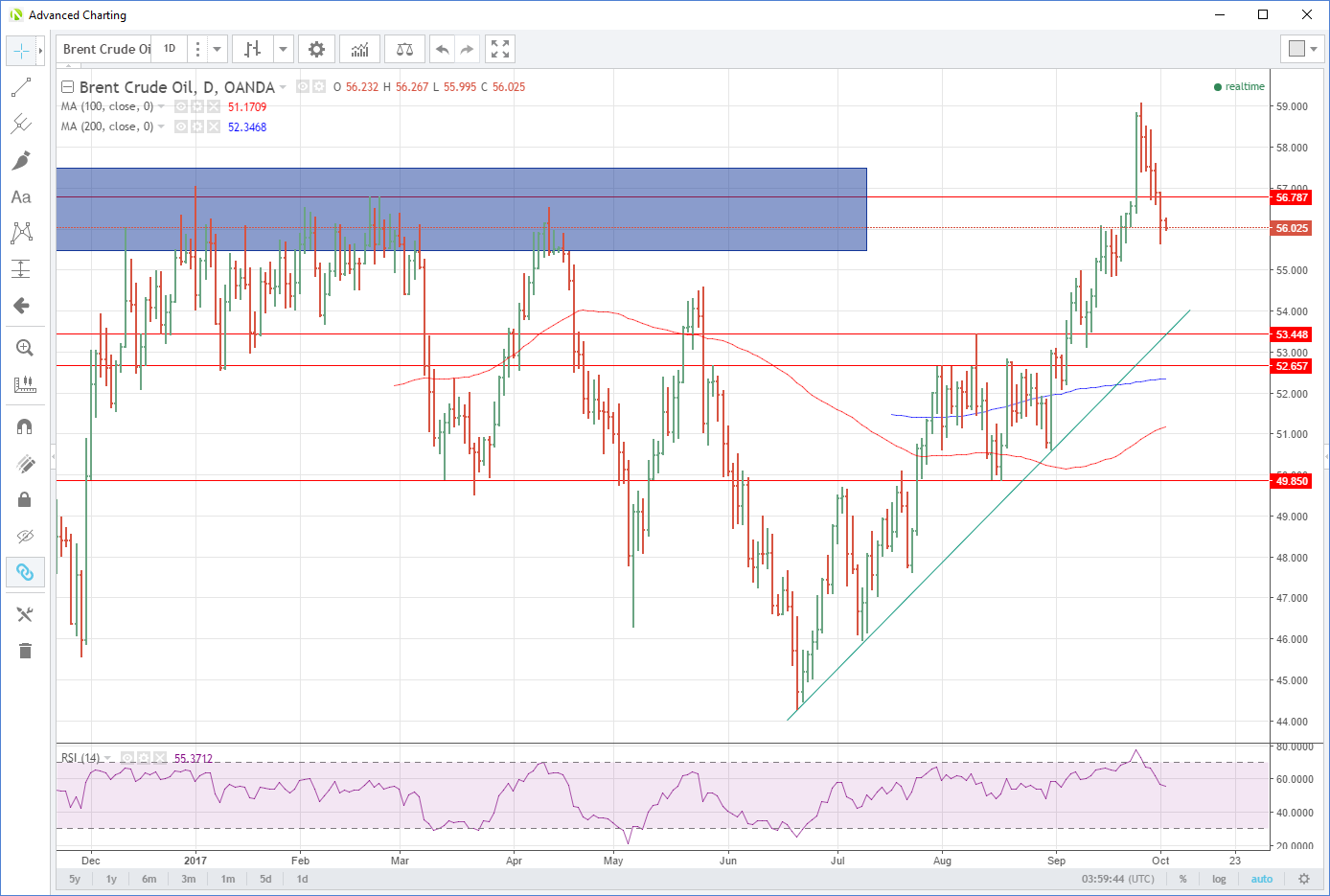

Brent

Brent spot dropped as low as 55.50 overnight on stop-loss selling before climbing to 56.10 this morning. We have now closed below the 56.50/57.50 long-term breakout region, which is a disappointing technical development. Support is now at 55.50 and then the triple bottom at 54.80 with a break opening a test back to the 56.00 area. Above, resistance is at 56.90 and then 57.60.

WTI

WTI spot fell from 51.30 to 49.80 at one stage as the herd cut longs positioning before rallying to 50.20 this morning. Key support lies at the multiple daily low and the 200-day moving average at 49.25 with a break opening up more downside pain to potentially below 48.00. Resistance is now distant at 51.40.

This week’s API and DOE Crude inventory data will now take on much more significance as other price drivers have run out of steam.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.