The short-term technical picture for crude oil’s rally gets even more cloudy following overnight inventory data.

Oil prices spiked higher initially overnight to test the week’s highs before an unexpected rise in the EIA Crude Inventories, pulled the rug from under oil’s feet. Both Brent and WTI gave back all of their gains to close unchanged at 63.70 and 56.70 respectively. With crude inventories rising 2.24 million barrel rise against an expected -1.56 million drawdown, traders will be pinning their hopes that the ongoing Saudi Arabia situation will continue to sustain this week’s rally.

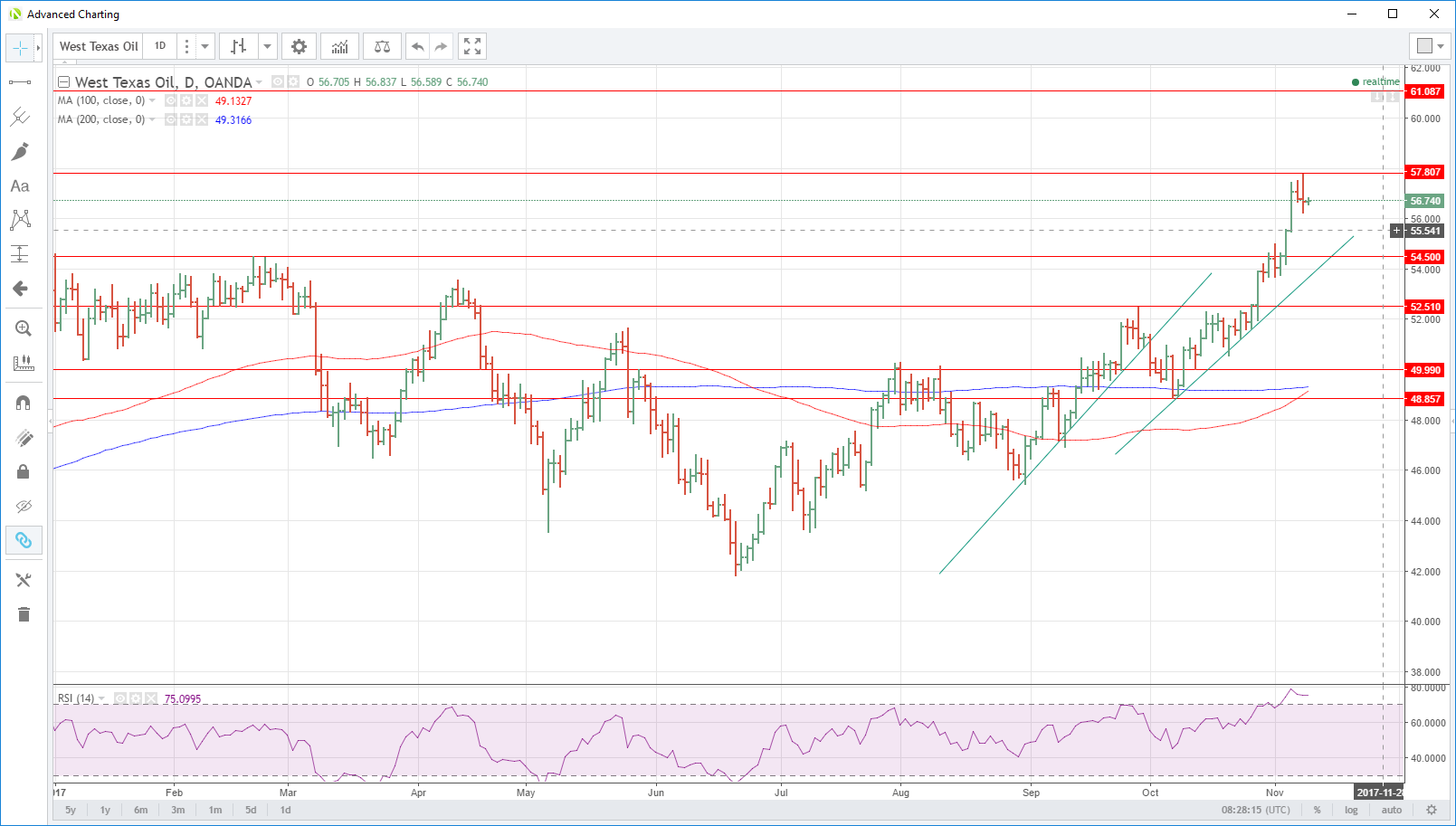

The charts are most definitely giving cause for concern as we enter the end of the week. Both contracts have now traced out technical topping formations and have been unable to push higher from Friday and Monday’s rallies. The Relative Strength Indices on both continue to remain at very overbought levels adding more concern that a possibly quite aggressive corrective pullback could be imminent.

Brent crude is unchanged at 63.65 this morning. It has traced out at the daily double top at 64.80, and along with Monday’s nearby high of 64.60, this is now a formidable area of resistance. Support appears initially at 63.00 and then 62.40 with a break implying Brent could drop back to the 60.00 area.

WTI spot is also unchanged, trading at 56.70 in early Asia. Its rally to 57.80 and then subsequent drop to 56.20 has traced a bearish outside reversal day formation. WTI has topped out this week in the 57.45/57.80 zone; the technical outlook is painting a very cautious picture in the short-term. Support is initially at 56.20 with a break opening a drop to 55.45. A break suggests a deeper correction to 53.70, multiple daily lows and also trendline support, could well occur.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.