Friday October 19: Five things the markets are talking about

Global concerns about rising yields, a deteriorating economic outlook and rising geopolitical tensions has capital markets closing out this volatile week on the back foot.

China’s slowing economic growth, Brexit and tensions between Rome and Brussels over the Italian budget are among the issues currently concerning investors. Also, throw into the mix – U.S/Saudi relations are worsening over the disappearance of journalist Jamal Khashoggi and investors are also waiting for November congressional elections in the U.S for guidance.

This Friday morning, Euro stocks are struggling as dealers weigh up corporate earnings against Chinese regulators whose rhetoric overnight promised to keep risks under control despite weaker economic headlines. This assurance saw China bourses rally from their four-year lows.

Elsewhere, Treasuries and the ‘big’ dollar are trading steady, while Italian debt comes under pressure as the E.U Commission responds to Italy draft budget plan with a stern rebuke – Italy plans are an “unprecedented” deviation from budget rules.

Oil prices have recovered a tad from their one-month lows after expanding U.S stockpiles surpassed tensions between the U.S and Saudi Arabia.

On Tap: Canadian CPI and retail sales are due at 08:30 am EDT.

1. Stocks mixed results

In Japan, the Nikkei ended the week in the ‘red,’ booking its third week of declines. The Nikkei share average at one stage dropped almost -2% intraday to hit a six-week low, however, by the closing bell, it was down -0.56%. The benchmark index has given up around -7.8%t since its 27-year peak print on Oct. 2.

Down-under, Aussie stocks edged lower overnight as China posted its weakest economic growth since the global financial crisis. The S&P/ASX 200 index eased -0.05%. The benchmark was up +0.7% for the week, snapping two straight weeks in the red. In S. Korea, the Kospi index recovered from early falls to close higher on the day. At the close, the index was up +0.37% after declining -1.4% earlier in the session. For the week, it slipped -0.3%, in its third consecutive weekly fall.

In China, regulators rushed to rally market confidence overnight as regional bourses traded atop of their four-year low on weaker economic data. China’s Q3 GDP y/y: +6.5% vs. +6.6%e (slowest growth since Q1 2009) and Sept. Industrial Production y/y: +5.8% vs. +6.0%e (slowest growth since 2016). Strong rhetoric managed to push the Shanghai index to close out +2.6% higher. Even with that, the index is still down -10% this month and nearly -25% on the year. In Hong Kong, the Hang Seng index also had a volatile session, closing out the week +0.42% higher.

In Europe, regional bourses are trading mixed. Italy remains the primary focus after the E.U Commission sent a letter to Finance Minister Tria regarding budget violations.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 -0.4% at 11533, FTSE -0.1% at 7019, DAX -0.5% at 11531, CAC-40 -0.8% at 5077, IBEX-35 -0.7% at 8833, FTSE MIB -1.3% at 18846, SMI +0.2% at 8798, S&P 500 Futures +0.1%

2. Oil higher, but set for weekly loss on stock builds, gold up

Oil prices are a tad firmer ahead of the U.S open on signs of surging demand in China, although the market is heading for a second consecutive week of losses on concern that trade wars were curbing economic activity and rising U.S inventories.

Brent crude oil is up +20c a barrel at +$79.49, while U.S light crude is up +15c at +$68.80.

Note: For the week, Brent is down -1% while WTI is down -3.5%, with both on track for a second consecutive weekly decline.

China is the world’s largest importer of crude and refinery data for September showed it rose to a record high of +12.49m bpd as some independent plants restarted operations after prolonged summer shutdowns.

However, undermining sentiment is weaker China growth data and a surge in last weeks U.S inventory data. According to the EIA, U.S crude stocks last week climbed +6.5m barrels, marking a fourth consecutive weekly build and almost triple market expectations.

Ahead of the U.S open, gold prices are holding steady as renewed political and economic concerns weigh on investor sentiment. The yellow metal is on track for a third consecutive weekly gain. Spot gold is up +0.1% at +$1,226.44 per ounce. The metal is up +0.7% for the week. U.S gold futures are up +0.1% at +$1,230.9 an ounce.

3. Italian bonds sold as E.U warns on Italy budget

Investors are selling Italian Euro periphery bonds, with Italy’s BTP yield hitting four-year highs as the E.U called its draft budget an “unprecedented” breach of E.U fiscal rules.

Italy’s benchmark 10-year bond yield has rallied to +3.74%, the highest since February 2014 and the spread of Italy’s 10-year BTP’s over Germany’s advanced +9 bps to the biggest premium in more than five-years.

Up to this point, E.U periphery debt, Spain and Portugal in particular, had gone somewhat unscathed, however this morning; periphery debt has also backed up +5 to +6 bps on possible signs of contagion.

Elsewhere, the yield on 10-year Treasuries decreased -1 bps to +3.18%. In Germany, the 10-year Bund yield declined -1 bps to +0.40%, the lowest in more than five weeks. In the U.K, the 10-year Gilt yield has dipped -1 bps to +1.533%, reaching the lowest in more than two-weeks on its seventh consecutive decline.

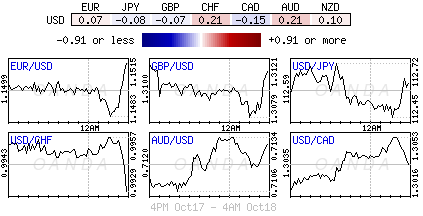

4. Italian worries push Euro to two-month lows

Concerns about Italy and a widening of the spread between Italian and German bond yields are keeping the EUR below the psychological €1.15 handle. The EUR is down -0.10% at €1.1445. The gap between BTP/Bund widened to a multi-year high after the E.C said Italy’s budget deviation was “unprecedented” and warned of “particularly serious non-compliance.”

Note: Next week, the Italian budget situation is key on the upcoming rating agency actions with S&P and Moody’s likely to act with possible downgrades on Italy.

Sterling trades slightly higher, up +0.1% at £1.3039 outright. Hard and soft Brexiteers’, moderates, the DUP and the SNP have all voiced opposition to the idea of an extension to the Brexit transition and this could bring up again speculation that PM May’s days are numbered.

PBoC continues to fix yuan weaker after escaping U.S treasury currency manipulator designation. USD/CNY was fixed at ¥6.9387 overnight, +112 pips from last fixing.

5. Eurozone’s current account surplus widens in August

Data this morning showed that the eurozone’s current-account surplus widened in August compared with July, supported by a rising surplus in goods.

The region’s current-account balance recorded a surplus of +€24B in August after July’s surplus of +€19B.

Despite the pickup, the balance was smaller than the +€39B surplus recorded in August last year, but the eurozone’s surplus remained elevated on a 12-month accumulated basis.

Numbers like this; you can bet further criticism from President Trump who has repeatedly scolded Germany for its bulging trade surplus, is coming.

In the 12-months through August this year, the eurozone recorded a current-account surplus of +€379B, or +3.3% of its GDP.

Note: By comparison, the U.S.’s current-account balance records a deficit.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.