Just when you thought it was safe to get back into the water, a political standoff in Washington and a political fiasco in Europe’s third largest economy have new “event risk” driving capital markets. Global political risk has eroded positive investor sentiment, last seen after the Fed’s “no” taper move a couple of weeks ago.

Over the weekend, the House of Representatives approved a Republican measure to delay implementation of Obamacare by one-year. With this piece of legislation not expected to get through a White House vote assures political stalemate with the US Senate. Under this scenario it will bring the US government to the edge of its first governmental shutdown in 17-years. Both US equities and the mighty dollar have naturally come under pressure as we begin a new week and finish another month.

Italy is not new to political crises – in fact Italian political life seems to thrive on them. Italy’s bad boy of politics is back at it again. Berlusconi’s PDL party ministers resigned from the coalition government in protest of continued tax reform this past weekend. The Italian Prime Minister Letta is expected to seek a confidence vote in Parliament on Wednesday, in hopes that some of the PDL lawmakers break from party ranks and support the coalition, and avert an immediate calamity.

Investors it seems are mostly concerned that Italy will be forced into new elections just seven-months after the last inconclusive vote. Letta will try to work out a new coalition government and if that doesn’t happen then it’s back to the polls and heightened market volatility.

It’s no surprise to see Italian bond yields back up and European equities trade under pressure as global political tension are beginning to cause further distress amongst investors who are already fearful of a US federal government shutdown. This morning, the Italian 10-year benchmark government bond yields rose +30bp to +4.73% (biggest one-day gain in four-months). However, despite the aggressive yield rally, fixed income dealers continue to go out of their way to assure the market that it’s still far from the level that causes any “funding problems” for the country itself.

Aside from the ongoing political sideshows, this first week of October will bring a plethora of updated economic releases along with central bank meetings and monetary policy decisions. The manufacturing and services PMIs will be studied by the market for signs of economic improvement in Europe et al. The RBA from down-under (their rate decision may see the bank reintroduce an easing bias to knock down AUD), Kuroda’s BoJ and Draghi’s ECB will get to release their latest monetary policy decisions starting tomorrow. Obviously all-important, but surely to be trumped by the US budget situation and what economic releases are sure “not” be released should the government even partially shut down.

With Fed taper plans remaining front and center, both the Fed and capital markets will be focusing on this weeks labor numbers – the granddaddy of economic events, Friday’s non-farm payrolls. Assuming no US government shutdown then a report will be delivered, otherwise depending on the depth of the US government shut down economic release in the US could become patchy.

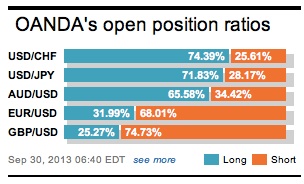

So far, the dollar is trading mixed against its G10 compatriot currencies, but stronger against EM Asia. In fixed income there have been rallies in US and Australian rates – a tad surprising is to see JGB yields back up ever so slightly across their own curve. The natural go to safe haven currencies remain in demand, with JPY outpacing both the EUR and USD, similar with the CHF and GBP. However, market flows have not been overtly aggressive into safer currencies. The EUR is hanging in, despite the Italian fallout; nevertheless, investors remain cautious and not yet wholly convinced by one scenario or another.

Aiding the yen’s drive higher was Japans industrial production (-0.7%) and retail sales (+1.1%) disappointing overnight ahead of the crucial PM Abe decision on consumption tax increase later this week. Investors will get a better understanding on how Japan is performing with the quarterly Tankan data release from the BoJ tomorrow. Uncertainty about the outcome of a “no-confidence” vote in Rome on Wednesday will surely keep the EUR trading under pressure and along with periphery bond market.

Other Links:

To Taper – The Hill and NFP to Decide

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.