Thursday November 15: Five things the markets are talking about

Earlier this morning U.K Brexit Minister Dominic Raab resigned, a day after PM May’s Cabinet agreed the wording of a post-Brexit trade deal between the U.K and the E.U.

Raab said he could not support, in good conscience, his former leaders deal. Sterling was immediately hit for six, falling -1.55% to £1.2785. The market was expecting some resignations, but not such a high profile individual to kick things off.

PM May can now expect more resignations, which would lead to a vote of no confidence and throws the future course of Brexit into uncertainty.

Future scenarios range from a calm divorce to rejection of May’s deal, potentially ending her leadership and leaving the bloc with no agreement, or another referendum.

Elsewhere, Japanese equities edged lower, while Hong Kong shares jumped on corporate earnings, while Chinese equities outperformed on the announcement of potential concessions to the Trump administration.

U.S equity futures start better bid after Fed Chair Powell painted an upbeat picture of the world’s biggest economy last night.

1. Stocks mixed results

Global stocks have mostly ‘stabilized’ after a recent selloff, even as ongoing Brexit developments drove sharp swings in the European markets.

In Japan, the Nikkei fell on Thursday, with banking stocks sliding after disappointing earnings forecasts and losses in U.S financial shares Wednesday. The Nikkei share average ended -0.2% lower, while the broader Topix was down -0.1%.

Ex-Japan, stocks were broadly higher on reports that China made an opening bid to the U.S on trade, as well as upbeat results in the technology sector. Shares of Tencent Holdings rallied +5.8% after reporting a better-than-expected +30% rise in profits. Hong Kong’s Hang Seng rallied +1.75%, the Shanghai Composite Index rose +1.4% and South Korea’s Kospi climbed +1%.

Down-under, a late-afternoon rebound in Aussie stocks pushed the benchmark back into positive territory at the day’s end. The ASX S&P 200-rallied +0.06%, supported mostly by an overnight uptick in crude oil prices.

In Europe, regional bourses trade mixed, with the FTSE outperforming on the back of a steep drop in the pound (£1.2790, -1.7%) after initial strength following yesterday’s cabinet agreement on the wording of a post-Brexit deal.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 -0.65% at 359.90, FTSE -0.09% at 7,027.45, DAX -0.20% at 11,390.06, CAC-40 -0.52% at 5,042.74, IBEX-35 -0.54% at 9,057.35, FTSE MIB -0.66% at 18,952.50, SMI -0.32% at 8,907.50, S&P 500 Futures +0.01%

2. Oil prices stabilize, but supply glut concerns weigh on sentiment, gold steady

Oil prices are trading somewhat stabile, reversing overnight declines, but investors remain cautious over concerns that a supply glut may emerge.

Brent crude oil is trading at +$66.17 per barrel, up +5c from Wednesday’s close, while U.S West Texas Intermediate (WTI) crude futures are at +$56.29 a barrel, up +4c from yesterday’s close.

Note: Brent soared to a four-year high of +$86.74 in early October as the market waited for U.S sanctions on Iran, but prices have plummeted -25% in the last four-weeks.

OPEC warned earlier this week that a supply glut could emerge in 2019 as the world economy slows and rivals increase production more quickly than expected.

Led by top exporter Saudi Arabia, OPEC has been making more public statements of late that they would start withholding crude next year to tighten supply and prop up prices.

In its monthly report Wednesday, IEA left its forecast for global demand growth for 2018 and 2019 unchanged from last month at +1.3M and +1.4M bpd, respectively, but cut its forecast for non-OECD demand growth. For H1 2019, based on its outlook for non-OPEC production and global demand, and assuming flat OPEC production, the IEA said the “implied stock build is +2M bpd.”

Note: Both OPEC and Russia are under pressure to reduce current production levels; this decision could be taken at the next OPEC meeting on Dec. 6.

Ahead of the U.S open, gold prices trade somewhat steady, after rising nearly +1% Wednesday, as the ‘big’ dollar eases away from its 16-month peak print earlier in the week. Spot gold is little changed at +$1,211.12 per ounce, while U.S gold futures have inched up +0.1% at +$1,211.7 per ounce.

3. Brexit worries support demand for Bunds

German Bund yields have tumbled to a new two-week low ahead of the open stateside after U.K Brexit Secretary Dominic Raab resigned, pushing PM May’s government into turmoil.

The German 10-year Bund yield is down -4.5 bps at +0.36%, its lowest in over two -weeks.

Borrowing costs in Spain, Italy and Portugal are backing up as the market stays away from riskier assets after this morning’s developments in the U.K.

Note: Euro leaders are expected to meet on Nov. 25 to endorse Britain’s divorce deal, but will there be one to ratify?

Yields on U.K 10-year Gilts fell -13 bps to +1.39% from +1.52%, while the yield on U.S 10-year Treasuries fell -2 bps to +3.10%, hitting the lowest in more than two-weeks with its fifth straight decline.

Elsewhere, the spread of Italy’s 10-year BTP’s over Germany’s Bunds increased +4 bps to +3.1352% to the biggest premium in more than three-weeks.

4. Investors short the pound on Brexit uncertainty

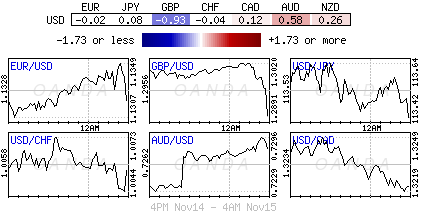

Uncertainty over whether PM May will be able to deliver a Brexit deal after two cabinet members resigned this morning and talks of increased support for a no-confidence vote has encouraged the market to sell the pound. GBP/USD has fallen -1.55% to £1.2785, while EUR/GBP has rallied +1.40% to €0.8828.

In case there is a no-deal Brexit, the pound is expected to plunge dramatically, so much so, that the pound ‘bears’ are speculating that that it could take EUR/GBP to €1.00 – €1.10 region. It would mean that the U.K would end up with a trade relationship with the E.U based on WTO regulations.

Elsewhere, the EUR has climbed +0.1% to €1.1317, while the Japanese yen has increased +0.1% to ¥113.41, the strongest in more than a week.

5. U.K retail sales fall in October

Data from the ONS this morning showed that U.K retail sales declined in October for the second-consecutive month. This would suggest that the U.K consumer is “tightening their belts.”

Retail sales fell -0.5% in October m/m and digging deeper, the headline print reflects sliding sales of clothing and household goods.

Comparing the three-months through October to the three-months through September, retail sales growth slowed to +0.4% from +1.2%, the fourth-straight slowdown over a three-month period.

Prior to today’s surprised Brexit resignations, both the BoE and IMF had expected the U.K economy to grow modestly next year as it begins restructuring its economic ties with the E.U after its withdrawal from the bloc in March.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.