Investors Buoyed as Earnings Season Gets Underway

New record highs look on the agenda for US equity markets when they reopen on Tuesday, with futures indicating gains of between 0.5% and 1% from Friday’s close.

It’s been a relatively quiet start to the new year and yet markets have continued to push on higher, with investors clearly very optimistic ahead of the fourth quarter earnings season. Not only is the US coming off a strong quarter previously but the new tax reform measures are continuing to provide a boost, with investors keen to hear more about what impact this will have on future earnings. Only six companies are scheduled to report on Tuesday but this will pick up significantly over the coming weeks.

CAC Hits 10-Week High, Eurozone CPI Next

USD Pares Losses But Remains Under Considerable Pressure

One thing that’s not benefiting in any way from tax reform is the dollar, despite the apparent positive impact that it will have on the economy in the coming years. The dollar has been in freefall in recent days, hitting levels not seen since the start of 2015 as traders question whether the Federal Reserve will continue to hike interest rates at the current pace while raising tightening expectations for those elsewhere, in particular the ECB.

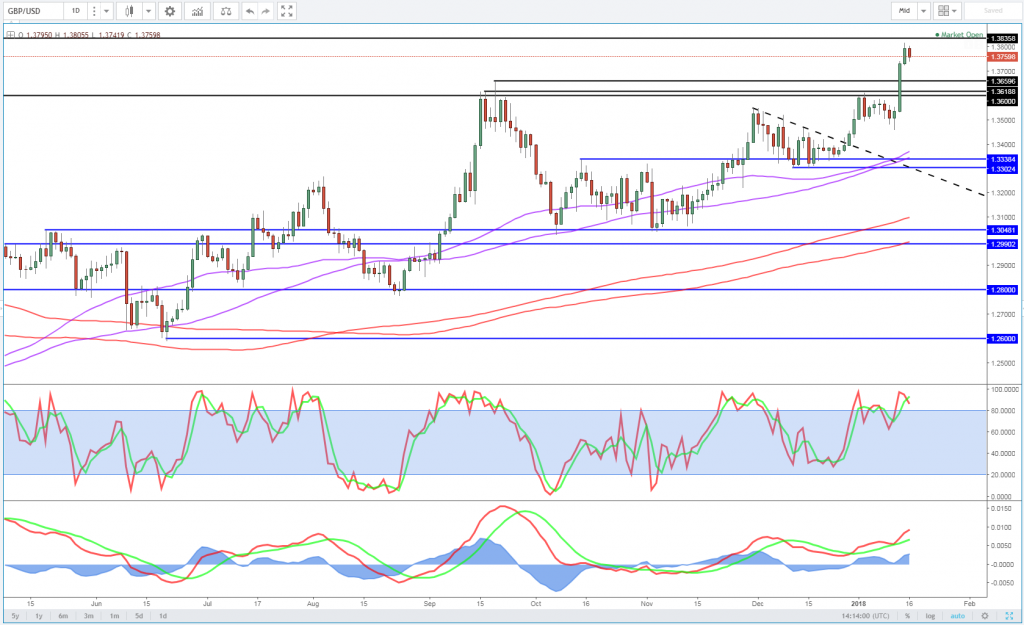

Source – Thomson Reuters Eikon

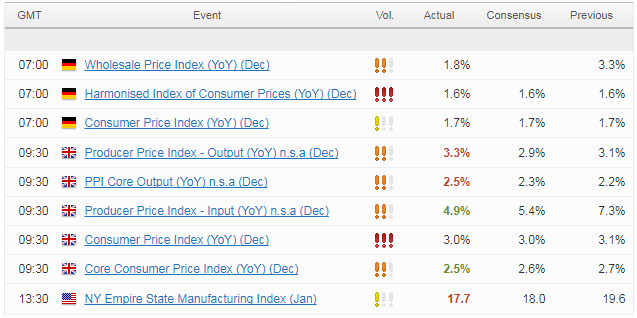

The dollar has pared its gains so far today, with EURUSD and GBPUSD coming off three year and 18-month highs, respectively. The drop off in the latter was helped by this morning’s inflation data from the UK, the core reading of which eased slightly more than expected. That will alleviate some pressure on the Bank of England to raise interest rates again this year although, of course, this is just one reading and more evidence of this will be needed in the months ahead or some policy makers may become uncomfortable again.

OANDA fxTrade Advanced Charting Platform

Cryptocurrencies Tumble as Bitcoin Hits Daily Low on CME

Bitcoin has been getting pummelled on Tuesday, falling to its lowest level since 22 December with the CME January contract hitting daily low limit before rebounding. Bitcoin was trading around 20% lower at one stage but has since recovered a little to trade around 14% down at the time of writing. The trigger for the move isn’t clear but there hasn’t been a shortage of negative headlines for cryptocurrencies recently, be it regulators clamping down on speculation or high profile names warning of bad outcomes.

Cryptocurrency enthusiasts were willing to shrug off these warnings as scaremongering prior to the launch of futures contracts on CME and CBOE, when prices were making huge gains on an almost daily basis. Since then Bitcoin has really struggled and while it showed significant resilience around $13,000 over the last few weeks, it finally gave way this morning which likely exacerbated the move lower as speculators quickly headed for the exit.

While Bitcoin selling hasn’t always come during a broader sell-off in the cryptocurrency space, with Ethereum for example having made large gains between the start of the year and yesterday, today’s sell-off is being felt throughout. Of the top 100 cryptocurrencies by market capitalisation, none are trading in positive territory over the past 24 hours, according to coinmarketcap.com which may be a worrying sign for what some have labelled a new asset class.

Dovish BoC Remains a Risk Ahead of Rate Decision

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.