We’re seeing a little risk aversion in the markets ahead of the open on Monday, with traders unsettled by the latest probe into Hillary Clinton’s emails while acting cautiously ahead of a big week for the markets.

The US dollar may be experiencing a minor recovery this morning but the sell-off late on Friday clearly highlights how unsettled traders have become just over a week before they head to the polls. What was looking to be a relatively comfortable win for Hillary Clinton, a market friendly outcome at least in the near term, has now just opened right up again.

Trade the Move or Fade the Move

At this stage there is no proof that Clinton is guilty of any wrongdoing and yet that is almost irrelevant as the seed of doubt has once again been planted. The timing of the disclosure could be very damaging for Clinton’s campaign and markets hate the uncertainty that this brings. The US dollar took a substantial hit, reflecting less confidence now in a December Fed rate hike, while equity markets ended the week on a sour note and the Mexican Peso – a key barometer of Trump risk ahead of the election – hit a three week low against the US dollar.

OANDA fxTrade Advanced Charting Platform

Oil prices have continued to edge lower this morning which could also be weighing on European equity markets ahead of the open. Increasingly we’re see the cracks appearing in the OPEC output deal which has unnerved traders that had pushed oil to 2016 highs on the expectation that the i’s would soon be dotted and the t’s crossed.

Week Ahead USD Loses Momentum Ahead of Employment Data Week

We’re also seeing general caution in the markets ahead of what will be an extremely eventful week. Four central bank monetary policy decisions, including the Fed, BoJ, BoE and RBA, the US jobs report and earnings season will keep traders on their toes this week, all of this while the final days of the US Presidential campaign ticks along in the background. That is in no way a short list of risk events for the coming week.

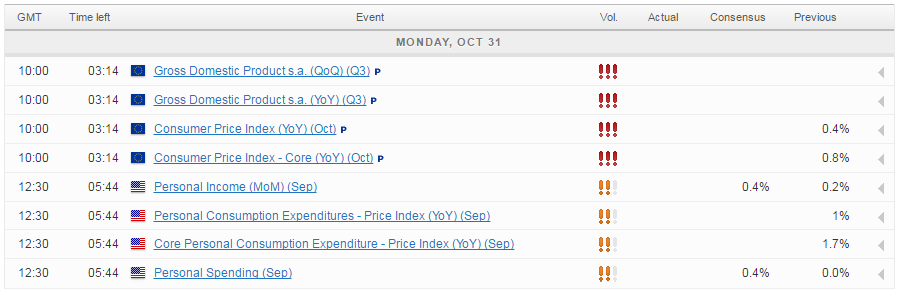

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.