As the week draws to a close, risk appetite appears to be drying up, not helped of course by recent moves in oil which is dragging on global benchmarks.

Oil Bounces But Losses Weigh on Indices

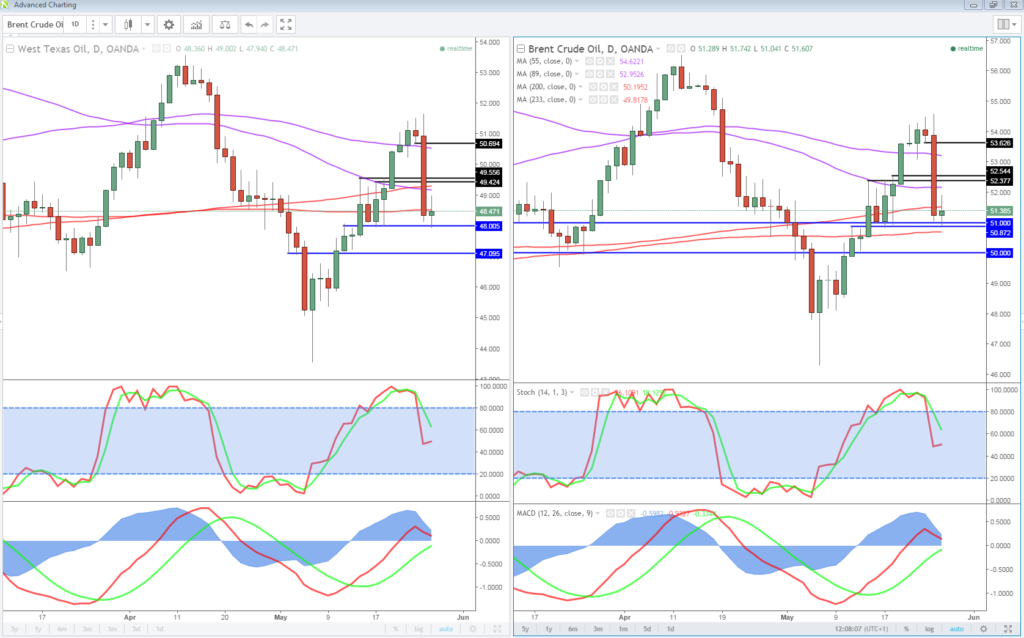

Oil has been one of the standout performers throughout May as traders banked on an extension to the deal between a number of OPEC and non-OPEC producers that came into effect earlier this year. The deal – which will see the 1.8 million barrel a day cut extended from the middle of this year to the first quarter of 2018 – was agreed between participating producers on Thursday, prompted a sudden and sharp sell-off in oil.

OANDA fxTrade Advanced Charting Platform

The reason for the sell-off was simple. There had been so much reported on the agreement in the weeks leading up to the meeting that it had been fully priced in. Once speculation became reality, there was no more gains to be had, not in the near-term anyway. Should we see full compliance and evidence that inventories are falling back towards their five year average, as intended, the prices may well creep higher once again. The result for now though has been a correction in oil prices which is weighing on energy stocks and therefore indices, particularly those with heavy exposure.

Oil Stops the Bleed, Sterling Pounded by Polls

FTSE Makes Small Gains as GBP Weakness Offsets Oil Moves

The FTSE 100, which ordinarily would be feeling the pain of this, is actually trading a little higher this morning. A second day of selling in the pound – this time driven by the latest poll numbers which show the gap between the Conservatives and Labour has shrunk to only five points from around 20 a couple of weeks ago – is more than compensating for the weakness in energy stocks and therefore helping to support the index.

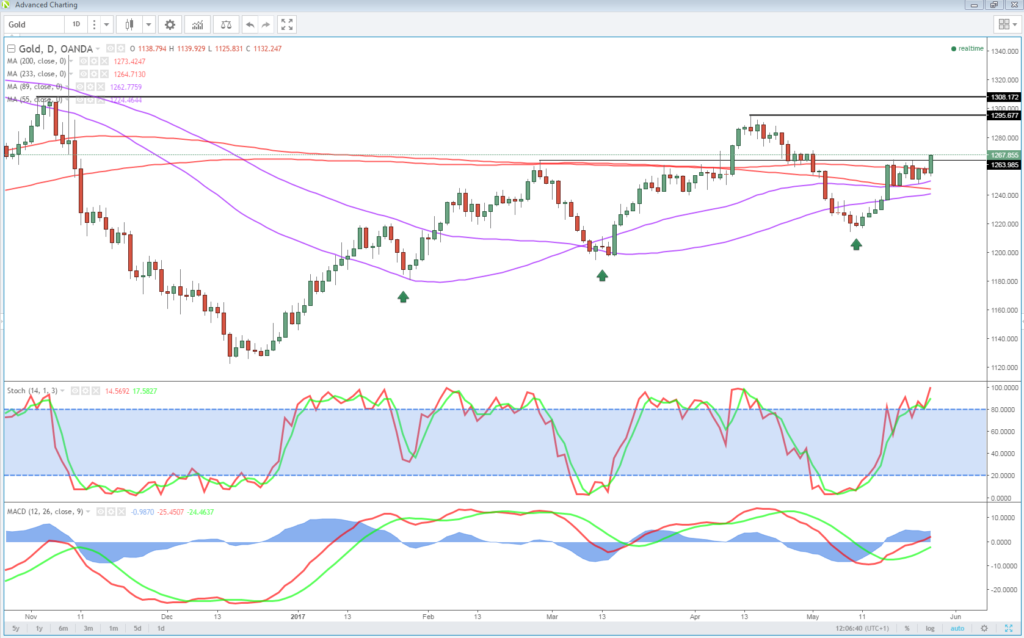

Could Gold Be Headed Towards $1,300?

Gold is benefiting from the more risk averse sentiment in the markets today, as well as the weakness in the US dollar which is off by around one fifth of one percent. Gold is currently trying to push its way through $1,265 which has been a tricky level for the yellow metal over the last few months. A move above here could see it test its 2017 highs just shy of $1,300.

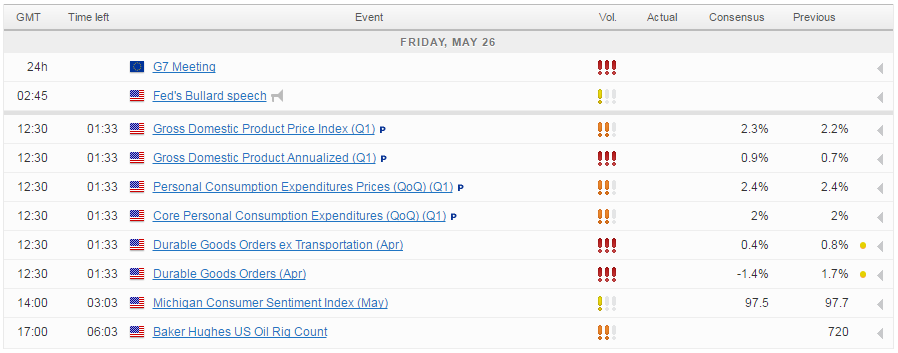

It’s been a relatively quiet morning on the newsflow and data side, with no numbers from Europe leaving traders looking to the US releases as we close out the week. A first revision of Q1 GDP will certainly be of interest as the Fed considers its second rate hike of the year at its next meeting in June. Policy makers have shown a clear desire to see evidence that the first quarter weakness was only transitory and an upward revision here may provide them with more comfort. Of course, the opposite is also true. We’ll also get durable goods orders and consumer surveys from UoM this afternoon, while the leaders of the G7 are also due to meet in Italy.

EUR/USD – Euro Listless Ahead of US GDP

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.