US stocks climbed up higher, clawing back a large portion of the losses suffered on Monday. Dow Jones Index was the most bullish of them all, gaining 0.56% and perhaps more importantly put itself back in the black on a Week/Week basis. On the other hand, gains in S&P 500 and Nasdaq 100 were slightly modest, even though recent trends suggest that gains in S&P 500 and risk sensitive Nasdaq 100 should have outperformed that of DJI. Hence, even though things have recovered slightly for now, it is far from being truly bullish and the stronger performance in DJI may simply be explained by the fact that the index has a much smaller number of stocks and prone to larger volatility movements.

Fundamentals remained weak as well. Headlines today are all raving about the much stronger than expected Consumer Confidence, saying that this was the reason why stocks were bullish. However, the inconvenient truth that New Home Sales have fallen, while the Home Price Index compiled by S&P/Case Shiller is also lower has been brushed aside. On the manufacturing front things are not look great either with Richmond Fed Manufacturing Index falling to -7 when market was expecting the index to come in at 4 after a disappointing -6 print last month. Hence, on the balance of things, it is hard to assert that fundamentals are actually strong and in fact we should posit that stock prices climbed higher “in spite of” rather than “because of” the latest economic data.

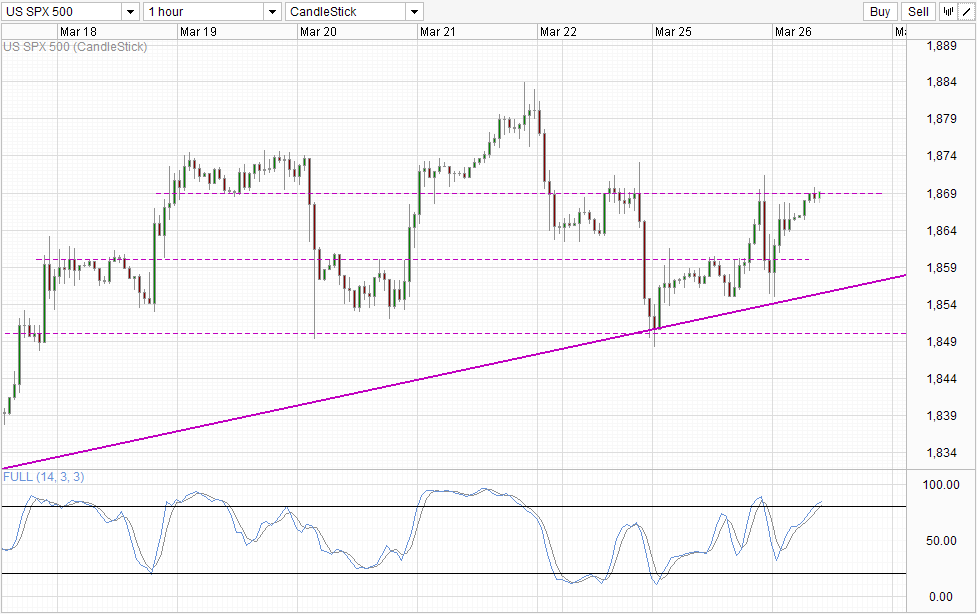

Hourly Chart

Looking at price action, it is clear the assertion that prices are bullish because of the stronger consumer confidence is patently false. S&P 500 prices actually traded lower in the few hours when the US stock exchanges opened – in line with the timing when all the various economic numbers (including Consumer Confidence) were released. Prices actually started pushing higher during early European session, and fortunately for the bullish European/late Asian traders, the more bearish US traders (an observation made from analysis of Monday’s price action) failed to do any significant amount of damage – allowing prices to rebound off the rising trendline and perhaps more importantly the 1,860 resistance turned support which opened the door for prices to rebound back.

Currently, price is facing the 1,869 – 1,870 resistance and the fact that yesterday’s rally wasn’t fundamentally based reduce the likelihood for bulls to break the aforementioned resistance. Furthermore, even though Asian traders and European traders are supposedly more bullish, they already had their plate full reversing the losses yesterday and it is highly unlikely that there will be enough juice to break the resistance based on sentiment alone. From a technical perspective, Stochastic indicators adds more strength to the resistance level as readings are already within the Overbought region, favoring a bearish cycle moving forward, compounding bulls misery.

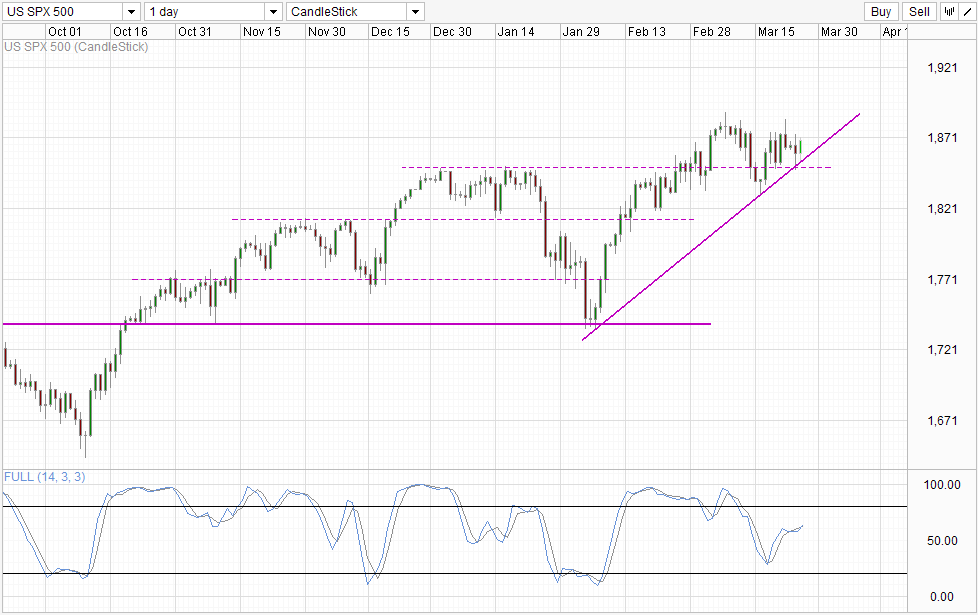

Daily Chart

Daily Chart remains bullish though. Prices appears to have rebounded off the rising trendline and this opens the door for prices to aim for 1,890 and even higher objectives. Stochastic indicator agrees as well as Stoch curve is now pointing higher and appears set to cross the Signal line. Hence, it is not difficult to understand why there are still staunch bullish supporters around. However, without significant improvement in economic fundamentals, it is hard to justify long-term increases and traders will need to get ready for sharp sell-offs if current bullish sentiment disappears.

More Links:

USD/CAD – Slight Losses As US Posts Mixed Numbers

AUD/USD – Steady As US Posts Mixed Data

USD/JPY – Little Movement Ahead of Key US Data

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.