U.S. futures are pointing to a slightly higher open on Friday as investor focus turns temporarily away from Brexit and the Italian banking system to the June U.S. jobs report and what it means for interest rates.

The surprise decision by the U.K. to leave the E.U. and the resurfacing of Italian banking concerns has somewhat overshadowed the obsession with U.S. interest rates over the last couple of weeks. Of course, this is partly due to the fact that Brexit has made a rate hike in the near term extremely unlikely, with policy makers at the Federal Reserve wanting to see what the impact of this will be, both domestically and on financial markets. This was alluded to specifically in the minutes that were released on Wednesday.

While U.S. interest rates are likely to continue to play second fiddle to European developments over the next couple of months, people will still be playing close attention to how the economy is performing and the tone coming from the central bank. While markets seem convinced that another rate hike this year is off the table, I don’t think it’s quite as unlikely as some would suggest.

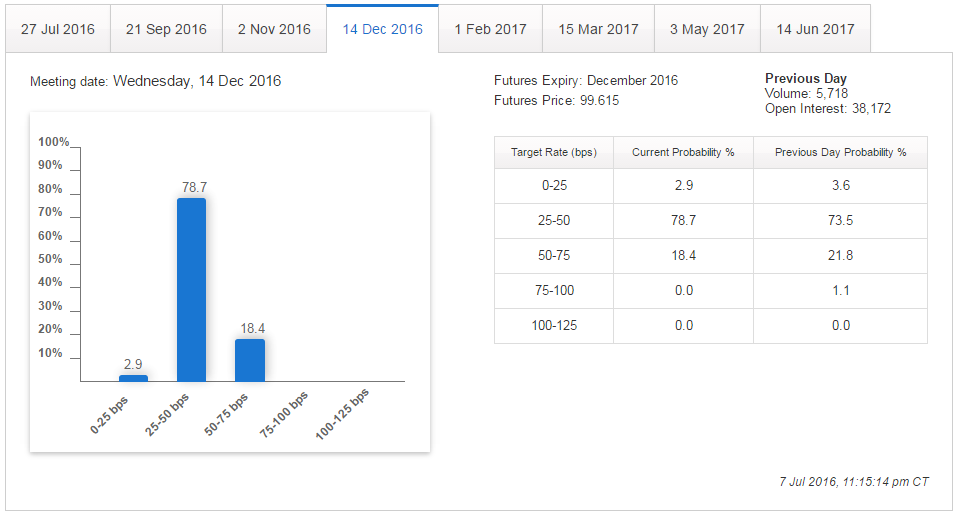

Source – CME Group FedWatch Tool

It does seem unlikely at this stage as the Fed will want to monitor both the near term implications of the vote and the impact once article 50 is triggered, which is effectively the point of no return for the U.K., and may not come before the end of the year. That said, if they judge in the coming months that the knock on effects of Brexit is having minimal impact on the U.S. economy, they could push ahead with another hike in December.

For this to happen, we’ll need to see convincing evidence that the economy is, and will continue to perform well, the labour market remains strong and inflation is ticking up to its 2% target. This means no repeat of May’s disastrous jobs report, which conveniently afforded the Fed an excuse to hold off on raising rates last month despite the coordinated hawkish message that policy makers had communicated to the markets in the weeks leading up to it.

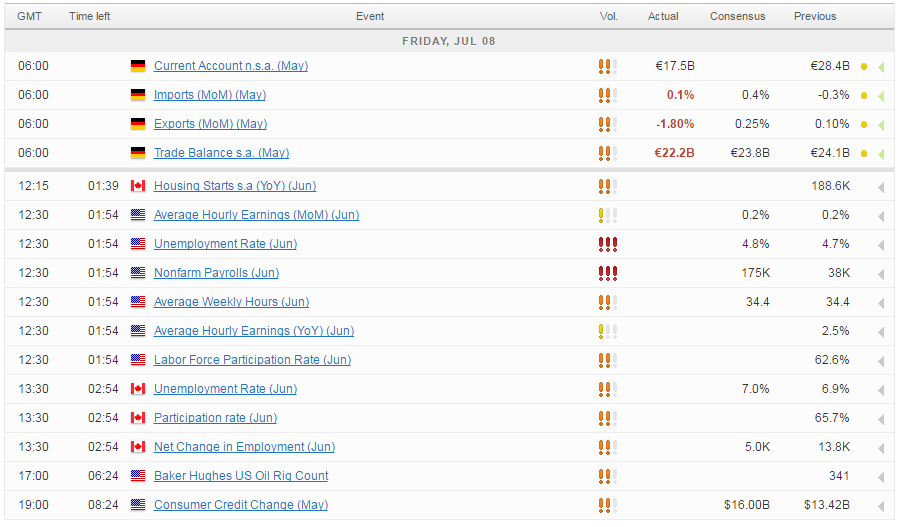

Given the low level of unemployment in the U.S. at the moment, it will be tough for job creation to continue in line with the kinds of numbers we were seeing last year. That said, the numbers we’ve seen over the last couple of months are simply not good enough and a continuation of this will stoke concerns that the economy is running into a rough patch. We’re expected 175,000 jobs to have been created last month, with unemployment ticking up to 4.8% and wage growth remaining at 0.2%. It will also be important to pay attention to revisions to recent data.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.