Whilst all the attention was on GBP/USD this morning the picture looks just as Ichimoku cloudy on the GBP Crosses.

Regular readers will know that I am always suspicious of large currency moves in the twilight market opening hours of Monday morning. Typically this time of the day comprises of very few participants, zero liquidity and a reactionary move in response to a weekend news event. Such moves typically get completely unwound by the time early London gets up and running.

The Times article is already widely out there. And traders did seize on it as if it was some earth-shaking new piece of news regards the UK Governments Brexit position. It should be no surprise to anyone that the Government’s stance will be a “hard” one. This is what the people of the UK voted for them to do in the referendum. Mrs May is merely following orders so to speak!

There are always exceptions and it appears that today may be one of them. The bounce in GBP made it to around 1.2040 but early Europe is voting with its feet and GBP is trading again just under 1.2000 as I write. What we are seeing I feel, is another bout of “reality bites’ aka the US dollar last week. The USD spent most of the week under pressure as the world finally realised that the Presidential Inauguration is this Friday and took a lot of long USD positioning of the table. With PM May’s speech tomorrow evening likely to set out in more concrete terms the government’s position re Brexit (finally), GBP is being taken off the table as Brexit starts to get real.

Though all the news is about GBP/USD today, GBP/XXX are also looking very ugly from a technical perspective as well. With daily Ichi moko cloud formations looking stormy indeed.

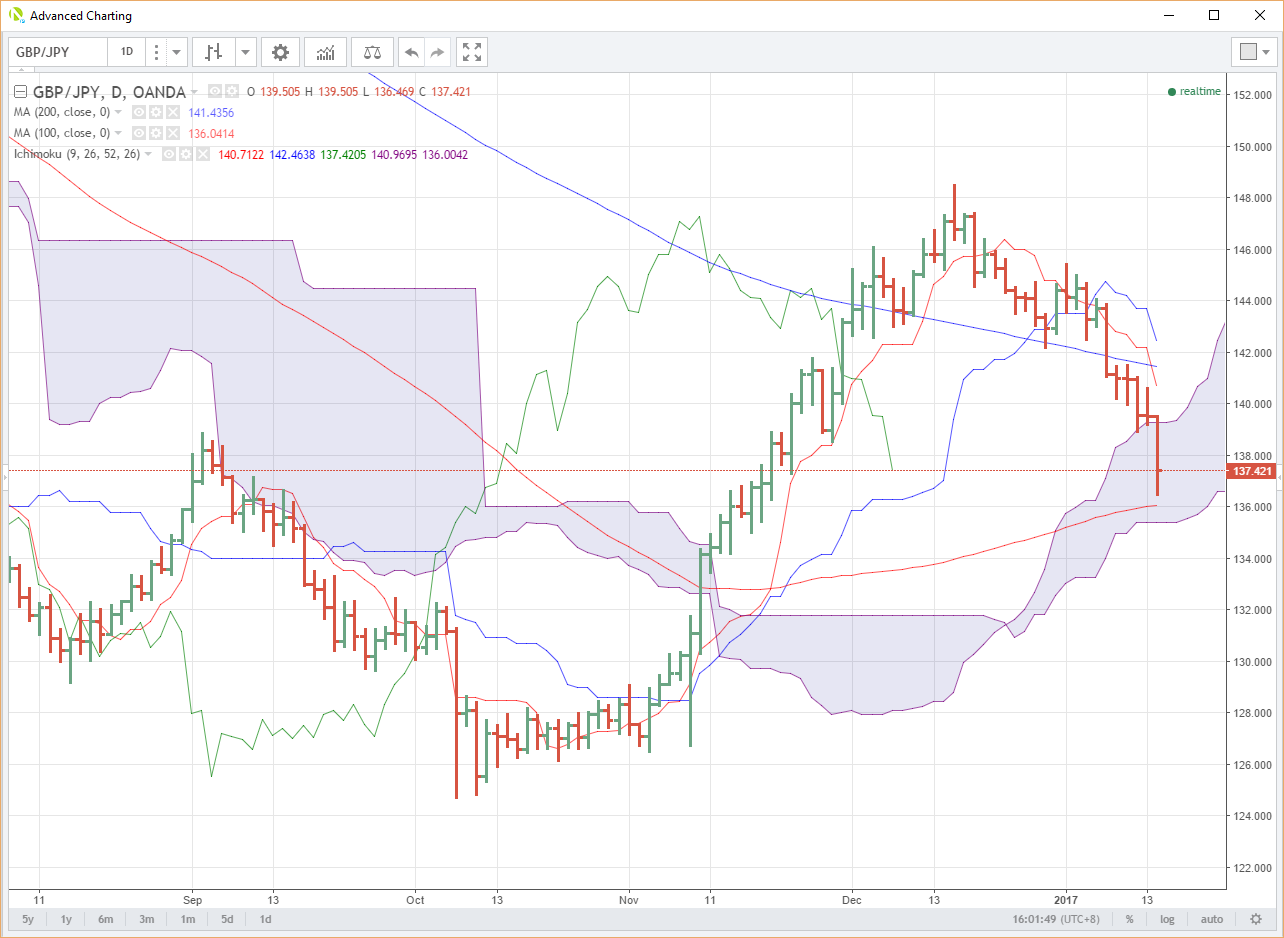

GBP/JPY

Broken back through the 200-day moving average at 141.80 last week. This now sits at 141.45 as resistance. More importantly, we have broken into the daily cloud at 139.25 to be down 1.60% on the day.

Support is near at 136.05 the 100-day moving average and then the bottom of the cloud at 135.40. A close below these levels opens up sub 130.00 from a chart perspective.

GBP/AUD

Has broken out of the daily cloud and consolidated below. Support appears at 1.5780 and then 1.5308. Resistance is the bottom of the cloud at 1.6250.

GBP/CHF

Has broken the base of the daily cloud today with a close opening up a move to next support at 1.1890. Resistance is the bottom of the cloud at 1.2190.

GBP/NZD

Another one to have broken the base of the cloud and consolidated under it. Like AUD, the NZD is reaping the benefits of the general USD malaise of the last week.

Resistance is the base of the cloud at 1.7115. Support are the two previous lows at 1.6685 and 1.6208 respectively.

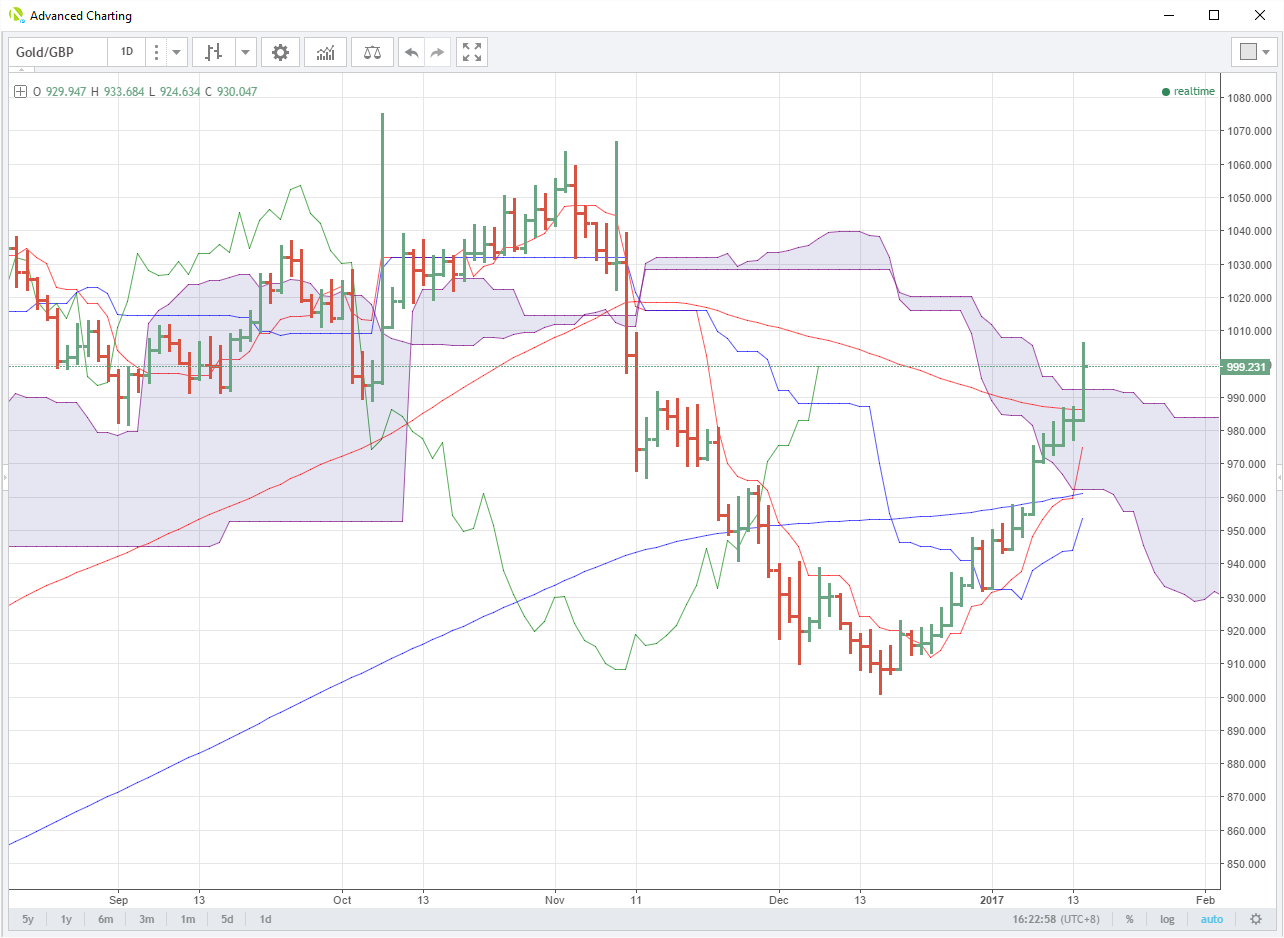

XAU/GBP

Gold is higher in its own right today as GBP gives last week’s Trump driven safe-haven buying an extra boost. Gold has broken out of the cloud and through the psychological GBP 1000 per ounce today. Taking out the 100-day moving average along the way.

The top of the cloud at 992.30 and the 100-day at 986.50 become support. The 1065/75 region is resistance.

Summary

What makes today interesting is the fact GBP has made not managed to recover from its Monday morning sell-off. More significantly it is also looking very ugly technically against both it’s safe haven and “risk on ” counterparts. This general weakness may not bode well in what will be an event heavy week for markets.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.