We have another busy session in store on Wednesday as we get jobs data from the UK, inflation data from the eurozone and US and hear from a few Federal Reserve officials including Chair Janet Yellen.

The pound on Tuesday recorded its largest daily gain against the dollar since 2008 and the currency is likely to remain in focus this morning as we get the latest jobs data from the UK. The catalyst for yesterday’s moves was Theresa May’s announcement that parliament will vote on any deal with the EU but the responsibility for the scale of its lies with the fact that the market was so heavily short prior to the speech that the unwinding of these positions triggered a significant short squeeze.

OANDA fxTrade Advanced Charting Platform

The pound may be having a breather so far today having peaked just above 1.24 but I would be surprised to see a further squeeze at the next opportunity. Today’s jobs data may provide such an opportunity, although forecasts suggests there’s going to be little to complain about in the numbers with unemployment seen edging up to 4.9% and earnings seen rising to the highest since late 2015. With inflation on the rise though, price rises are already chipping away at these wage increases and are likely to overtake them soon enough, at which point we should get a real idea of how resilient the UK economy truly is.

While other countries aren’t expecting to see the kind of inflationary pressures that the UK is, we are generally seeing deflationary pressures ease in many countries that have until now struggled to generate much. The US and to a greater extent, the eurozone, are two examples of this and yet CPI inflation data released today is expected to show prices are on the rise again, although it’s worth noting that this is in large part driven by higher commodity prices, particularly oil. Still, there are other factors that would suggest conditions are finally improving, hence the Fed now being in a tightening cycle and the ECB reducing its asset purchases.

Trump Deflates USD Ahead of Inflation Data

We’ll also likely hear from a number of officials today including Fed Chair Yellen who is due to speak on the goals of monetary policy and how we pursue them. Robert Kaplan and Neel Kashkari, two FOMC voting members this year, are also scheduled to appear today which could add some volatility to the dollar, especially following Donald Trump’s claims that it is currently too strong.

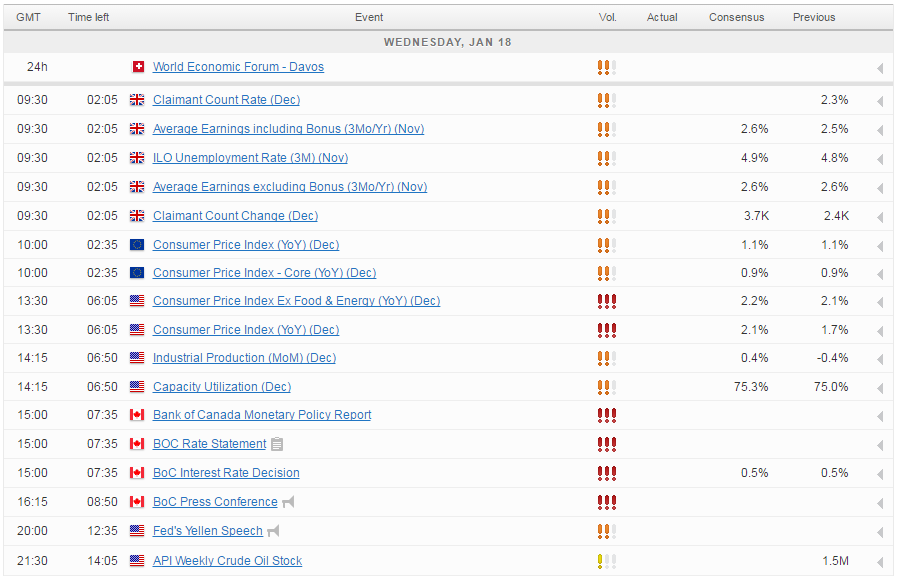

For a look at all of today’s economic events, check out our economic calendar.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.