Today’s selloff stemmed from trade worries, narrowing of the yield curve, and a very bad day for PM May. We really did not have any major new catalysts for today’s selloff, but we took out key levels that are making investors run to the sidelines. The economy is still strong, we are nowhere near the end of the trade war with the US and China, and the Fed will most likely still tighten and invert the yield curve next year.

Stocks collapsed on trade concerns and expectations that the 10-year and 2-year bond yield will invert soon and signal a recession. Another day of processing the results from the G-20 led investors to question whether anything of substance was achieved. President Trump also reminded us that if the US and China are unable to make a deal, he is the “tariff man”, a sign that if a deal is not reached in 90-days, things will get uglier.

Yesterday, the yield on the 5-year fell below the 3-year yield for the first time since 2009. The 2s10s curve also narrowed from 14 basis points yesterday to 11 basis points. Over the past few decades, when we see 3s5s curve invert, we have seen a recession roughly two-thirds of the time. Since 1975, the inversion with the 10-year and 2-year has successfully signaled each recession.

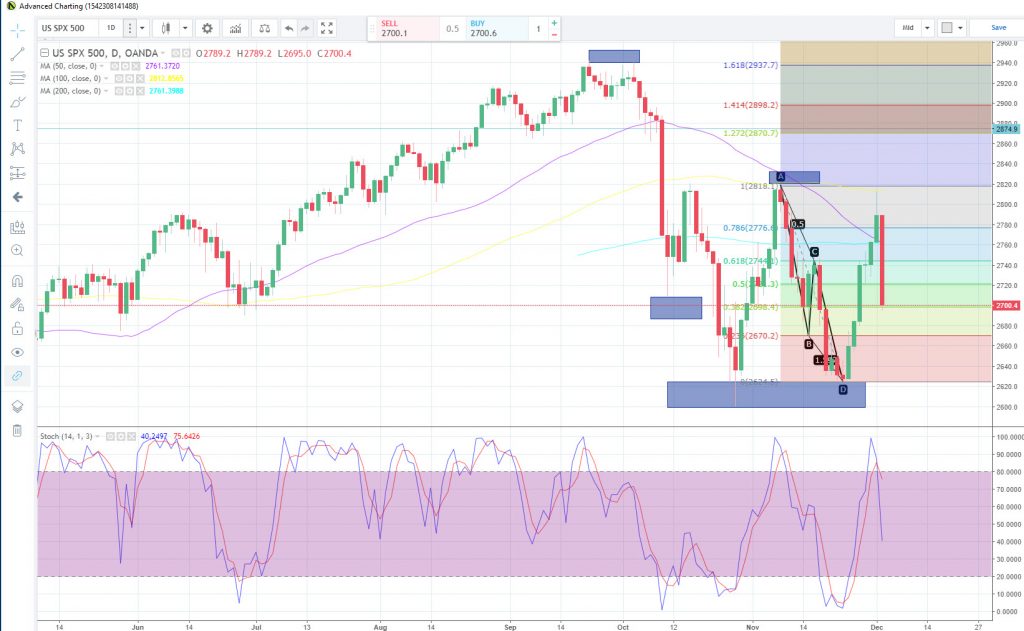

The S&P 500 index steadily sold off all session and managed to drop below all 3 key SMAs (200-day, 100-day and 50-day). A bearish indication that could support a move lower back to the recent swing low.

Cable initially rallied to start the day after, the European Court of Justice Advocate General Campos-Sanchez-Bordana noted that the UK could unilaterally overturn Brexit. Sterling quickly gave up those gains once the Prime Minister lost Grieve amendment, a key vote in the House of Commons to force the government to publish the complete legal advice it received from the attorney general about the divorce deal May reached with the European Union last month. Many MPs were frustrated that PM May was withholding information from them ahead of the key December 11th vote. Expectations are strong that the Prime Minister May’s withdrawal agreement will lose the December 11th vote.

Sterling fell to a fresh 2018 low against the dollar at 1.2658 before stabilizing above the 1.2700 handle.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.