Stocks are broadly lower as industrial and energy stocks lead the decline. Haliburton, one of the world’s biggest oil service providers, beat on earnings, but the outlook going forward is showing signs of losing momentum in North America. Healthcare stocks were dragged down by Johnson & Johnson disappointing guidance. Both Caterpillar and DowDuPont dropped on global growth concerns.

The first two weeks of earning season saw strong results for S&P 500 companies. Earnings were strong while revenues started to show some softness. The effects of the tax cuts and continued uncertainty with the trade truce is likely to weigh on stocks. Risk aversion is hitting the currency markets as the yen and dollar have rallied against the majors, with the exception of the British pound. Earlier in Europe, the UK posted the best wage growth since the financial crisis and the unemployment rate falling to the lowest level in four decades. Pressure will mount for the BOE to start removing stimulus.

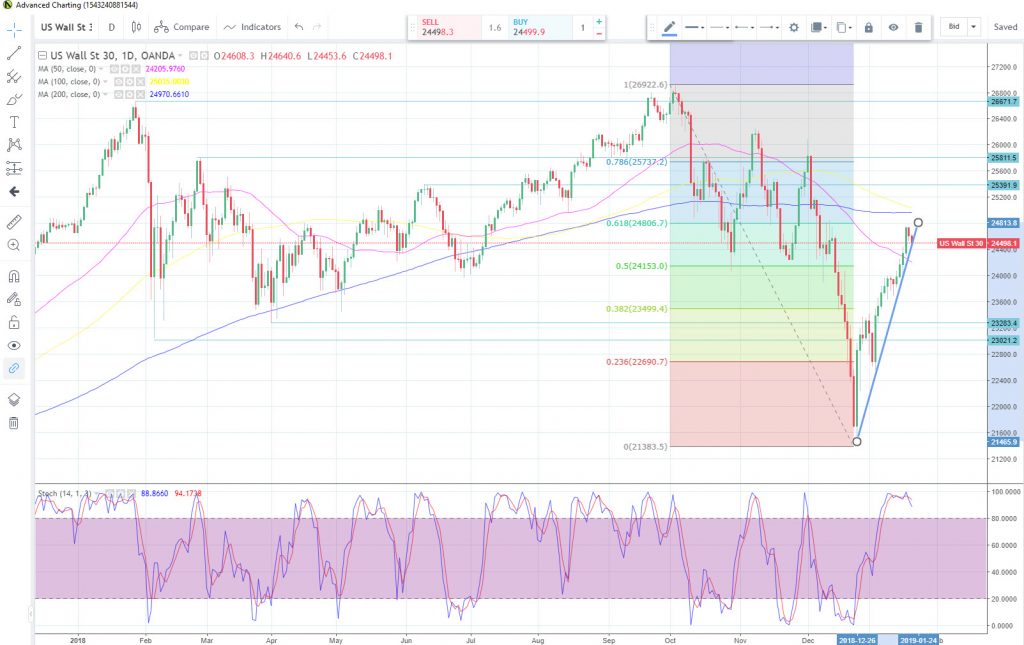

Price action on the Dow Jones Industrial Average shows the recent bullish trend line is being breached. If bearish momentum grows, downward pressure could target the 50-day SMA, which currently trades at the 24,278 level. Deeper support would fall at the psychological 24,000 level. To the upside, 25,000 remains critical resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.