Just when you thought that short EUR position you had been carry was about to strike big, along comes a few US politicians to throw yet another curve ball. The US fiscal cliff is again capturing the markets attention, as investors look for signs of an imminent resolution to the tax hikes and spending cuts that are scheduled to hit the US in a matter of weeks. The prospect of a compromise on the US deficit strategy has boosted global equities and the vulnerable EUR against the dollar, while also giving oil and commodity prices a lift.

It is all about the signals. This market requires guidance, as low volume and problems with liquidity does not provide market confidence to many. The US House of Representative speaker Boehner said that he was optimistic that a deal over the fiscal cliff can be reached. Even President Obama is signaling that he would not insist tax rates on upper-income Americans rise to Clinton-era peaks as part of a deficit-reduction deal. US political opposites seem to be showing new flexibility towards a solution. However, the Republicans remain opposed to raising top rates and want more details on potential entitlement cuts. If for nothing else, the market is beginning to see some US political movement, 24-hours before we were in a stalemate, now there is a window of opportunity to negotiate. This has allowed risk strategies to be rewarded.

So far, concerns about Europe have been pushed aside, trumped by US budget deficit progress clues, and this despite Moody’s uttering remarks that the Euro-Greek aid deal agreed to earlier this week does not resolve the periphery country’s debt sustainability situation. Again, they were pointing out the market obvious and again the market seems to be showing how important rating agencies are in the grand scheme of things. The German government will vote tomorrow on whether to give more financial aid to the economically crippled Greeks. The Dutch Prime Minister has already indicated that they will need more financial aid to stay in the Euro. Next we will have Ireland and Portugal seeking concessions and shouting foul of preferential treatment for Greece.

Moody’s was not the only rating agency looking for ‘air time’ this morning. The Fitch agency has indicated that they too will not be left alone, and want to join the ‘lemming’ path. They seem to be indicating that they could strip France of its triple-A credit status in 2013, only if the country fails to meet its targets on debt reduction and its economy performs worse than forecast. Fitch is the final surviving agency to still rate France triple-A after Moody’s cut it one notch earlier this month and S&P in January.

Employment is the hot topic of conversation for any economy. Despite an economy that is looking towards recession, Britain’s employment numbers have surprised to the upside. The term ‘underemployment’ is now being officially thrown around and being defined as the reason why this phenomenon is occurring. The defined phrase refers to individuals having to work part-time instead of full-time. According to the British Office of National Statistics the number of underemployed individuals in that country has risen another million since the beginning of the economic downturn in 2008 to +3.05m. If one ever visits the center of London, ask why so many European youths are employed rather than UK nationals. The answer will surprise you!

The market anticipates that the data Stateside today, Q3 GDP, will likely be the best US economic news release of the week. Analysts are looking for an upward revision from +2% to +3%, q/q. It is believed that inventories and final sales should provide for the bulk of the revision. Weekly claims is looking for a w/w improvement to +390k from +410k, however, rumpling’s of a further weakness would not be at all surprising.

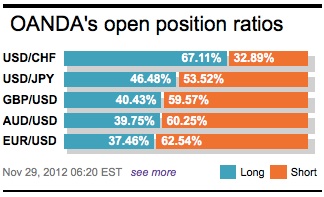

The Single currency is within striking range of the psychological 1.30 benchmark print. A level briefly visited earlier in the week and considered ideal to set new EUR shorts. The market handsomely rejected this level first time around, however, this time it feels different. The investor bias is building for gains towards the upper 1.30 echelons over the coming sessions. The 10 and 30-DMA point north, again adding further support to the upside potential. Many investors are looking to buy the EUR on dips and this despite the pullbacks of late being rather limiting. Are they in danger of missing the boat? Topside, above 1.3020 could trigger the next step high towards 1.3150-1.32.

Other Links:

Is the EUR Confined to Lame Duck Status?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.