Talks extension raises hopes

News that the US-China trade negotiations in Beijing were being extended a day fueled a better appetite for the market to take on risk, amid hopes for a positive announcement. US President Trump had tweeted that the talks were going “very well” but, as usual, lacked any details of progress.

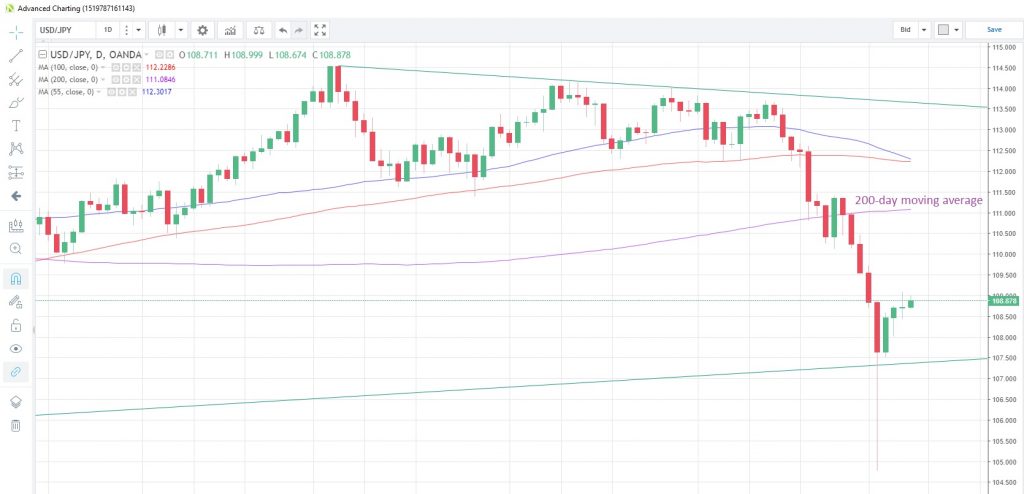

It was a sea of green across equity markets in Asia, with the China50 index outperforming US indices. China shares rose 1.5% while the US30 index rallied 0.5%, pushing the current advance into a fourth day. Beta-risk currencies, such as the Aussie, were better bid, while USD/JPY gained 0.16% to 108.90, as safe haven yen assets were liquidated.

The dust appears to be settling

In his address to the nation this morning, President Trump focused mostly on his Mexico wall, with no mention of trade talks and hence had zero impact on markets. He also didn’t give any clues whether a re-opening of the US government would happen soon. It’s now in its 19th day.

USD/JPY Daily Chart

World Bank downgrades growth forecasts

In the semi-annual update to its global outlook, the World Bank warned that slowing growth in trade and investment combined with rising interest rates was sapping momentum from global growth. It said downside risks had increased including the potential for “disorderly” markets if trade wars escalate. It forecast global growth of 2.9% for this dear, down 0.1% from its June prediction, and below 2018’s 3.0%.

Tiny chance of a Bank of Canada cut

The Bank of Canada kept rates unchanged at its December meeting, having increased the benchmark rate to 1.75% at the meeting before. This time round the Bank is expected to hold rates again, though pricing in the Overnight Index Swaps market suggests there is a tiny 17% chance that the central bank will reverse the most recent hike.

USD/CAD Loonie Appreciates Ahead of Bank of Canada Rate Statement

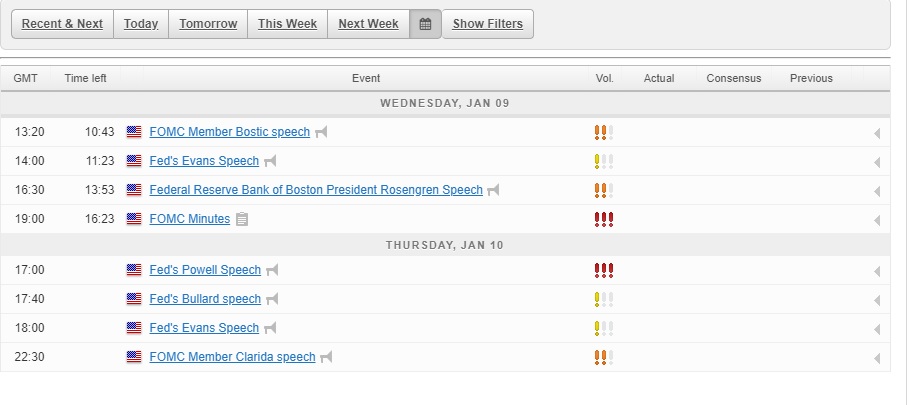

First of a deluge of Fedspeakers

Today kicks off a slew of speeches from FOMC members over the next two days, centred around the release of the minutes of the December FOMC meeting, starting with Bostic, then Evans and Rosengren. There are more to come tomorrow:

Fedspeakers

Aside from the BOC and Fed events, Germany releases trade data for November today, with Brexit and tariff wars crimping exports and slowing imports, resulting in a wider trade surplus. The Euro-zone unemployment rate is seen holding steady at 8.1%, while Bank of England’s Carney delivers his first speech of the new year.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.