Heightened Geopolitical Risk May Weigh on Gains into End of the Week

The end of the week is looking a little quieter in some respects and yet, with geopolitical risk heightening in recent days and first quarter earnings season getting under way, it’s unlikely to be entirely peaceful.

The open in Europe and trade in Asia was broadly mixed with investors clearly adopting more of a cautious tone. US futures are a little higher but again, given the backdrop of a trade conflict with China and rising tensions with Russia over Syria, any rallies may be somewhat gradual and dependent on the situations not deteriorating further. We are seeing small signs of encouragement but the unpredictable nature of all concerned doesn’t provide much confidence.

With Donald Trump being so active on Twitter, it’s unlikely the day will pass without at least some mention of one or both of the above, the question is whether his comments will act to calm or inflame the situation. Any indication that strikes in Syria are likely over the weekend could trigger risk aversion into the close in case of a negative fallout in the markets at the open next week.

Investors to Remain Sensitive to Market Tensions

Earnings Season to Provide Timely Distraction

Something that may provide some distraction over the coming weeks is earnings season, with JP Morgan, Wells Fargo and Citigroup kicking things off today. Expectations for the quarter and year as a whole have grown in recent months following the passing of tax reforms at the back end of last year and this comes on the back of already improving and impressive numbers.

Lower taxes will likely play a big role in the improved earnings numbers and outlook but higher interest rates on the horizon will likely also have an impact. On the flipside, the prospect of a trade war may also feature in some reports and the impact that could have on the outlook for the coming year.

EUR/USD – Euro Trading Sideways as German CPI Matches Forecast

Is This Another False Dawn For Bitcoin?

Bitcoin has sprung back to life in the last 24 hours and while numerous people have tried to explain the sudden surge as being a short squeeze or numerous other things, it’s at least brought the cryptocurrency space back to life having become somewhat lifeless by its own standard. In terms of where it goes from here, the move yesterday was certainly encouraging for the bulls and came amid a clear lack of selling appetite in the weeks previous but I remain unconvinced this is the end of the sell-off as some are already claiming.

Bitcoin (CME) Daily Chart

Source – Thomson Reuters Eikon

For one, every time we’ve seen a resurgence in prices over the last four months, cryptocurrency enthusiasts have claimed the good times are back and we’ll be back at $20,000 before you know it. While I’m not saying we won’t get back there, I think we need a little more evidence that the bulls are back in force before I believe it’s happening and one day of sudden gains just doesn’t cut it. Let’s see what the weekend brings but we’ve not even touched the last peak in March. We’ve had good days on numerous times this year and they turned out to be false dawns, this could be another.

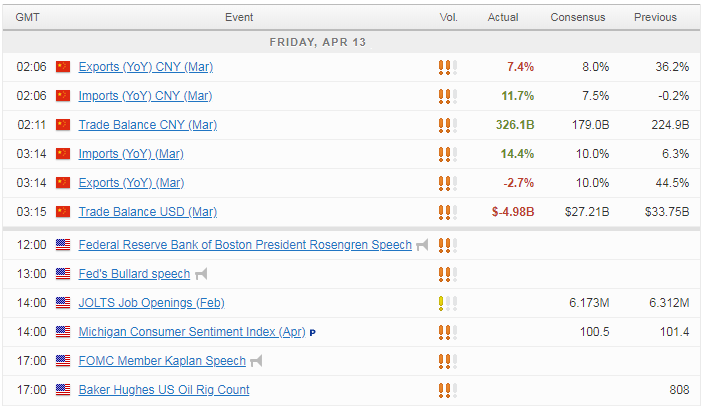

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.