TransCanada’s Keystone pipeline problems have squeezed supplies and upset South Dakota, sending West Texas Intermediate (WTI) gushing higher ahead of the Thanksgiving holiday.

Crude oil traders enjoyed a frisky session overnight in what will effectively be the end of the week for the U.S. as it heads into the Thanksgiving break. Brent Crude enjoyed a 0.80% gain to very near its highs at 63.40. However, it was WTI that was the star of the show, climbing 1.30% to 57.75, two-year highs.

The U.S. DOE Crude Inventories marked a slightly larger than expected drawdown of -1.9 million barrels, but it was the South Dakota Public Utilities Commission that spooked traders. The regulator has threatened to revoke TransCanada Corps permit to operate the 600,000 barrel per day Keystone Pipeline if the leak was found to be due to negligence. The regulator’s language sounded quite militant and with the pipeline already closed for repairs and “forensic examination,” trader needed no further excuses to buy WTI.

We would expect trading to be muted in Asia and Europe today and to mostly move on short-term headline for the remainder of the week.

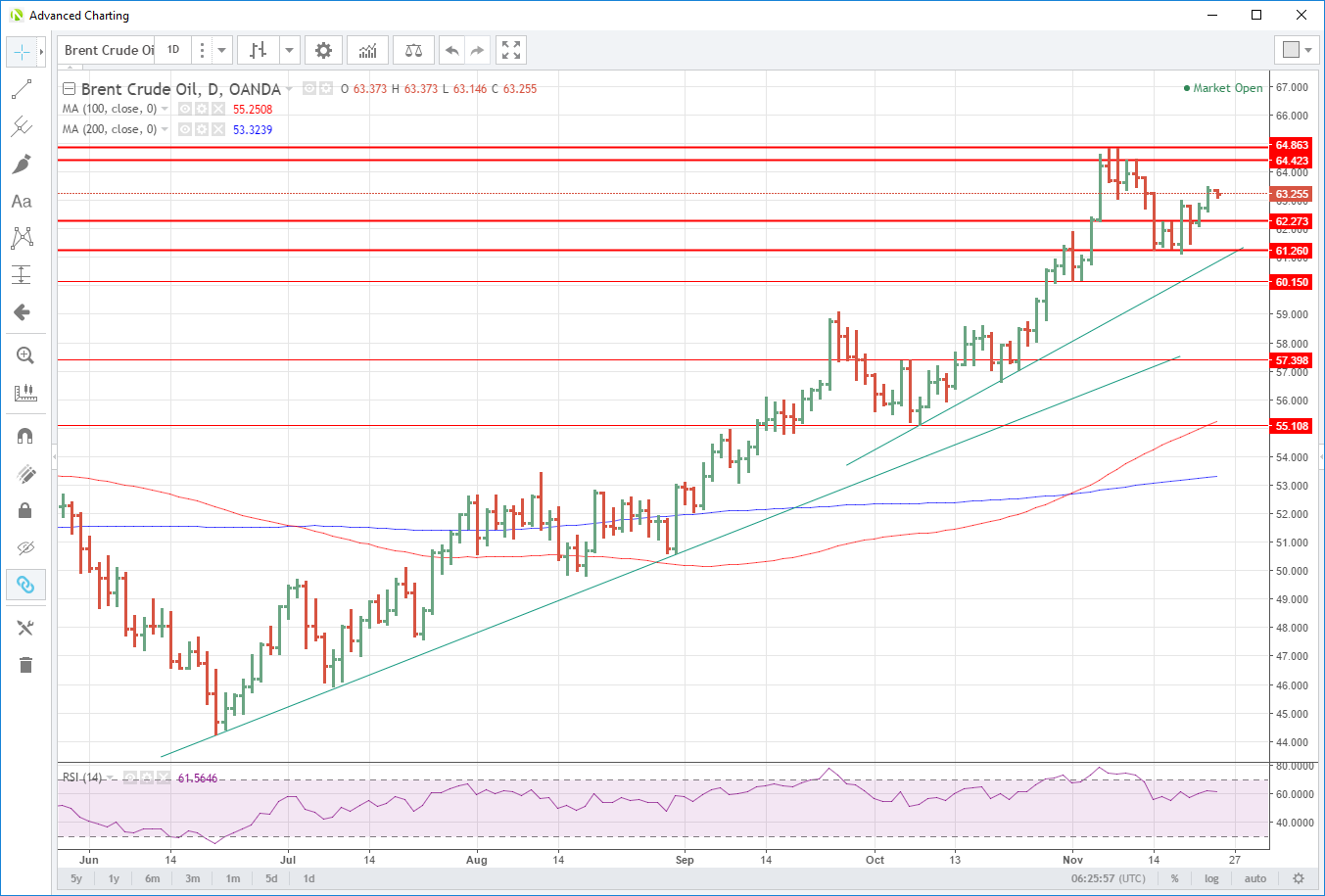

Brent crude has eased slightly by 20 cents in Asia on profit-taking. Support rests at 62.30 and the key 61.25, a multiple daily low and trendline support. Resistance continues to loom large over Brent at 64.45 and 64.85, both levels being daily double tops.

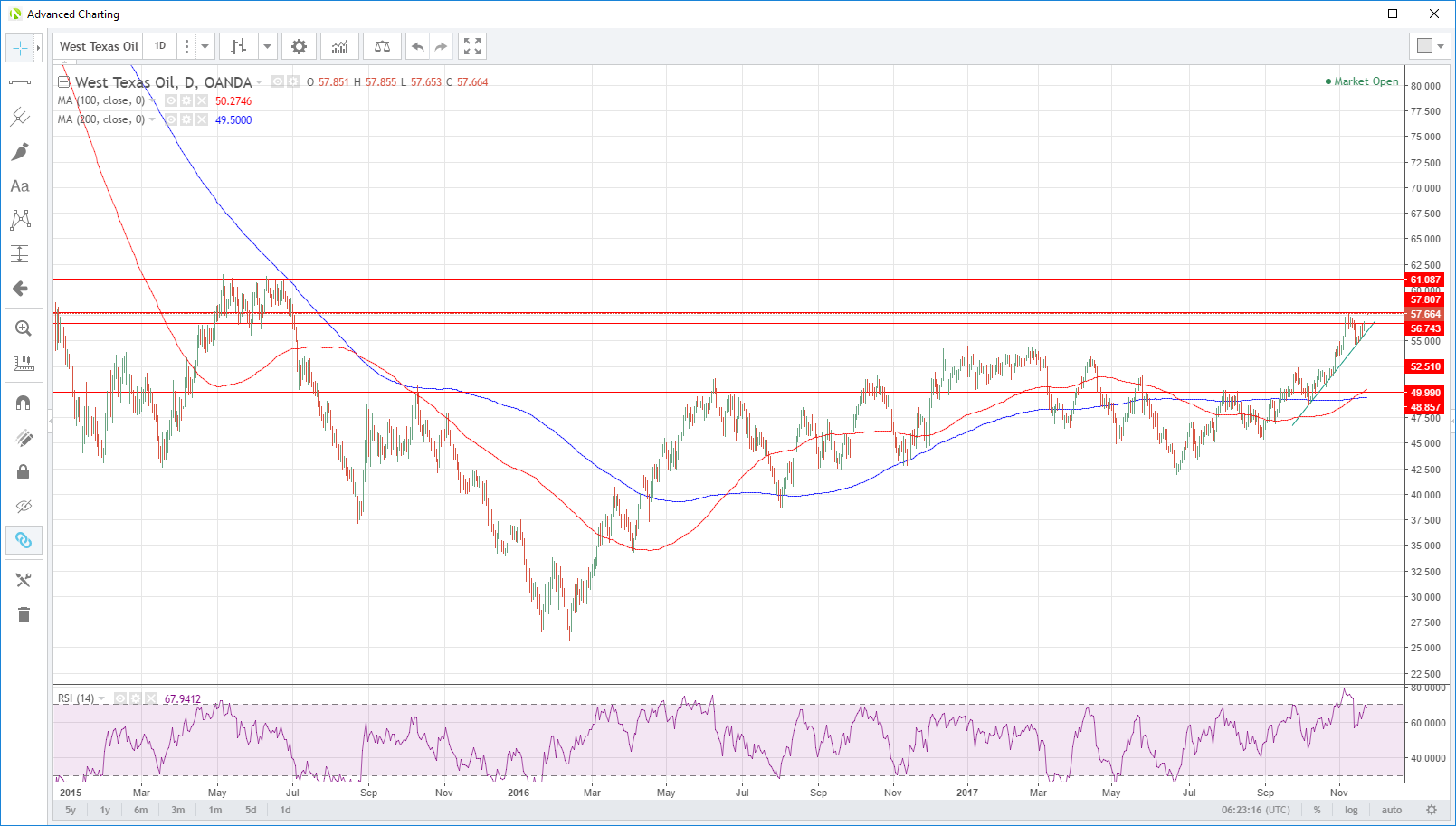

WTI is unchanged at 57.75 with support at 56.70 and then the impressive trendline support, today at 56.00. We would expect some profit taking at 58.00 and 59.00 but chart-wise, the path is now clear for a march to 61.00.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.