A little tug of war in the bond market may be turning into a warning sign for investors.

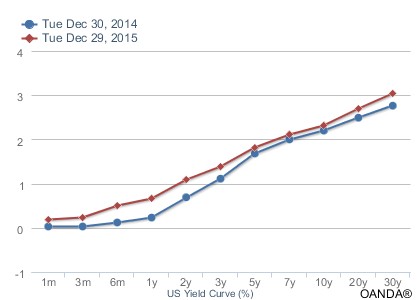

The increase in returns on short-term bonds is outpacing that of long-term bonds. This has led to a flattening yield curve, which measures returns on U.S. Treasurys across the lengths of maturity. On one side of the yield curve, rates have been rising as a result of the Federal Reserve’s decision in December to raise the federal funds rate. However, long-term bonds like the U.S. 10-year note and the U.S. 30-year note have yet to see a move similar in magnitude, as inflation expectations have remained muted.

This narrowing difference between short-term and long-term Treasury yields presages market tumult, according to Max Wolff of Manhattan Venture Partners.

“The reason people should worry is the short-term signals they tend to watch and the long-term signals they need to worry about in the bigger picture are sending opposite messages,” Wolff said Tuesday on CNBC’s “Trading Nation.” “They can’t both be right, and so it almost certainly means a period of a bit of turbulence coming up.”

A tightening yield spread is generally viewed as a negative sign for the market, since investors should generally demand higher returns the longer they hold bonds. The absence of this yield premium for long-term bonds typically indicates a lack of confidence in the economy.

“[The Fed has] got to push these rates up, but really the economy isn’t tremendously strong, and there’s some real indication that it’s weakening globally and that it’s having an effect here,” said Wolff.

And as the Fed tightens further in the year ahead, the trend could become even more pronounced.

“You have this huge pent-up demand for long-term which is driven by the market and short term rates which are controlled more by the Fed. So you could see this invert,” Dennis Davitt of Harvest Volatility Advisors said Tuesday.

A situation in which short-term bond yields exceed long-term yields is known as “yield curve inversion,” and it is typically seen as a signal of recession.

This is a big risk in the year ahead, according to the investor.

“If you’re in a mutual fund that specializes in trading fixed-income instruments, you need to be aware because most people are not looking for an inverted yield curve, which we haven’t seen for a very long time,” Davitt said.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.