European equity markets are expected to open higher on Thursday following another mixed session in Asia overnight. Trading volumes are expected to be lower throughout the European session due to the bank holiday’s in Germany and France, which can quite often result in higher levels of volatility.

The U.K. services PMI will be key today, coming at a time when we appear to be witnessing a slowdown in economic activity driven by a number of factors, most notably slowing global growth and the EU referendum in June. The manufacturing and construction PMIs have already disappointed this week but with the services industry accounting for more than three quarters of the U.K. economy, this is the one that really matters. A disappointment here and it would suggest we’re in for a very tough second quarter.

US Crude Subdued, Crude Inventories Jumps

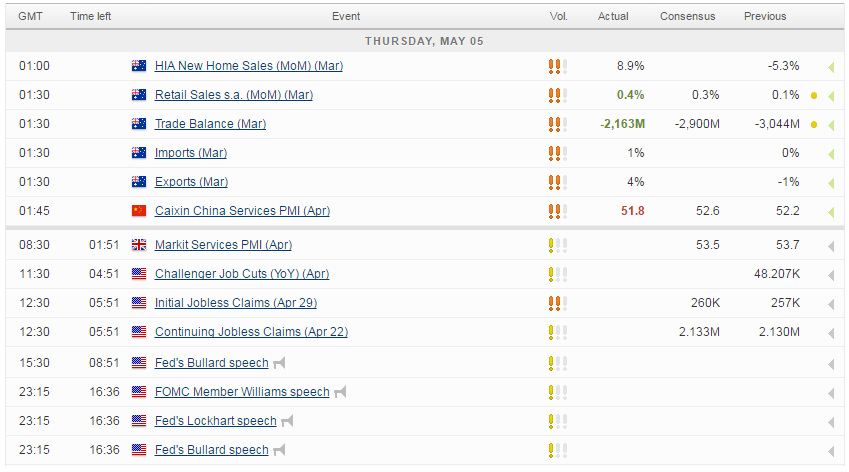

The Chinese Caixin Services PMI came out softer than expected overnight, which may cast further doubt over the sustainability of the rebound in the economy coming days after a similarly disappointing reading from the manufacturing sector. That said, it wasn’t all bad news in the report, with the service providers reporting a faster rise in new orders and hiring.

The composite reading – which covers both manufacturing and services – was hampered again by the slowdown in manufacturing and fell to 50.8 but importantly remained in growth territory. While the economy could do with activity in the services sector expanding at a faster rate during this period of transition, this was always going to be a difficult task. The important thing now is that the government and central bank remain accommodative to help the economy through the transition and avoid a hard landing.

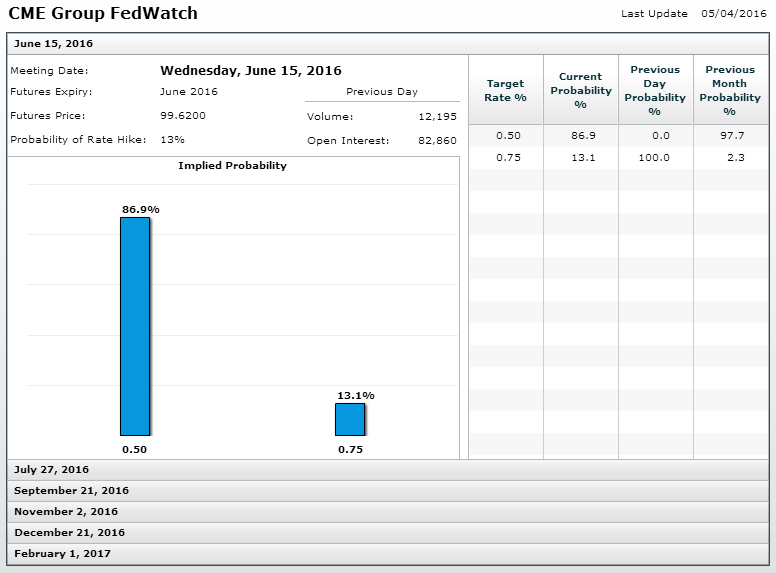

Later on in the U.S. session we’ll get the latest jobless claims data and hear from a number of Fed officials, including James Bullard, Robert Kaplan, Dennis Lockhart and John Williams. It will be interesting to see where they all stand ahead of the June meeting which has currently been written off by the markets for the next rate hike. We have seen some dollar strength in recent days although this doesn’t appear to be a reflection of higher rate hike expectations, with Fed Funds futures implied odds still only being at 13% for June and the first hike still only seen in December.

Source – CME Group FedWatch Tool

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.