It’s been another mixed start to trading in Europe and the U.S. is looking to open in a similar fashion on Wednesday, as investors eye what should be quite an active end of the week.

It would appear that temporarily at least, the improved risk appetite – probably spurred on by the hope of more global monetary stimulus – that drove indices higher despite an increasingly risky environment has been drained by either inaction or underwhelming easing measures. There’s also likely to be a case of traders adopting more of a cautious approach ahead of tomorrow’s Bank of England decision and Friday’s U.S jobs report.

The inability of central banks to live up to the high expectations of markets is an issue that has been around for a while now but become increasingly clear as of late. With interest rates at record lows around the globe, the ability of central banks to cut in any meaningful way has been dramatically reduced and investors just aren’t blown away by quantitative easing any more. Any other forms of unconventional easing also just don’t seem to sit the same way with investors. None of this bodes well ahead of the BoE decision tomorrow and it seems once again that the chance of the central bank disappointing far exceeds the chance of it living up to or surpassing expectations.

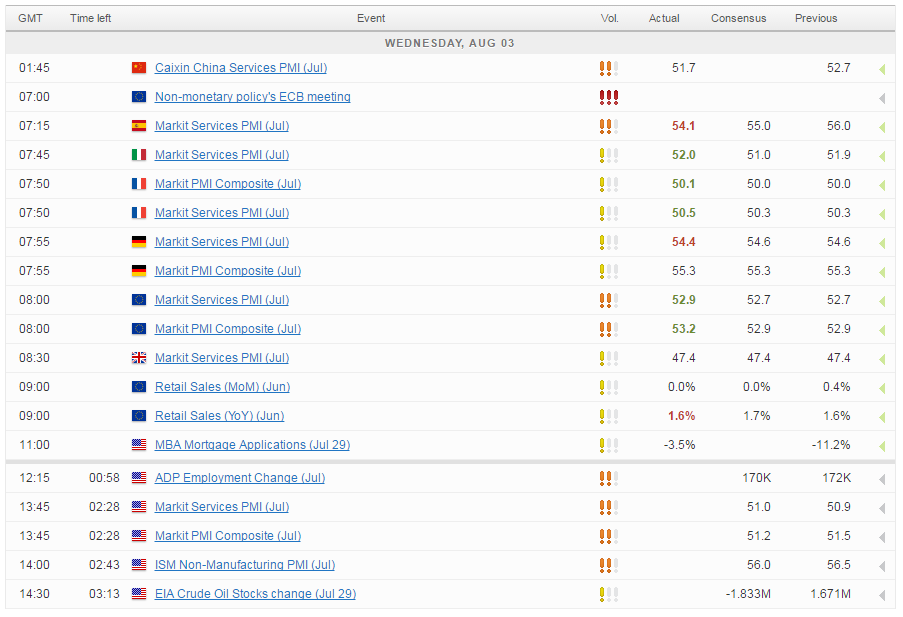

The data we’ve had so far this morning has had limited impact on market sentiment today, although it is worth noting that these are revised numbers and while there were some improvements, they were marginal. We may get more of a reaction to the data coming from the U.S. with particular attention falling on the ADP non-farm employment and ISM non-manufacturing releases.

The reliability of the ADP release as an estimate of Friday’s non-farm payrolls number is debateable but traders will still be monitoring is closely for any insight into how the labour market performed last month. In reality, what we’re looking for here is any suggestion that the labour market dramatically under or over performed in July, rather than the specific number. Given the decline we’ve seen in the dollar since Friday’s second quarter GDP miss, any weakness in the employment number could weigh heavily as investors give up any hope of another rate hike this year.

Source – Thomson Reuters Eikon Platform, Dollar Index Chart

Big Dollar Squeeze Remains In Effect

The other release of note today is the EIA crude oil stocks number. Oil has fallen more than 20% over the last couple of months as some of the temporary supply disruptions were resolved and the number of oil rigs in the U.S. started to rise again.

Source – OANDA fxTrade Platform

Brent Crude – Have We Broken Through Support?

The U.S. shale industry has dealt with the low oil prices extremely well and adapted far quicker than OPEC anticipated when it decided to let the market drive out higher cost producers. We’re now back looking at a situation in which supply could pick up considerably again and prices as a result head south. The EIA number today is expected to show a small decline in inventories but after last week’s build broke a run of nine consecutive weekly falls, I wouldn’t be surprised if we saw a similar result again which could once again be bearish for oil.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.