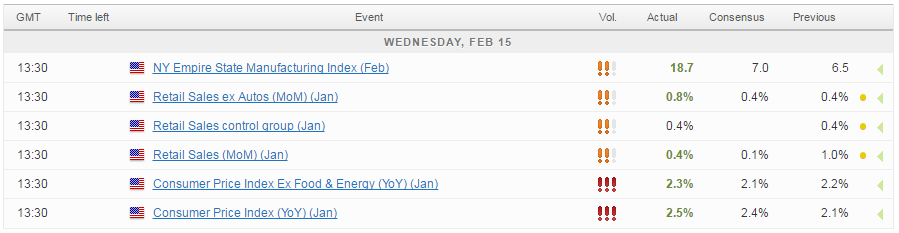

The first batch of releases in our US economic data marathon today painted a fairly optimistic picture for the US, with CPI inflation rising 2.5% from January last year, core inflation rising 2.3% over the same period and retail sales up 0.4% from what was already and strong December, made even better by the upward revision to 1%. Under the circumstances, it’s no surprise that the US dollar has rallied on the back of these numbers as all exceeded expectations and should feed into the narrative that the economy is improving and the Fed should continue raising rates.

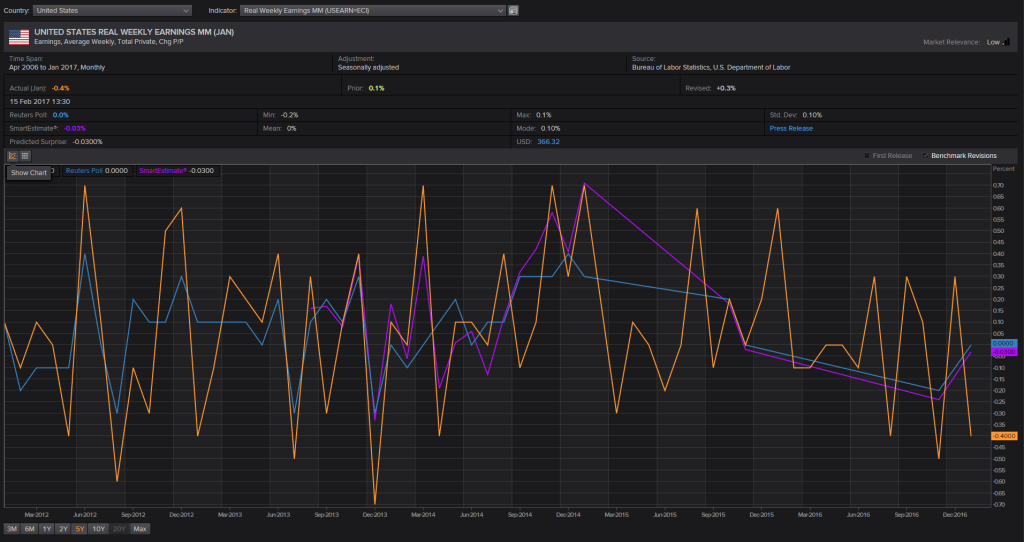

However, the lesser followed release, real average weekly earnings, was not so impressive falling 0.4% and continuing a potentially worrying trend that has materialised over the last year.

The full US real earnings report from the BLS can be found here.

We’ve all been relieved that average hourly earnings have, broadly speaking, been improving, but with inflation now ticking higher and the average workweek having fallen over the last year, consumers may not be as well off as we hoped.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.