Thursday March 7: Five things the markets are talking about

Global equities are mostly lower as revised lower economic forecasts add to investor worries about the outlook for global growth. The ‘big’ dollar has climbed for a seventh consecutive session while U.S Treasuries ticked a tad higher.

Already this week, the OECD cut global growth estimates again and the U.S trade deficit widened to levels not seen in a decade.

Ahead of this morning’s ECB monetary policy meeting, global central banks continue to stay on a “dovish” path. On Monday, RBA governor Lowe signaled it is hard to think “rates will rise,” while yesterday it was the Bank of Canada (BoC) “very bleak” policy statement which put further pressure on the loonie (C$1.3440).

Separately, an ECB sourced report ahead of the today’s scheduled meeting (07:45 ET) suggests that growth rate forecasts are likely to come down enough to justify launching a new TLTRO program later this year.

Trade remains the dominate theme for markets with investors waiting for details of a possible China-U.S accord, as President Trump is itching to cut a deal with Beijing soon.

Elsewhere, sterling (£1.3173) is steady despite European officials being pessimistic about the chances of a breakthrough in Brexit talks this week. In commodities, investors are weighing up a U.S crude-stockpile surge – will it be a threat to OPEC’s bid to avert a glut against a drop-in fuel inventory?

On tap: ECB policy makers are expected to leave rates unchanged amid a deteriorating outlook. Draghi will hold a news conference at 08:30 am ET.

1. Stocks have mixed feelings

In Japan, the Nikkei hit a one-week low overnight, with chip-related stocks tracking a decline in their U.S. peers and financials retreating as they slash profit outlooks. The Nikkei share average ended down -0.65%, while the broader Topix dropped -0.84%.

Down-under, Aussie shares advanced overnight as hopes for an RBA rate cut supported consumer and financial stocks, but gains were capped by a weak mining sector. The S&P/ASX 200 index rose +0.3% at the close of trade. The benchmark gained +0.8% on Wednesday. In S. Korea, the Kospi index fell for a fifth straight session, tracking Wall Street losses the OECD cut global growth forecasts again. The benchmark index fell -0.45%overnight, the index has lost -3.1% in the last five sessions.

In China, blue-chips fell overnight after four consecutive sessions of gains while Shanghai shares closed slightly higher, after the finance minister reiterated that China “would not seek to flood a slowing economy with stimulus.” At the close, the Shanghai Composite index was up +0.14%, while the blue-chip CSI300 index ended -1.02% lower. In Hong Kong, stocks fell on Thursday on investor caution over the outlook for global growth. At the close of trade, the Hang Seng index was down -0.89%, while the Hang Seng China Enterprises index fell -1.14%.

In Europe, regional bourses trade mostly lower across the board following a mixed session in Asia and lower U.S Index futures ahead of today ECB rate meeting.

U.S stocks are set to open in the ‘red’ (-0.23%).

Indices: Stoxx600 -0.42% at 373.90, FTSE -0.52% at 7,158.87, DAX -0.53% at 11,526.43, CAC-40 -0.39% at 5,268.38, IBEX-35 +0.09% at 9,305.49, FTSE MIB -0.17% at 20,816.50, SMI -0.52% at 9,348.50 S&P 500 Futures -0.23%

2. Oil edges up on sanctions and OPEC supply cuts, gold unchanged

Oil prices are a tad higher ahead of the U.S open amid ongoing OPEC+ led supply cuts and U.S sanctions against exporters Venezuela and Iran. However, gains are being capped by a record U.S crude output and rising commercial fuel inventories.

Brent crude futures are at +$66.12 per barrel, up +13c, or +0.2%, from Wednesday’s close. U.S West Texas Intermediate (WTI) crude oil futures are at +$56.24 per barrel, up +2c.

Prices are being supported by efforts led by OPEC+ who have agreed to withhold around +1.2M bpd of oil, a strategy aimed at tightening markets.

Also, U.S sanctions against the oil industries of Iran and Venezuela have also had an impact Venezuela’s state-run oil firm PDVSA this week declared a maritime emergency, citing trouble accessing tankers and personnel to export its oil amid the sanctions.

However, despite these factors, oil remains in plentiful supply, thanks to surging U.S production, which has resulted in weaker WTI vs. Brent prices. U.S crude oil stockpiles rose much more than expected last week, according to EIA data yesterday, inventories were up by +7.1M barrels to +452.93M barrels.

Note: U.S crude oil production remains at a record +12.1M bpd, an increase of more than +2B bpd since early 2018.

Gold prices are steady as the U.S dollar trades atop of its two-week high, while lacklustre appetite for riskier assets is offering support to the safe-haven metal ahead of this morning’s ECB meeting. Spot gold is down -0.1% at $1,284.59 per ounce, while U.S gold futures have slipped -0.2% to $1,284.90 an ounce.

3. Sovereign yields fall ahead of ECB

Euro sovereign bond yields are lower on reports that the European Central Bank is likely to cut its forecasts enough to warrant kicking off a new round of ultracheap long-term loans for banks.

The yield on the 10-year German Bund has fallen to a session low of +0.129%, while the 10-year U.S Treasury yield fell off its session high and was at +2.706%.

Analysts have been speculating whether the ECB was likely to take the step to bolster the ailing European economy. So-called TLTROs have been one way the ECB has tried to kickstart growth over the years.

Elsewhere, short-dated Italian bond yields have hit their lowest level in seven months ahead of the ECB meet.

Italy’s two-year bond yields hit +0.198% in early trade, before settling at +0.23%, still down -4 basis points on the day.

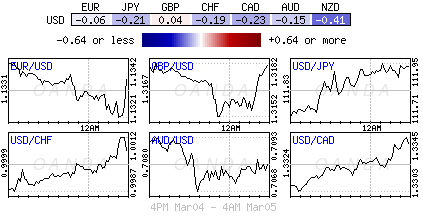

4. Dollar subdued ahead of ECB

FX markets are again very quiet in the overnight sessions as investors shift their focus to the ECB rate decision and President Draghi’s press conference (08:30 am).

EUR/USD (€1.1313) is steady holding above the psychological €1.13 level ahead of the ECB rate decision. No change in rates are expected, but the market is looking to see if anything is said in regard to the TLTRO operation. Given the recent prolonged economic slowdown in the region many expect the ECB would be eventually forced to provide further stimulus and shift its rate guidance.

Note: Market expectations for first potential rate hike was seen in early Q4 2020, compared to the ECB forward guidance of key rates to remain at present level at least through the summer of 2019.

In the U.K, Brexit talks appear to be heading nowhere fast, but the GBP/USD (£1.3159) remains confined to a tight range. All the sterling fireworks are expected next week.

The Japanese yen is unchanged at ¥111.77 per dollar.

5. Eurozone growth held back by drawdowns

Data this morning showed that the eurozone economy picked up in Q4 of 2018, although growth was held back by businesses drawing down on inventories rather than producing new goods.

Data from the European Union’s statistics agency showed GDP rose at an annualized rate of +0.9% in the three months through December, up from +0.6% in Q3 and slightly higher than the previous estimate of 0.8%.

Note: Growth was supported by a rise in exports, as well as an acceleration in government spending, and a smaller pickup in consumer spending.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.