Dollar bulls have reason to be wary of the currency’s Friday rally on stronger-than-forecast U.S. labor data.

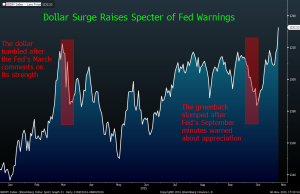

The jobs report bolstered the case for a December interest-rate increase by the Federal Reserve and propelled a broad gauge of the greenback past this year’s previous high. Yet the last time the dollar was this strong, the central bank flagged it as a burden on exporters and a damper of inflation, driving the currency down by the most since 2009.

The March experience is raising red flags for investors and strategists. A surging dollar may lead Fed officials to warn that currency moves will limit rate increases in 2016, even if they boost their benchmark next month from near zero, where it’s been since 2008.

“It’s going to be really hard for them to hike rates aggressively,” said Brendan Murphy, a senior portfolio manager at Standish Mellon Asset Management Co., who oversees $19 billion of fixed-income assets in Boston. Once the Fed lifts rates, “you may be nearing the end of this broader move we’ve seen in the dollar.”

Murphy says he’s betting on the greenback versus the euro and currencies from commodity exporting nations, but he’s trimmed positions since the start of the year.

Jobs Boost

The dollar appreciated to its strongest level since April versus the euro and its highest in more than two months versus the yen after a Labor Department report showed U.S. employers added 271,000 workers in October, the most this year.

The U.S. currency rose 0.2 percent to 123.37 yen as of 11:35 a.m. in Tokyo on Monday and was at $1.0749 per euro. The Bloomberg Dollar Spot Index was little changed after climbing on Friday to its highest level in data going back to December 2004.

Futures traders boosted expectations for a December rate increase to 68 percent, from 56 percent before the labor report, data compiled by Bloomberg show. The calculation assumes the effective fed funds rate averages 0.375 percent after liftoff.

The Fed is assessing progress toward its employment and inflation objectives as it considers whether to raise rates in December. But officials are also keeping an eye on the dollar.

Watchful Fed

Central bankers noted in minutes from their September meeting that the dollar has “strongly appreciated” against emerging-market counterparts and climbed versus currencies of commodity exporters and the U.S.’s main trading partners. They expressed concern that this could delay or diminish price gains.

“The dollar is a big factor for the Fed,” said Kathy Jones, chief fixed-income strategist at Charles Schwab & Co. in New York. “If the dollar moves higher as a result of Fed tightening, which is what we expect, then I think it reinforces the message that this will be a ‘slow and low’ cycle.”

Jones still sees the dollar rallying an additional 5-10 percent in the next year on a trade-weighted basis.

Beating Forecasts

The dollar has already surpassed most analysts’ predictions for its appreciation.

Against the euro, it’s exceeded the median of more than 60 year-end forecasts compiled by Bloomberg. The U.S. currency is expected to fall versus four of its 16 major counterparts by the end of March, including the British pound.

Christoph Kind, head of asset allocation at Frankfurt Trust, which manages about $20 billion, foresees the greenback climbing toward parity with the euro in the first quarter if the Fed lifts rates in December. But he sees limits to the strength.

“I’m bullish on the U.S. dollar, but if the dollar gets too strong I would cut back on my position,” he said. “It will take some time until we see parity, maybe next year, but then a level is reached where the Fed will signal they are not going to hike aggressively. That makes this appreciation unsustainable.”

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.